- Taiwan

- /

- Semiconductors

- /

- TWSE:2454

Global's Leading Trio Of Dividend Stocks

Reviewed by Simply Wall St

As global markets continue to experience robust growth, with the S&P 500 and Nasdaq Composite reaching record highs for consecutive weeks, investors are increasingly focused on finding stable income sources amidst the dynamic economic landscape. In this context, dividend stocks stand out as a compelling option, offering potential for consistent returns through regular payouts while navigating market fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.47% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.04% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.87% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.05% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★★ |

Click here to see the full list of 1519 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

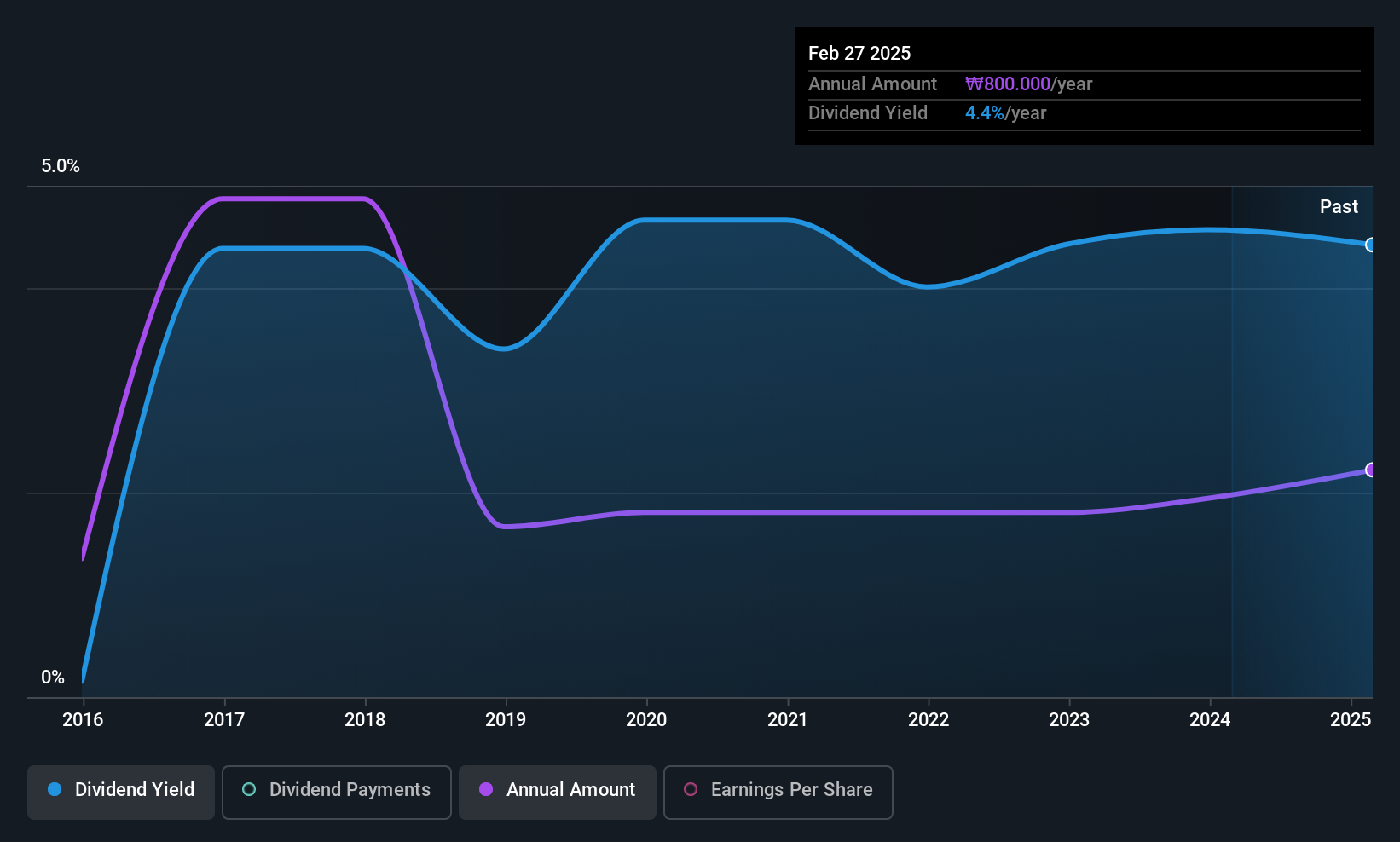

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ORION Holdings Corp. is a company that manufactures and sells confectioneries in South Korea, China, and internationally, with a market cap of ₩1.47 trillion.

Operations: ORION Holdings Corp. generates revenue primarily from its confectionery segment, amounting to ₩3.90 trillion, along with contributions from its landlord and video segments, which are ₩66.56 billion and ₩41.64 billion respectively.

Dividend Yield: 3.1%

ORION Holdings' dividend payments have been volatile and unreliable over the past decade, with a current yield of 3.13%, which is below the top 25% in the KR market. However, dividends are well covered by both earnings (payout ratio: 31.5%) and cash flows (cash payout ratio: 12.6%). Despite an unstable dividend track record, recent earnings growth of 43.3% and trading at a significant discount to fair value may interest some investors seeking potential value opportunities.

- Click here to discover the nuances of ORION Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of ORION Holdings shares in the market.

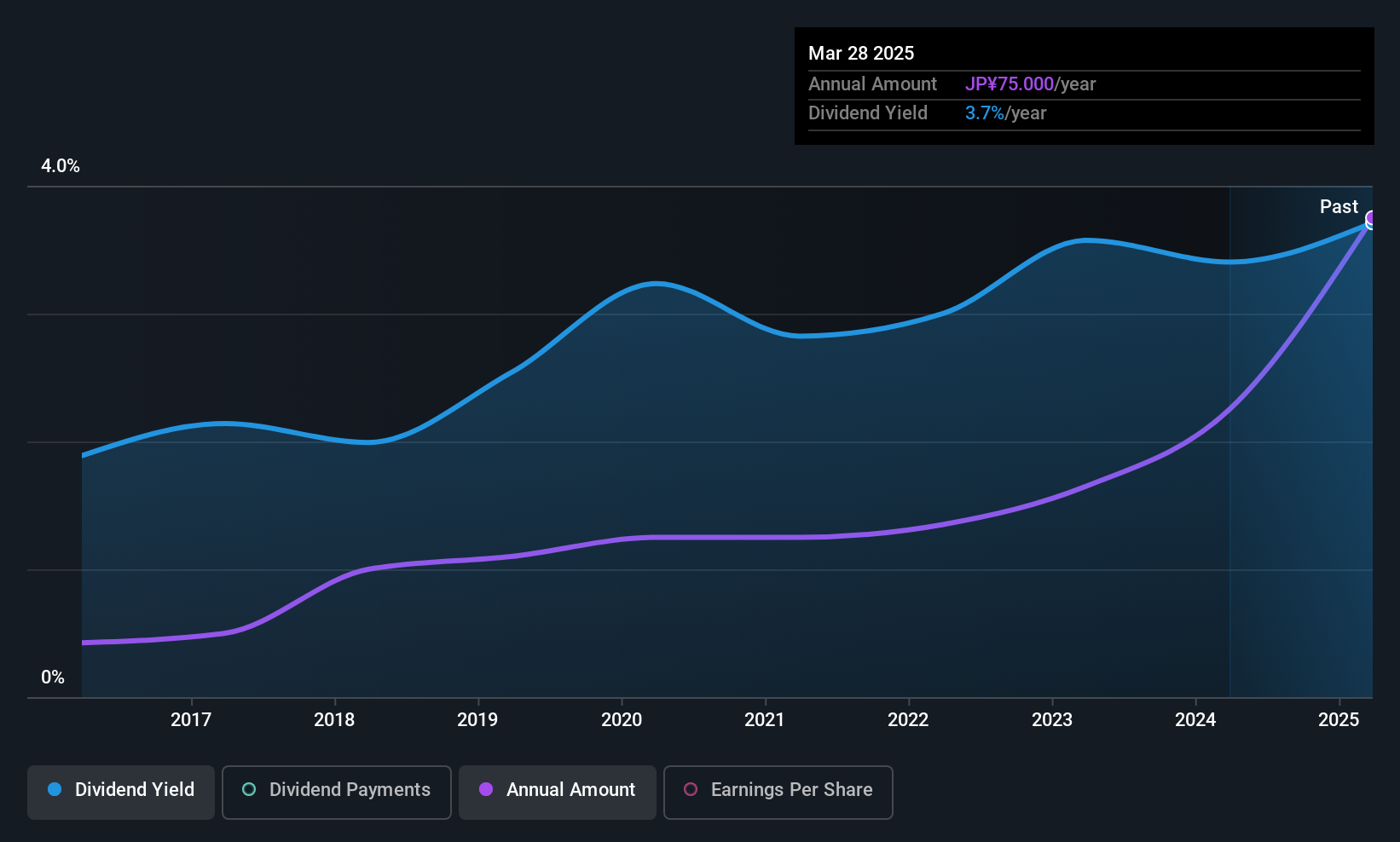

Tanabe Engineering (TSE:1828)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tanabe Engineering Corporation operates in Japan, focusing on plant construction and machinery production, with a market cap of ¥24.55 billion.

Operations: Tanabe Engineering Corporation generates revenue from its operations in plant construction and machinery production within Japan.

Dividend Yield: 3.8%

Tanabe Engineering's dividends have been stable and increasing over the past decade, with a reliable current yield of 3.8%, slightly below the top 25% in the JP market. The company recently announced an increased year-end dividend of ¥87 per share, with plans for further growth to ¥92 next year. Dividends are well covered by earnings (payout ratio: 18.5%) and cash flows (cash payout ratio: 8.3%), indicating sustainability amidst strong earnings growth of 36.8%.

- Dive into the specifics of Tanabe Engineering here with our thorough dividend report.

- The valuation report we've compiled suggests that Tanabe Engineering's current price could be quite moderate.

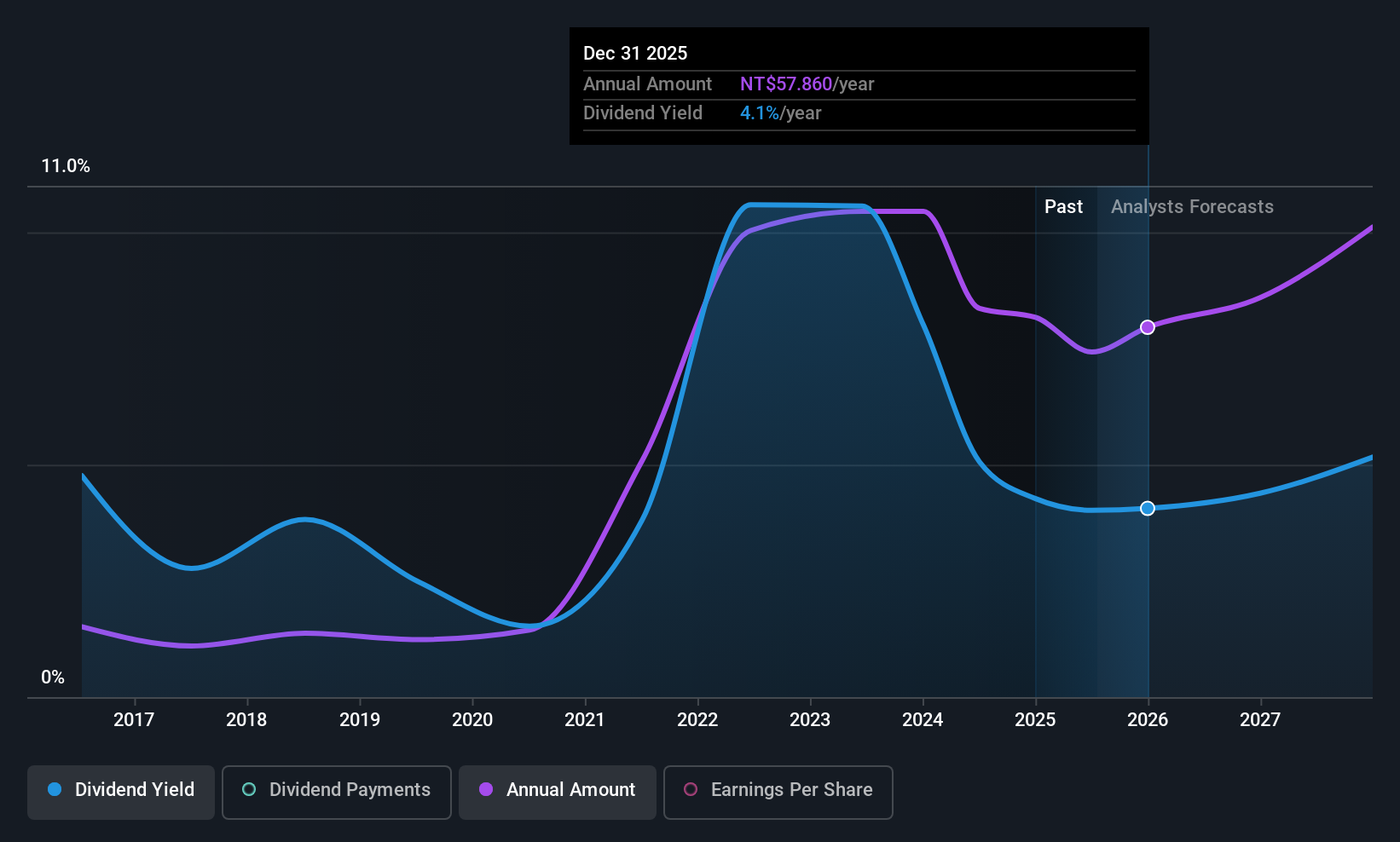

MediaTek (TWSE:2454)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MediaTek Inc. is involved in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) across Taiwan, the rest of Asia, and internationally with a market cap of NT$2.16 trillion.

Operations: MediaTek Inc.'s revenue primarily comes from its multimedia and mobile phone chips and other integrated circuit design products, totaling NT$550.44 billion.

Dividend Yield: 3.9%

MediaTek's dividend yield of 3.87% is lower than the top 25% in the Taiwan market, and its dividends have been volatile over the past decade. However, they are covered by both earnings (payout ratio: 82.4%) and cash flows (cash payout ratio: 71%). Despite a history of unreliable payments, recent earnings growth of 13.7% suggests potential for improvement in dividend sustainability as MediaTek continues to innovate with AI-driven technologies like the FG390 module.

- Navigate through the intricacies of MediaTek with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that MediaTek is priced higher than what may be justified by its financials.

Make It Happen

- Gain an insight into the universe of 1519 Top Global Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2454

MediaTek

Engages in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) in Taiwan, rest of Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives