- United States

- /

- Medical Equipment

- /

- NasdaqCM:CTSO

Health Check: How Prudently Does Cytosorbents (NASDAQ:CTSO) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Cytosorbents Corporation (NASDAQ:CTSO) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Cytosorbents

What Is Cytosorbents's Debt?

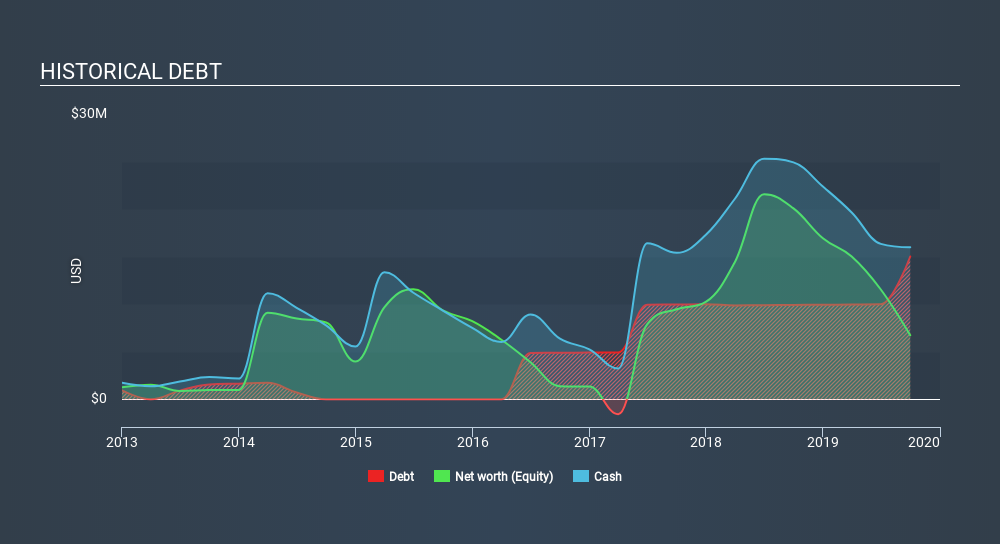

The image below, which you can click on for greater detail, shows that at September 2019 Cytosorbents had debt of US$15.0m, up from US$9.92m in one year. But it also has US$16.0m in cash to offset that, meaning it has US$961.6k net cash.

How Healthy Is Cytosorbents's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Cytosorbents had liabilities of US$9.30m due within 12 months and liabilities of US$12.6m due beyond that. On the other hand, it had cash of US$16.0m and US$3.45m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.52m.

Having regard to Cytosorbents's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$127.7m company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Cytosorbents also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Cytosorbents's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Cytosorbents wasn't profitable at an EBIT level, but managed to grow its revenue by12%, to US$24m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Cytosorbents?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Cytosorbents had negative earnings before interest and tax (EBIT), over the last year. And over the same period it saw negative free cash outflow of US$17m and booked a US$21m accounting loss. With only US$961.6k on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Cytosorbents insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:CTSO

Cytosorbents

Engages in the research, development, and commercialization of medical devices with its blood purification technology platform incorporating a proprietary adsorbent and porous polymer technology in the United States, Germany, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)