- China

- /

- Electronic Equipment and Components

- /

- SHSE:603228

Global's September 2025 Stocks Possibly Priced Below Estimated Value

Reviewed by Simply Wall St

In September 2025, global markets are navigating a complex landscape marked by mixed economic signals, including weakening U.S. labor market data and fluctuating interest rate expectations. Amid these conditions, investors are increasingly focusing on identifying undervalued stocks that may offer potential value in a challenging environment. Recognizing such opportunities often involves assessing companies with strong fundamentals that have been overlooked or mispriced due to broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Walvax Biotechnology (SZSE:300142) | CN¥12.25 | CN¥24.48 | 50% |

| Takara Bio (TSE:4974) | ¥915.00 | ¥1829.46 | 50% |

| SIT (BIT:SIT) | €1.695 | €3.37 | 49.7% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.97 | 49.8% |

| Pansoft (SZSE:300996) | CN¥17.14 | CN¥34.20 | 49.9% |

| Norconsult (OB:NORCO) | NOK46.50 | NOK92.12 | 49.5% |

| Meitu (SEHK:1357) | HK$9.14 | HK$18.01 | 49.3% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥986.00 | ¥1945.43 | 49.3% |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$529.80 | MX$1056.05 | 49.8% |

| adidas (XTRA:ADS) | €178.10 | €351.81 | 49.4% |

Here's a peek at a few of the choices from the screener.

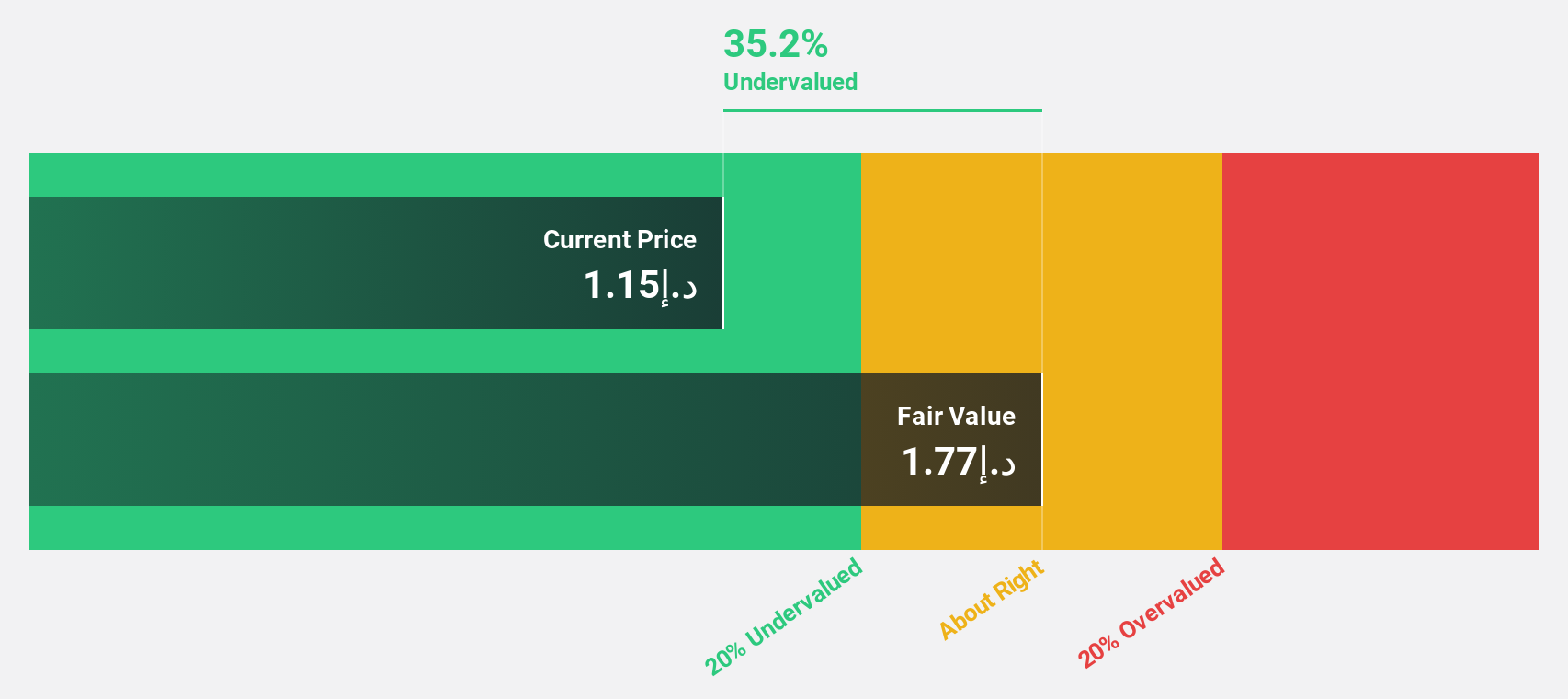

Talabat Holding (DFM:TALABAT)

Overview: Talabat Holding plc operates an on-demand online food ordering, delivery, takeaway and groceries, and convenience retail marketplace across several Middle Eastern countries with a market cap of AED28.41 billion.

Operations: The company's revenue primarily comes from its operations in the Gulf Cooperation Council (GCC) region, generating $1.99 billion.

Estimated Discount To Fair Value: 31.5%

Talabat Holding is trading 31.5% below its estimated fair value, indicating potential undervaluation based on cash flows. Recent earnings reports show net income of US$121.31 million for Q2 2025, with earnings growing by 40.1% over the past year and forecasted to grow by 15.18% annually, outpacing the AE market's growth rate of 6.6%. Revenue is also expected to grow faster than the market at a rate of 17.9% per year.

- According our earnings growth report, there's an indication that Talabat Holding might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Talabat Holding.

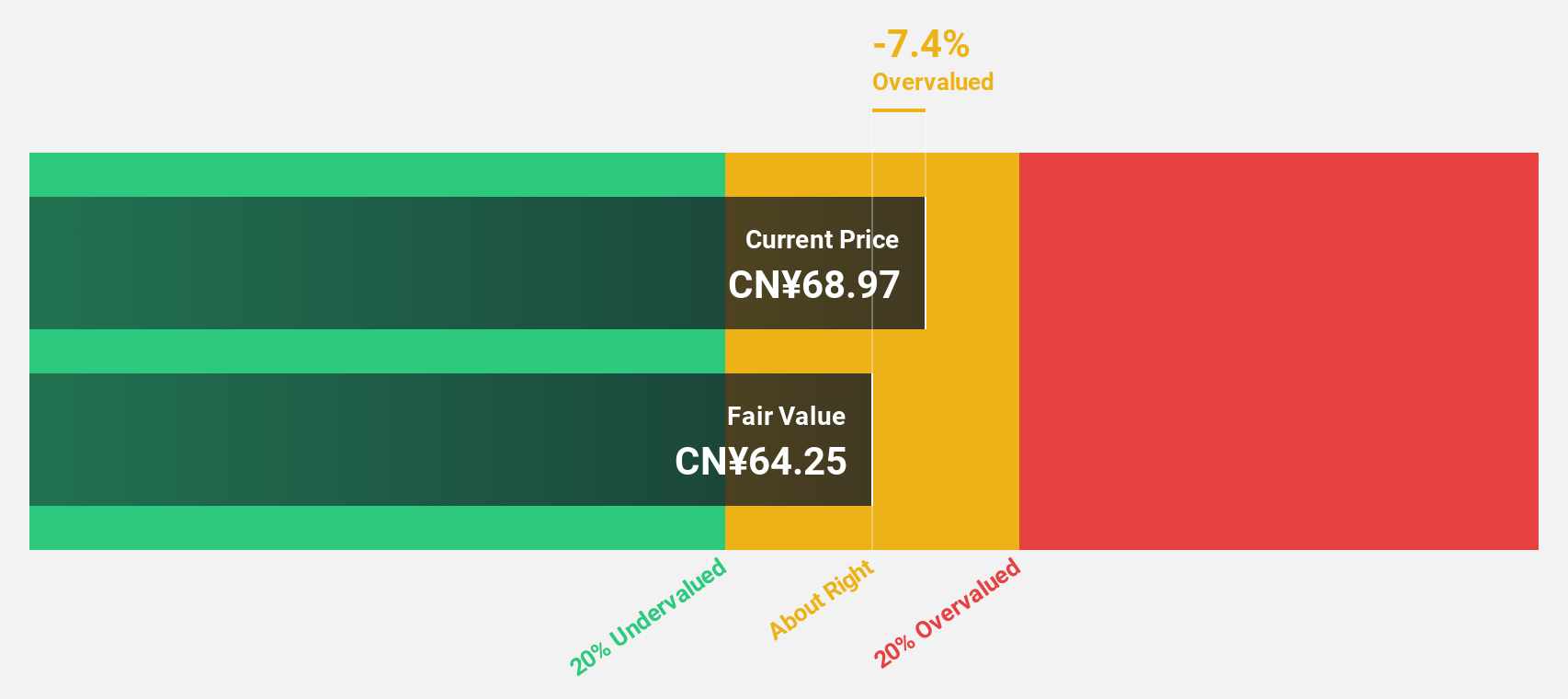

Shenzhen Kinwong Electronic (SHSE:603228)

Overview: Shenzhen Kinwong Electronic Co., Ltd. is involved in the research, development, production, and sale of printed circuit boards and electronic materials both in China and internationally, with a market cap of CN¥48.86 billion.

Operations: The company's revenue segment is primarily derived from its printed circuit board business, which generated CN¥13.89 billion.

Estimated Discount To Fair Value: 10.9%

Shenzhen Kinwong Electronic is trading 10.9% below its fair value estimate, suggesting undervaluation based on cash flows. Despite a slight decline in net income to CNY 649.55 million for the first half of 2025, earnings are forecasted to grow significantly at 31.51% annually, outpacing the Chinese market's growth rate of 26.2%. However, its dividend yield of 1.4% is not well covered by free cash flows and return on equity remains modest at a forecasted 15.4%.

- Upon reviewing our latest growth report, Shenzhen Kinwong Electronic's projected financial performance appears quite optimistic.

- Take a closer look at Shenzhen Kinwong Electronic's balance sheet health here in our report.

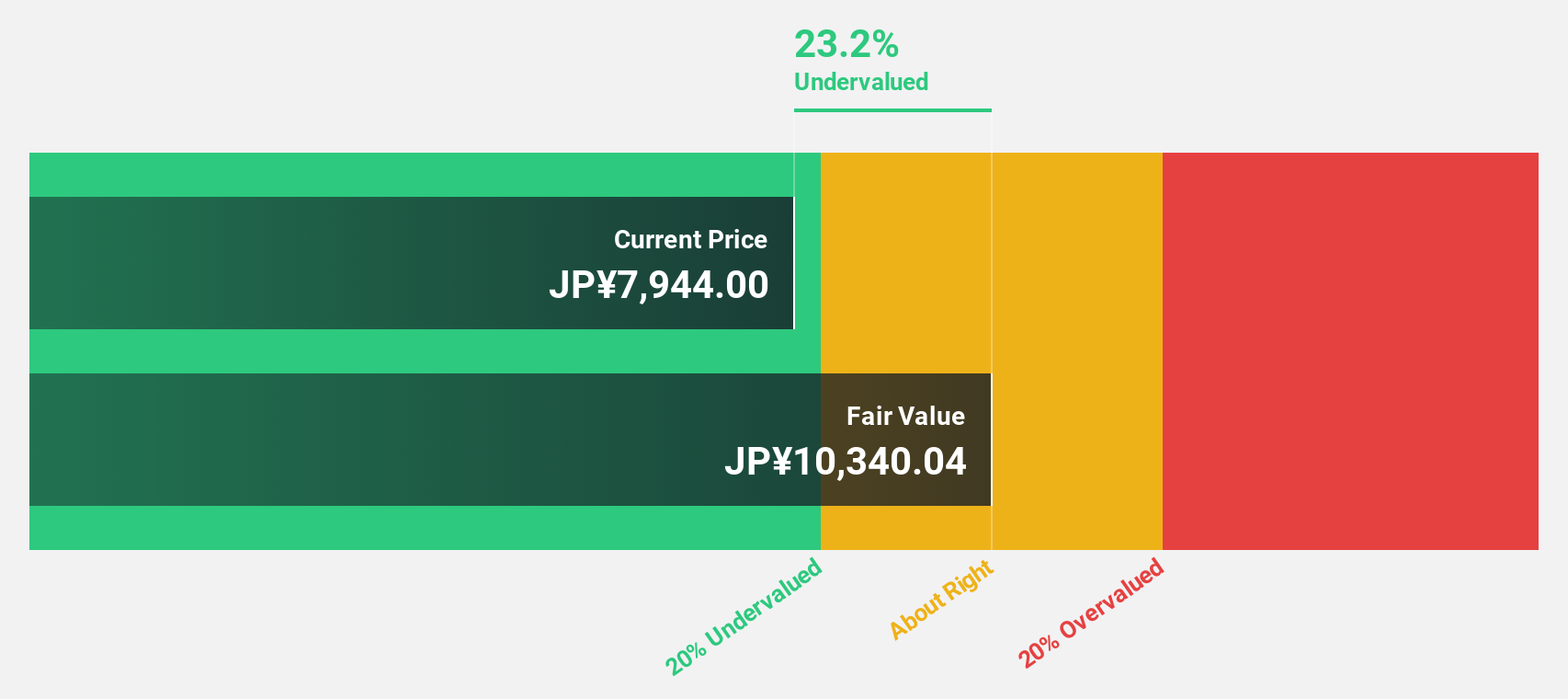

Baycurrent (TSE:6532)

Overview: Baycurrent, Inc. offers consulting services in Japan and has a market cap of approximately ¥1.27 billion.

Operations: The company generates revenue from its Consulting Business, amounting to ¥123.32 million.

Estimated Discount To Fair Value: 17.1%

Baycurrent is trading at ¥8,552, below its estimated fair value of ¥10,315.35, indicating potential undervaluation based on cash flows. Revenue and earnings are both forecast to grow over 20% annually, outpacing the Japanese market's growth rates. Recent board meetings focused on disposing of treasury shares for restricted stock compensation. Despite strong growth prospects and high forecasted return on equity at 36.8%, it remains slightly undervalued relative to its fair value estimate.

- The growth report we've compiled suggests that Baycurrent's future prospects could be on the up.

- Click here to discover the nuances of Baycurrent with our detailed financial health report.

Key Takeaways

- Gain an insight into the universe of 515 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603228

Shenzhen Kinwong Electronic

Engages in research, development, production, and sale of printed circuit boards (PCB) and electronic materials in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives