- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

Global Penny Stock Insights: Fu Shou Yuan International Group Among 3 Noteworthy Picks

Reviewed by Simply Wall St

Global markets have shown mixed performances recently, with the S&P 500 and Nasdaq Composite reaching new highs driven by robust corporate earnings, while inflation concerns continue to simmer in the U.S. Amid these economic dynamics, investors are exploring various avenues for potential growth, including penny stocks. Although often considered a niche investment area today, penny stocks can still present opportunities for significant returns when backed by strong financials. In this article, we will examine three noteworthy examples of such stocks that combine balance sheet strength with promising long-term potential.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.14 | A$104.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.46 | HK$921.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.49 | SGD198.59M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.515 | MYR304.7M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.53 | SGD9.96B | ✅ 5 ⚠️ 0 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.915 | MYR7.05B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £193.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.71M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,828 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.56 billion, operates in the People’s Republic of China offering burial and funeral services through its subsidiaries.

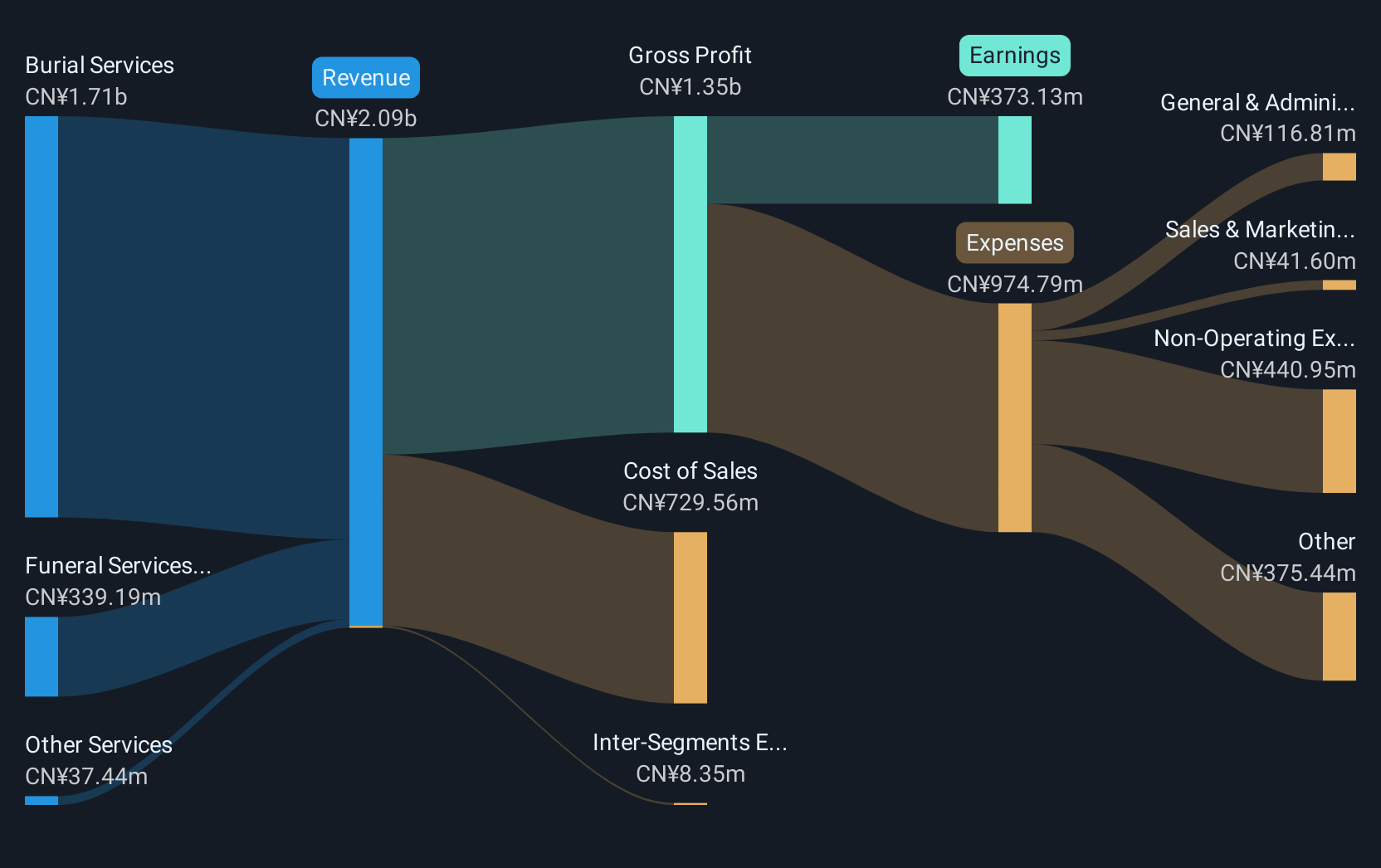

Operations: The company's revenue is primarily derived from burial services (CN¥1.71 billion) and funeral services (CN¥339.19 million), with additional contributions from other services (CN¥37.44 million).

Market Cap: HK$8.56B

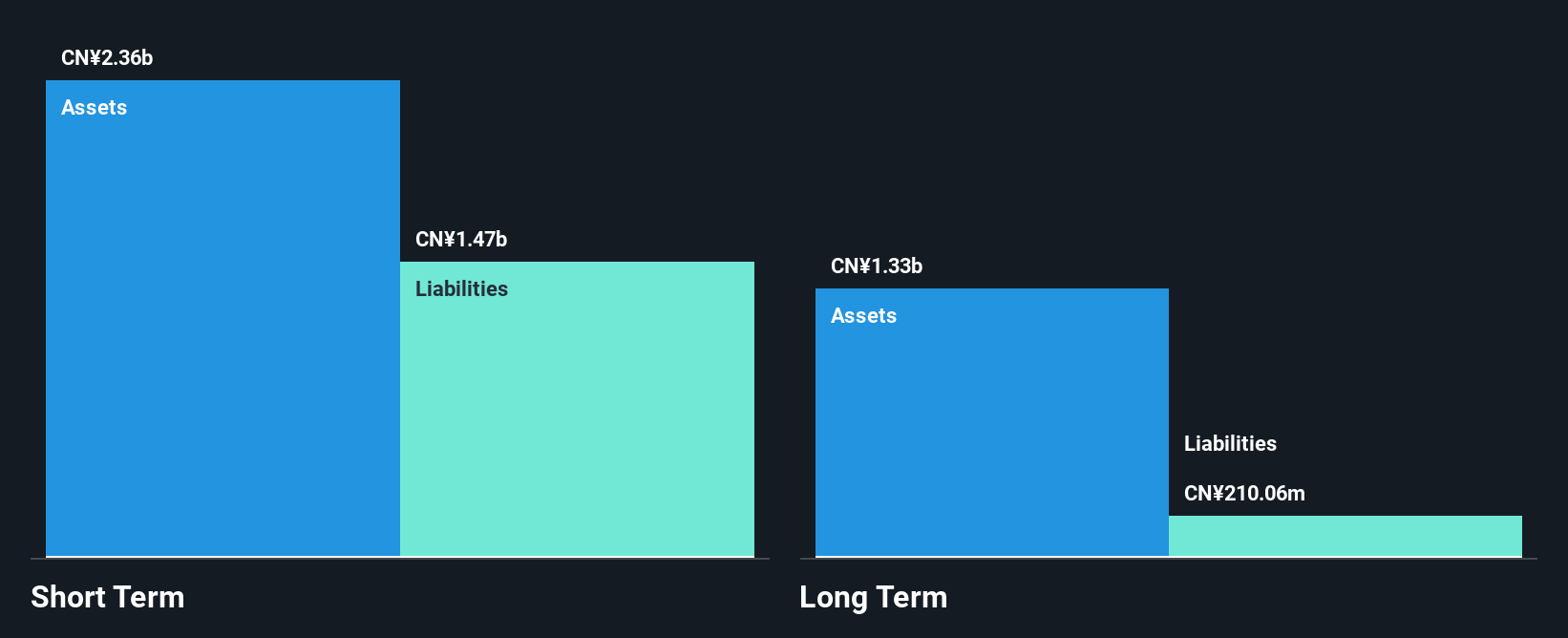

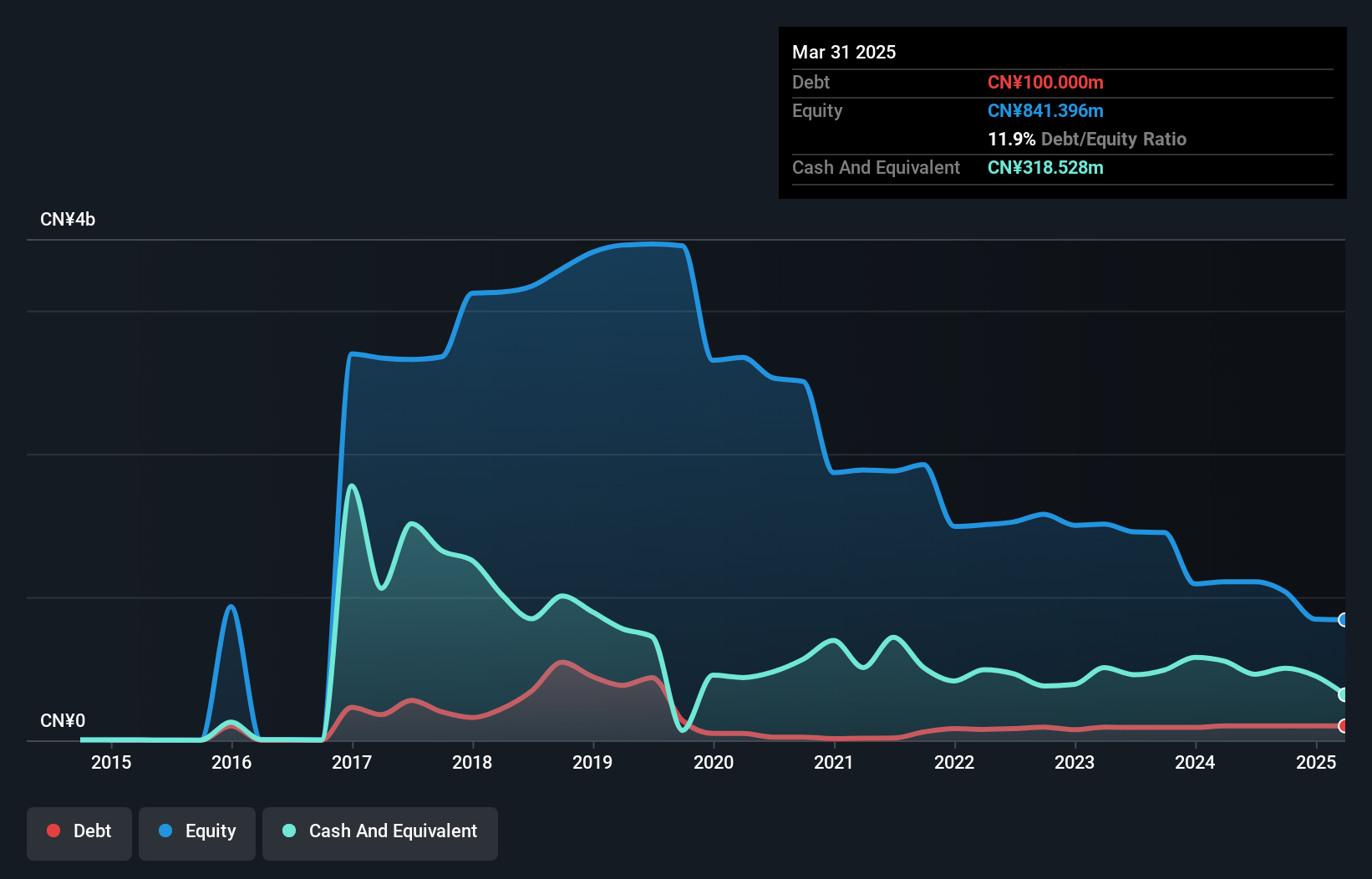

Fu Shou Yuan International Group, with a market cap of HK$8.56 billion, operates in the burial and funeral services sector in China. The company's revenue is primarily driven by burial (CN¥1.71 billion) and funeral services (CN¥339.19 million). Despite a decline in profit margins from 30.1% to 18%, its debt is well covered by operating cash flow, and it has reduced its debt-to-equity ratio significantly over five years. Short-term assets exceed both short- and long-term liabilities, indicating financial stability. However, earnings growth has been negative recently, contrasting with modest long-term growth forecasts of 8.2% annually.

- Navigate through the intricacies of Fu Shou Yuan International Group with our comprehensive balance sheet health report here.

- Evaluate Fu Shou Yuan International Group's prospects by accessing our earnings growth report.

Cosmo Lady (China) Holdings (SEHK:2298)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cosmo Lady (China) Holdings Company Limited is an investment holding company focused on the design, research, development, and sale of branded intimate wear products in China, with a market cap of HK$773.67 million.

Operations: The company's revenue is primarily derived from the designing, marketing, and selling of intimate wear products, amounting to CN¥3.01 billion.

Market Cap: HK$773.67M

Cosmo Lady (China) Holdings, with a market cap of HK$773.67 million, has demonstrated significant earnings growth of 197% over the past year, surpassing both its five-year average and the luxury industry growth rate. The company's financial health is bolstered by short-term assets exceeding liabilities and more cash than total debt. Despite a low return on equity at 5.7%, interest payments are well covered by EBIT, indicating manageable debt levels. Recent changes in governance align with updated corporate codes, while dividends remain modest but consistent at 0.5 HK cents per share for 2024 amidst an unstable dividend track record.

- Take a closer look at Cosmo Lady (China) Holdings' potential here in our financial health report.

- Assess Cosmo Lady (China) Holdings' previous results with our detailed historical performance reports.

H&R Century Union (SZSE:000892)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: H&R Century Union Corporation operates in China, focusing on drama series production and artist brokerage, with a market cap of CN¥4.56 billion.

Operations: H&R Century Union Corporation has not reported any specific revenue segments.

Market Cap: CN¥4.56B

H&R Century Union Corporation, with a market cap of CN¥4.56 billion, operates in the drama series production and artist brokerage sectors in China. The company is pre-revenue, reflected by its unprofitability and negative return on equity of -31.51%. Despite this, it has managed to reduce losses by 26.1% annually over the past five years. Short-term assets of CN¥1.4 billion comfortably cover both short- and long-term liabilities, while cash reserves exceed total debt levels. However, the share price remains highly volatile and recent board changes indicate a lack of seasoned governance experience within the company’s leadership team.

- Click here and access our complete financial health analysis report to understand the dynamics of H&R Century Union.

- Learn about H&R Century Union's historical performance here.

Summing It All Up

- Discover the full array of 3,828 Global Penny Stocks right here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives