- United States

- /

- Healthcare Services

- /

- NYSE:HCA

HCA Healthcare (NYSE:HCA) Appoints Former Subway CEO John Chidsey To Board

Reviewed by Simply Wall St

HCA Healthcare (NYSE:HCA) has appointed John W. Chidsey, III as an independent director, enhancing its board's expertise and corporate governance. Meanwhile, the company's inclusion in multiple Russell 1000 indexes underscores its stability and appeal to defensive investors. During the quarter, HCA also emphasized shareholder value through its share repurchase activities. Overall, the company's share price rose 13% in line with broader market gains over the past year. These strategic moves, coupled with solid financial performance in Q1, including increased sales and net income, have reinforced investor confidence, contributing to a 13% quarterly price move.

The recent appointment of John W. Chidsey, III to HCA Healthcare's board is expected to enhance governance and expertise, potentially leading to more informed decisions that support the company's strategic goals. This move complements HCA's focus on shareholder value through repurchase activities and could bolster investor confidence further.

Over a longer-term horizon of five years, HCA's total shareholder return, including dividends, reached an impressive 269.05%. This performance highlights the company's ability to deliver significant value to its investors over an extended period. For context, the company outperformed the broader healthcare industry, which experienced a decline of 22.1% over the last year, whereas HCA's share price increased 13%, aligning with the broader market gains.

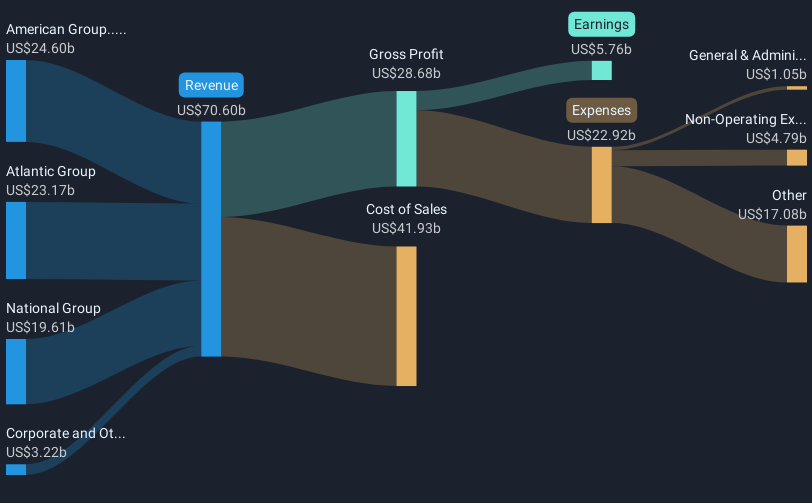

Looking forward, the new board leadership may influence revenue and earnings forecasts as HCA continues its expansion of healthcare services. Analysts forecast a 5.5% annual revenue growth over the next three years, with earnings expected to rise to US$7.1 billion by 2028. The current share price of US$356.7 remains close to the consensus analyst price target of US$371.84, indicating a modest 4.1% increase anticipated. These forecasts suggest that while HCA is projected to grow steadily, the market already factors in much of this potential. Therefore, the additions to the board and continued strategic capital allocations will be crucial in aligning future performance with investor expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives