- United States

- /

- Consumer Services

- /

- NYSE:GHC

Graham Holdings (GHC) Declares Regular Quarterly Dividend Of US$1.80 Per Share

Reviewed by Simply Wall St

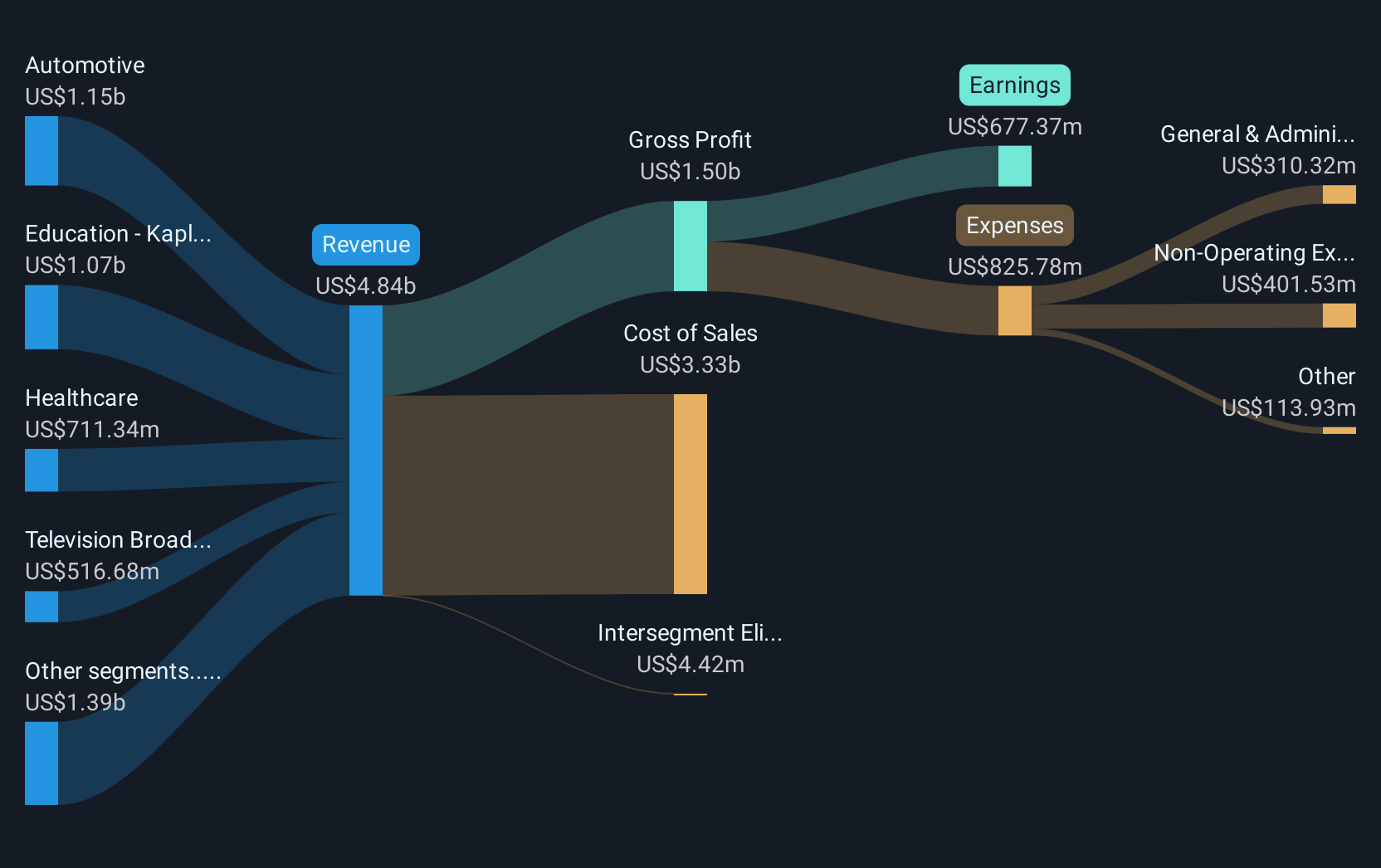

Graham Holdings (GHC) recently declared a regular quarterly dividend of $1.80 per share, demonstrating its commitment to shareholder value. The company's share price rose 20% over the last quarter, a move potentially supported by its strong earnings report and financial health. With reported revenue of $1.2 billion and a bounce back to profitability from a previous loss, Graham Holdings illustrated its operational strength. This performance aligns with broader market trends, as major U.S. indexes reached record highs amidst inflation data that reinforced interest rate cut expectations, providing a favorable context for GHC's positive movement.

Over the past five years, Graham Holdings (GHC) enjoyed a total return, including share price appreciation and dividends, of 172.45%. In the past year alone, GHC outpaced the broader US market and the Consumer Services industry, which saw returns of 20% and 23.8%, respectively. This robust performance reflects well on the company's long-term capacity to generate shareholder value.

The company's recent operational resilience, underscored by its return to profitability and strong earnings growth, could positively influence revenue and earnings forecasts. These improvements align with positive market conditions reflected in recent interest rate expectations and major index movements. However, the current share price of $1,138.85 diverges from the consensus analyst price target of $785.00. This difference may indicate a market expectation of future earnings strength or other growth drivers not fully captured in analyst estimates. As such, stakeholders may view GHC's current price dynamic with interest, considering the extensive past gains against forward-looking targets.

Gain insights into Graham Holdings' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHC

Graham Holdings

Through its subsidiaries, operates as a diversified holding company in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives