- India

- /

- Electronic Equipment and Components

- /

- NSEI:CENTUM

Has Centum Electronics (NSE:CENTUM) Got What It Takes To Become A Multi-Bagger?

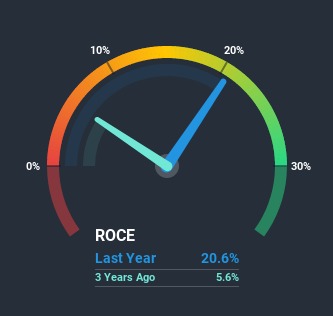

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Looking at Centum Electronics (NSE:CENTUM), it does have a high ROCE right now, but lets see how returns are trending.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Centum Electronics, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.21 = ₹739m ÷ (₹11b - ₹7.2b) (Based on the trailing twelve months to June 2020).

Thus, Centum Electronics has an ROCE of 21%. That's a fantastic return and not only that, it outpaces the average of 11% earned by companies in a similar industry.

View our latest analysis for Centum Electronics

Historical performance is a great place to start when researching a stock so above you can see the gauge for Centum Electronics' ROCE against it's prior returns. If you're interested in investigating Centum Electronics' past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

On the surface, the trend of ROCE at Centum Electronics doesn't inspire confidence. Historically returns on capital were even higher at 40%, but they have dropped over the last five years. Given the business is employing more capital while revenue has slipped, this is a bit concerning. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

On a side note, Centum Electronics' current liabilities have increased over the last five years to 67% of total assets, effectively distorting the ROCE to some degree. Without this increase, it's likely that ROCE would be even lower than 21%. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.In Conclusion...

From the above analysis, we find it rather worrisome that returns on capital and sales for Centum Electronics have fallen, meanwhile the business is employing more capital than it was five years ago. It should come as no surprise then that the stock has fallen 50% over the last five years, so it looks like investors are recognizing these changes. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

If you'd like to know more about Centum Electronics, we've spotted 7 warning signs, and 1 of them is potentially serious.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

When trading Centum Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CENTUM

Centum Electronics

Designs, manufactures, exports, and sells electronic products in India, the United Kingdom, Canada, France, Belgium, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Very Bullish

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.