- United States

- /

- Banks

- /

- NYSE:BAP

Here's What Credicorp Ltd.'s (NYSE:BAP) P/E Is Telling Us

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

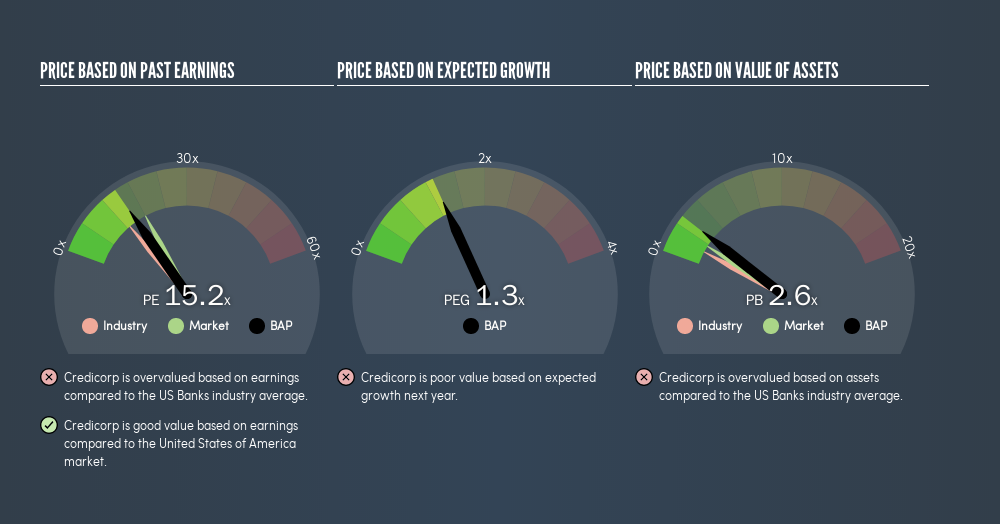

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). To keep it practical, we'll show how Credicorp Ltd.'s (NYSE:BAP) P/E ratio could help you assess the value on offer. Credicorp has a price to earnings ratio of 15.18, based on the last twelve months. In other words, at today's prices, investors are paying $15.18 for every $1 in prior year profit.

View our latest analysis for Credicorp

How Do You Calculate Credicorp's P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price (in reporting currency) ÷ Earnings per Share (EPS)

Or for Credicorp:

P/E of 15.18 = PEN772.83 (Note: this is the share price in the reporting currency, namely, PEN ) ÷ PEN50.92 (Based on the year to March 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each $1 of company earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Does Credicorp's P/E Ratio Compare To Its Peers?

The P/E ratio essentially measures market expectations of a company. As you can see below, Credicorp has a higher P/E than the average company (12.7) in the banks industry.

Its relatively high P/E ratio indicates that Credicorp shareholders think it will perform better than other companies in its industry classification.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Credicorp saw earnings per share decrease by 4.6% last year. But it has grown its earnings per share by 18% per year over the last five years.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. That means it doesn't take debt or cash into account. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Is Debt Impacting Credicorp's P/E?

Credicorp has net cash of S./4.1b. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On Credicorp's P/E Ratio

Credicorp trades on a P/E ratio of 15.2, which is below the US market average of 17.9. Falling earnings per share are likely to be keeping potential buyers away, the healthy balance sheet means the company retains potential for future growth. If that occurs, the current low P/E could prove to be temporary.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:BAP

Credicorp

Provides various financial, insurance, and health services and products in Peru and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.