- India

- /

- Electronic Equipment and Components

- /

- NSEI:COMPINFO

Here's What We Learned About The CEO Pay At Compuage Infocom Limited (NSE:COMPINFO)

Atul Mehta has been the CEO of Compuage Infocom Limited (NSE:COMPINFO) since 2011, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Compuage Infocom

How Does Total Compensation For Atul Mehta Compare With Other Companies In The Industry?

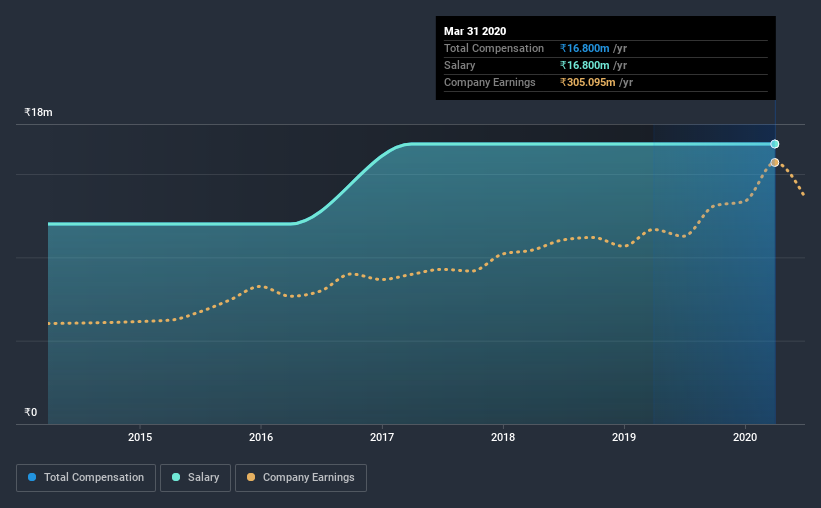

At the time of writing, our data shows that Compuage Infocom Limited has a market capitalization of ₹812m, and reported total annual CEO compensation of ₹17m for the year to March 2020. This means that the compensation hasn't changed much from last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹17m.

For comparison, other companies in the industry with market capitalizations below ₹15b, reported a median total CEO compensation of ₹2.4m. Hence, we can conclude that Atul Mehta is remunerated higher than the industry median. Furthermore, Atul Mehta directly owns ₹189m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹17m | ₹17m | 100% |

| Other | - | - | - |

| Total Compensation | ₹17m | ₹17m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. At the company level, Compuage Infocom pays Atul Mehta solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Compuage Infocom Limited's Growth

Over the past three years, Compuage Infocom Limited has seen its earnings per share (EPS) grow by 11% per year. Its revenue is down 15% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Compuage Infocom Limited Been A Good Investment?

Given the total shareholder loss of 53% over three years, many shareholders in Compuage Infocom Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Compuage Infocom rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we touched on above, Compuage Infocom Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But the company has impressed with its EPS growth, but we cannot say the same about the uninspiring shareholder returns (over the last three years). Although we'd stop short of calling it inappropriate, we think Atul is earning a very handsome sum.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for Compuage Infocom (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Compuage Infocom, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:COMPINFO

Compuage Infocom

Engages in trading of computer parts and peripherals, software, and telecom products in India and internationally.

Low risk with weak fundamentals.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion