- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

GlobalFoundries (GFS) Announces US$16 Billion Semiconductor Manufacturing Expansion

Reviewed by Simply Wall St

GlobalFoundries (GFS) recently held its Annual General Meeting amid a range of impactful developments over the last quarter, leading to a price increase of nearly 5%. The announcement of a $16 billion investment to expand semiconductor manufacturing in response to AI-driven demand captured market interest, likely buoying investor confidence. Additionally, the company's strong Q1 performance, with increased sales and net income, may have further supported its stock price. While the broader market experienced fluctuations with stocks surging after a sell-off, these corporate events helped align GFS's quarterly performance with prevailing market optimism.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments surrounding GlobalFoundries, including the $16 billion semiconductor expansion, have stirred optimism in the market. Despite this positive reaction, over the past year, the company's total shareholder return was a substantial decline of 18.29%. In contrast, it lagged behind both the broader US market, which returned 17.5%, and the US Semiconductor industry, which posted a 47.9% gain. This underperformance highlights the challenges GlobalFoundries faces amidst a rapidly evolving sector.

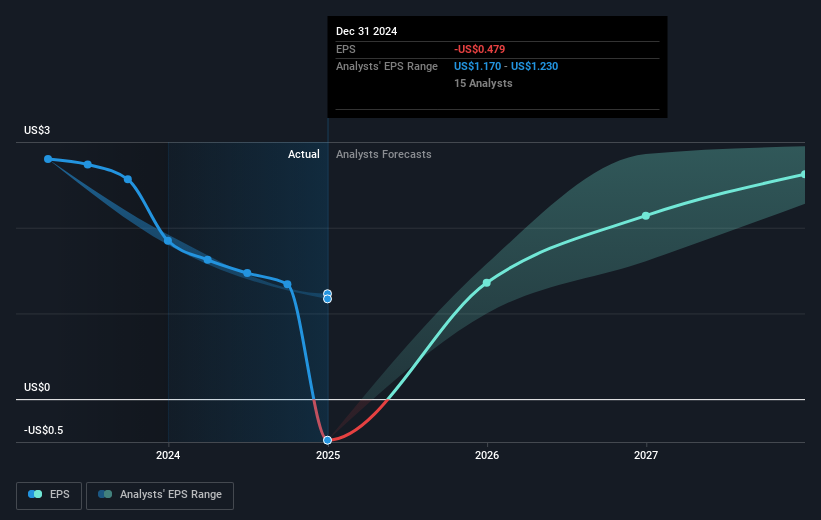

The proposed expansion and AI-driven demand are potentially transformative, positioning GlobalFoundries for increased revenue and enhanced earnings. Analysts anticipate revenue to grow at approximately 8.4% annually over the next few years, with earnings expected to turn positive, reaching US$1.4 billion by 2028. These forecasts hinge on the successful deployment of investments in key sectors like automotive, IoT, and AI. However, the current share price of US$36.58 presents a discount to the average analyst price target of approximately US$44.58, suggesting that there is a 21.87% potential upside if targets are met. This discrepancy indicates market skepticism regarding the company's future performance, warranting careful monitoring of upcoming corporate strategies and external economic factors that could influence these projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives