- China

- /

- Commercial Services

- /

- SHSE:603778

Global Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. indices like the S&P 500 and Nasdaq Composite hitting record highs, driven by strong job growth and positive economic indicators. Amidst these robust market conditions, investors may find opportunities in penny stocks—companies that are smaller or newer but can still offer significant value when backed by solid financials. Despite the term's outdated feel, penny stocks remain a relevant investment area for those seeking to uncover under-the-radar companies with potential for long-term success.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.43 | A$113.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.37 | HK$807.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.418 | £45.23M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.19 | SGD8.62B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.495 | SEK2.39B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.995 | MYR7.32B | ✅ 5 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.835 | £11.5M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,831 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Guosheng Shian Technology (SHSE:603778)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guosheng Shian Technology Co., Ltd. operates in the garden engineering construction, garden landscape design, and seedling sales sectors in China with a market cap of CN¥2.25 billion.

Operations: No revenue segments have been reported for Guosheng Shian Technology Co., Ltd.

Market Cap: CN¥2.25B

Guosheng Shian Technology Co., Ltd. recently reported a decrease in quarterly revenue to CN¥95.63 million, down from CN¥110.14 million the previous year, with a net loss of CN¥41.93 million. Despite being unprofitable, the company maintains a satisfactory net debt to equity ratio of 2.6% and has sufficient cash runway for over three years even as free cash flow shrinks by 21% annually. The management team is experienced with an average tenure of 7.8 years, though the board is relatively new with an average tenure of 1.8 years, indicating potential strategic shifts ahead.

- Get an in-depth perspective on Guosheng Shian Technology's performance by reading our balance sheet health report here.

- Gain insights into Guosheng Shian Technology's historical outcomes by reviewing our past performance report.

Rongan PropertyLtd (SZSE:000517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rongan Property Co., Ltd. engages in the development and sale of real estate properties in China, with a market cap of CN¥5.92 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥25.98 billion.

Market Cap: CN¥5.92B

Rongan Property Co., Ltd. is facing challenges with declining earnings, having reported a significant drop in quarterly sales to CN¥2.62 billion from CN¥7.69 billion the previous year, and net income falling to CN¥19.32 million from CN¥408.4 million. Despite being unprofitable, the company has managed its debt effectively, reducing its debt-to-equity ratio from 142.8% to 38.3% over five years and maintaining a satisfactory net debt to equity ratio of 10.3%. The board is experienced with an average tenure of five years, though recent financial performance highlights potential volatility in this investment space.

- Click here to discover the nuances of Rongan PropertyLtd with our detailed analytical financial health report.

- Learn about Rongan PropertyLtd's historical performance here.

Huapont Life SciencesLtd (SZSE:002004)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Huapont Life Sciences Co., Ltd. operates in the fields of medicine, medical care, agrochemicals, new materials, and tourism both in China and internationally, with a market cap of CN¥8.40 billion.

Operations: Huapont Life Sciences Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥8.4B

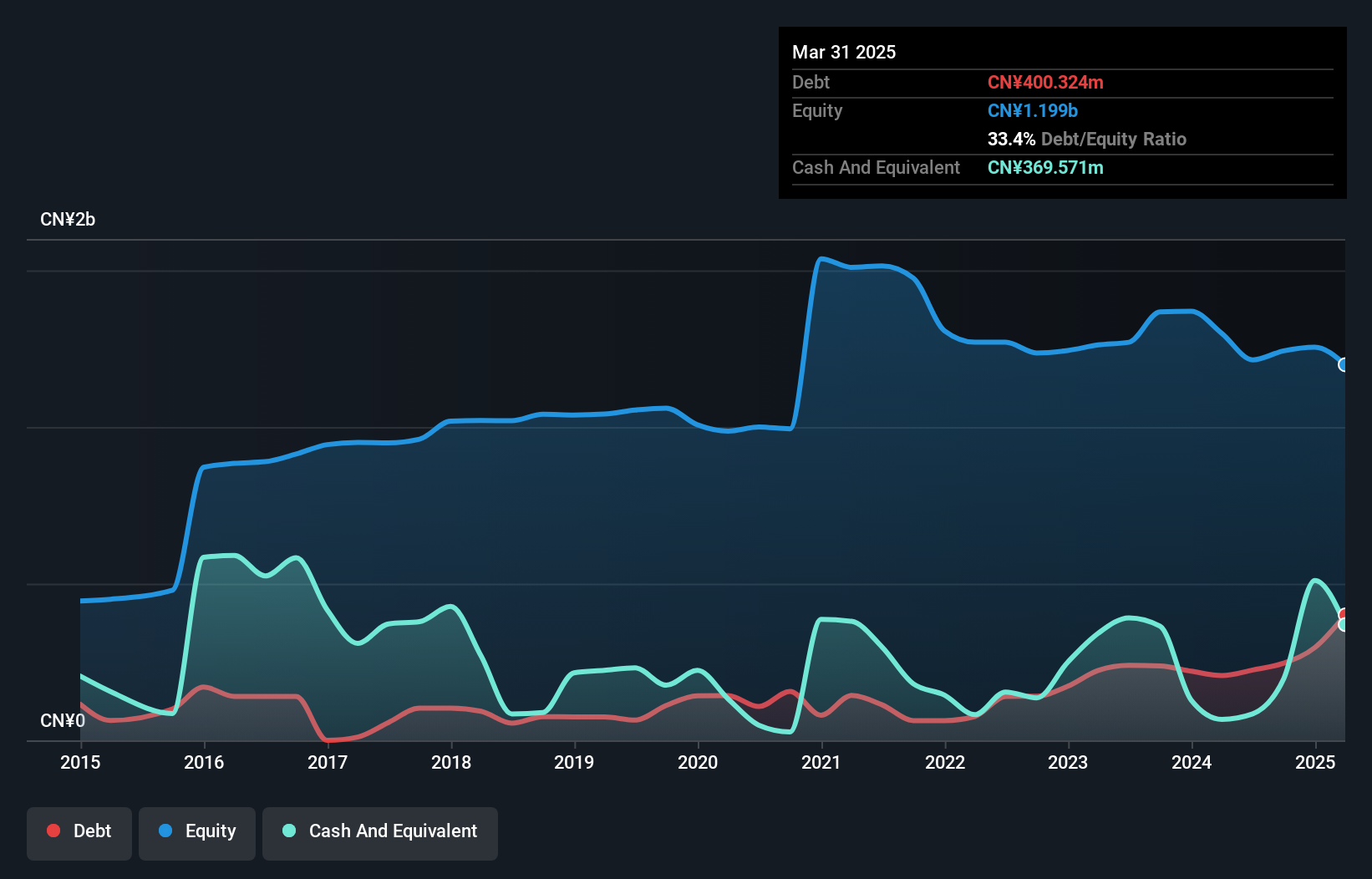

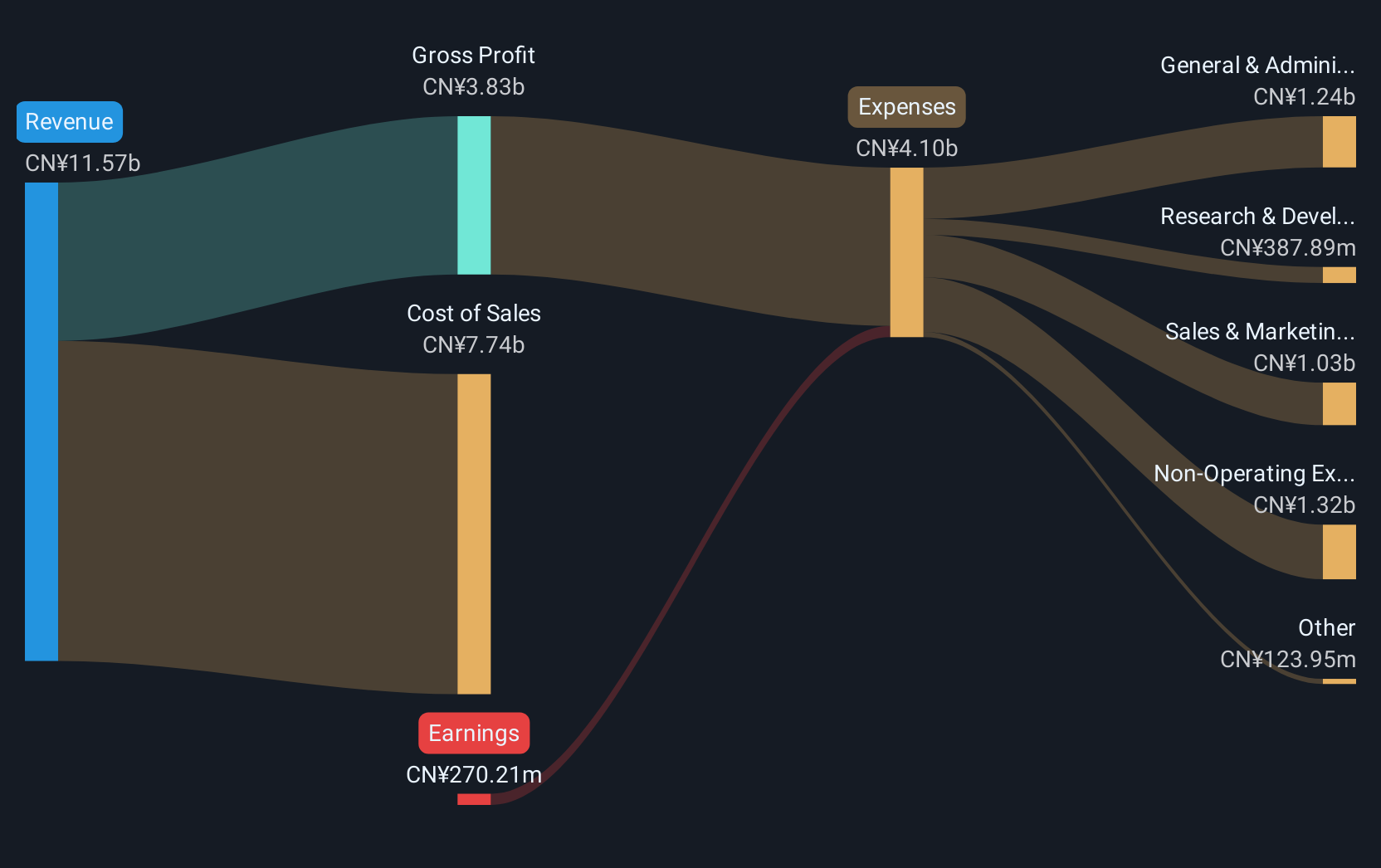

Huapont Life Sciences Co., Ltd. has experienced financial challenges, reporting a net loss of CN¥298.99 million for the full year 2024, despite generating revenue of CN¥11.66 billion. The company's short-term assets comfortably cover both its short and long-term liabilities, indicating solid liquidity management with a satisfactory net debt to equity ratio of 31.6%. However, it remains unprofitable with negative return on equity and declining earnings over five years at an annual rate of 32.2%. Recent board changes include the election of Zhang Songshan as non-independent director, reflecting ongoing governance adjustments.

- Click to explore a detailed breakdown of our findings in Huapont Life SciencesLtd's financial health report.

- Understand Huapont Life SciencesLtd's track record by examining our performance history report.

Key Takeaways

- Explore the 3,831 names from our Global Penny Stocks screener here.

- Looking For Alternative Opportunities? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603778

Guosheng Shian Technology

Engages in the garden engineering construction, garden landscape design, and seedling sales businesses in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives