- Hong Kong

- /

- Construction

- /

- SEHK:6189

Guangdong Adway Construction (Group) Holdings (HKG:6189) Seems To Use Debt Quite Sensibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Guangdong Adway Construction (Group) Holdings Company Limited (HKG:6189) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Guangdong Adway Construction (Group) Holdings

How Much Debt Does Guangdong Adway Construction (Group) Holdings Carry?

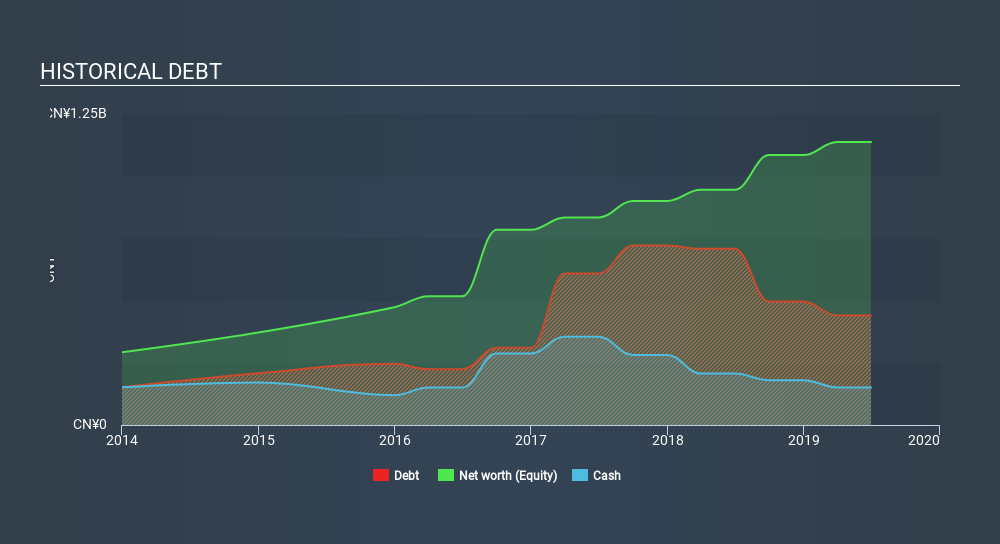

You can click the graphic below for the historical numbers, but it shows that Guangdong Adway Construction (Group) Holdings had CN¥440.6m of debt in June 2019, down from CN¥708.8m, one year before. However, because it has a cash reserve of CN¥151.0m, its net debt is less, at about CN¥289.6m.

How Strong Is Guangdong Adway Construction (Group) Holdings's Balance Sheet?

The latest balance sheet data shows that Guangdong Adway Construction (Group) Holdings had liabilities of CN¥1.56b due within a year, and liabilities of CN¥2.62m falling due after that. Offsetting these obligations, it had cash of CN¥151.0m as well as receivables valued at CN¥2.32b due within 12 months. So it can boast CN¥907.0m more liquid assets than total liabilities.

This luscious liquidity implies that Guangdong Adway Construction (Group) Holdings's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 1.4 and interest cover of 6.5 times, it seems to us that Guangdong Adway Construction (Group) Holdings is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Fortunately, Guangdong Adway Construction (Group) Holdings grew its EBIT by 2.2% in the last year, making that debt load look even more manageable. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Guangdong Adway Construction (Group) Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Guangdong Adway Construction (Group) Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

The good news is that Guangdong Adway Construction (Group) Holdings's demonstrated ability to handle its total liabilities delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that Guangdong Adway Construction (Group) Holdings can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Guangdong Adway Construction (Group) Holdings you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:6189

Guangdong Adway Construction (Group) Holdings

Engages in the provision of interior and exterior building decoration and design services in the People’s Republic of China.

Moderate with imperfect balance sheet.

Market Insights

Community Narratives