As global markets navigate a landscape marked by tech sell-offs, record government shutdowns, and fluctuating consumer sentiment, investors are increasingly seeking stability amid uncertainty. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for enhancing investment portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.91% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.97% | ★★★★★★ |

| NCD (TSE:4783) | 4.60% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.83% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.90% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1322 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

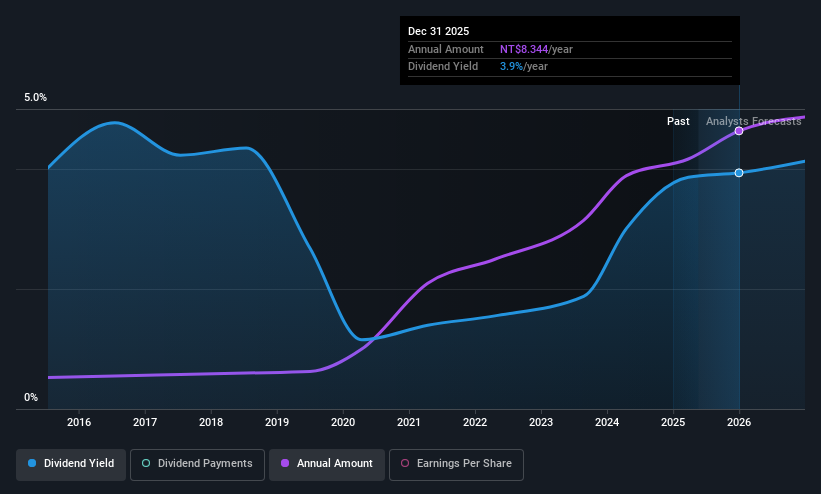

Universal Vision Biotechnology (TPEX:3218)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Vision Biotechnology Co., Ltd. operates a chain of eye care clinics in Taiwan and China, with a market cap of NT$12.29 billion.

Operations: Universal Vision Biotechnology Co., Ltd.'s revenue is primarily derived from its Medical Operations Department, contributing NT$3.40 billion, followed by the Optical Operation Department with NT$1.04 billion.

Dividend Yield: 4.8%

Universal Vision Biotechnology's dividend is well-covered by earnings and cash flows, with payout ratios of 71.6% and 51.2%, respectively. Although its yield of 4.79% is below the top quartile in Taiwan, dividends have been stable and growing over the past decade. The company trades at a significant discount to estimated fair value, enhancing its appeal for value-conscious investors. Recent earnings show increased net income despite slightly lower sales, supporting continued dividend reliability.

- Dive into the specifics of Universal Vision Biotechnology here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Universal Vision Biotechnology is priced lower than what may be justified by its financials.

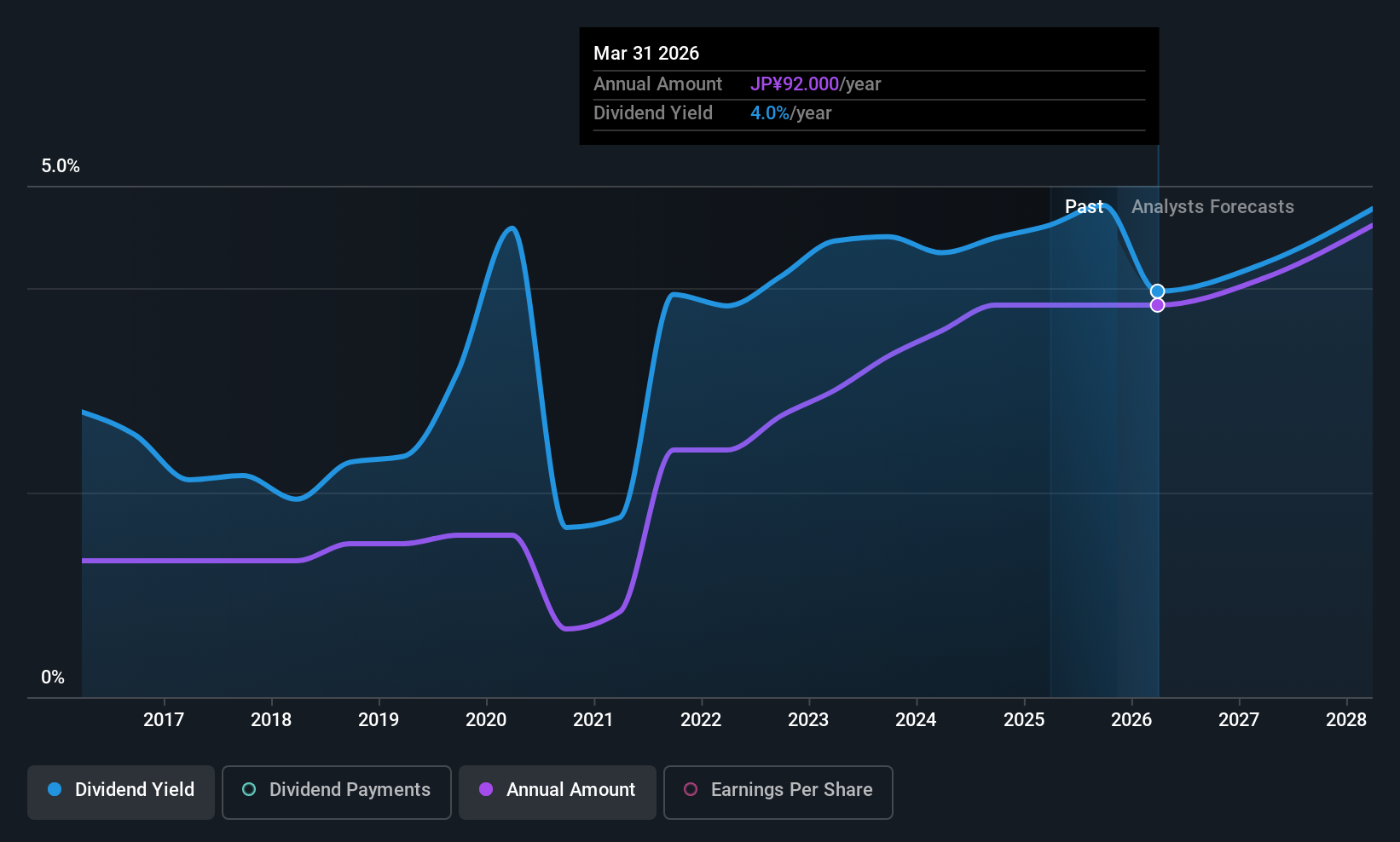

Isuzu Motors (TSE:7202)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Isuzu Motors Limited is a global manufacturer and seller of commercial vehicles, light commercial vehicles, and diesel engines and components, with a market cap of ¥1.40 trillion.

Operations: Isuzu Motors Limited generates revenue of ¥3.29 billion from the manufacture and sale of vehicles, their components, and industrial engines.

Dividend Yield: 4.1%

Isuzu Motors' dividend remains stable at JPY 46.00 per share, consistent with last year, but is not well-covered by free cash flows due to a high cash payout ratio of 231.3%. Despite this, the payout ratio of 52.3% suggests coverage by earnings. The stock trades below market P/E averages and offers a top-tier yield of 4.08%. Recent earnings guidance indicates strong revenue and profit expectations, supporting potential dividend sustainability despite current cash flow concerns.

- Navigate through the intricacies of Isuzu Motors with our comprehensive dividend report here.

- Our expertly prepared valuation report Isuzu Motors implies its share price may be lower than expected.

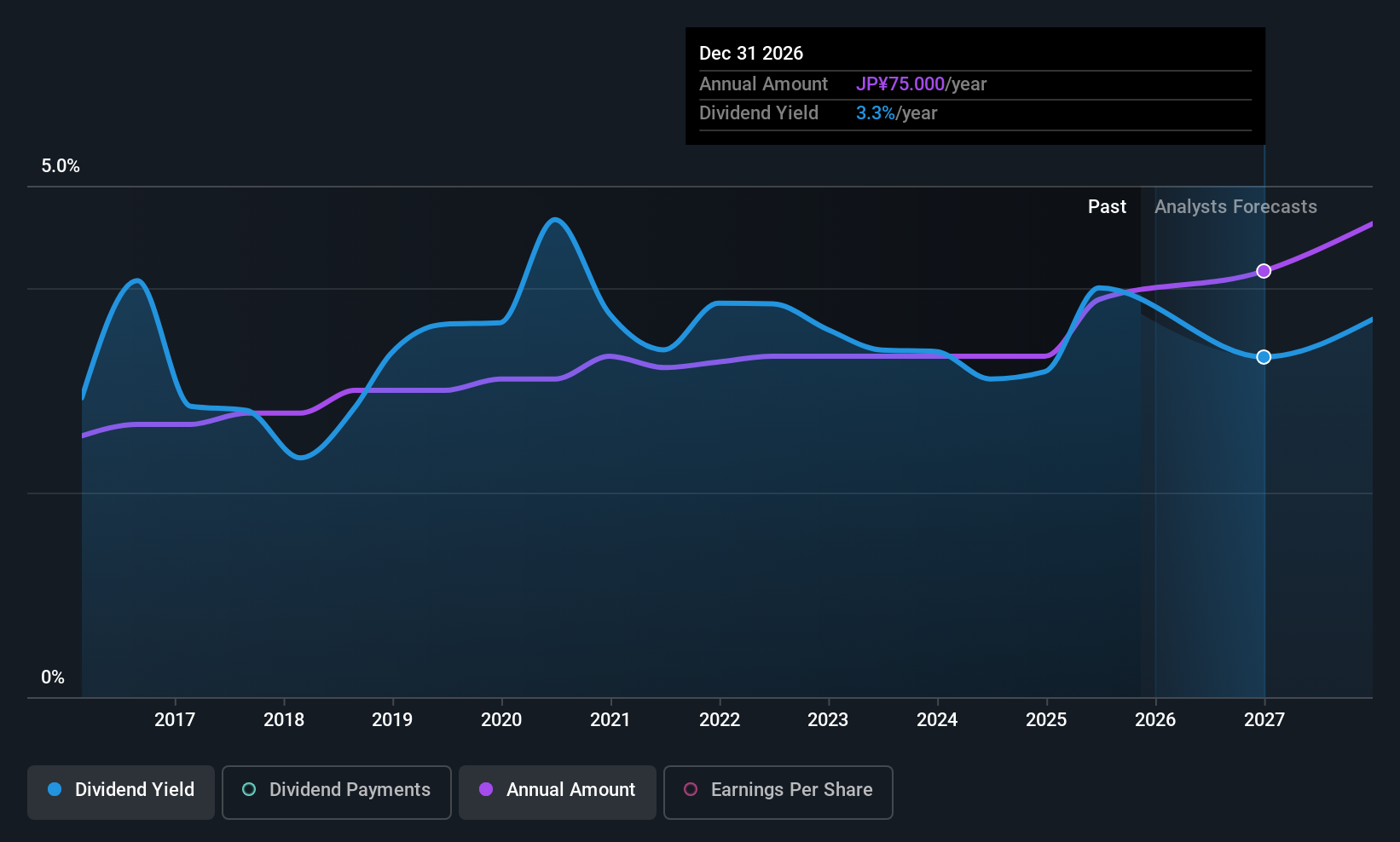

Star Micronics (TSE:7718)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Micronics Co., Ltd. is engaged in the production and sale of machine tools and special products across Japan, Europe, the United States, and Asia, with a market cap of ¥81.94 billion.

Operations: Star Micronics generates revenue primarily from its Machine Tool Business, including the Precision Part Business, at ¥52.23 billion and the Power Products Business at ¥15.38 billion.

Dividend Yield: 3.3%

Star Micronics' dividend yield of 3.31% is below the top tier in Japan and not well-covered by free cash flows, raising sustainability concerns despite a 70.1% payout ratio covered by earnings. The company's dividends have been stable and growing over the past decade, but recent shareholder dilution could impact future payouts. An acquisition by Taiyo Pacific Partners L.P., valued at ¥67.6 billion, may influence dividend policy pending transaction completion and shareholder approval.

- Delve into the full analysis dividend report here for a deeper understanding of Star Micronics.

- The analysis detailed in our Star Micronics valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Investigate our full lineup of 1322 Top Global Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7718

Star Micronics

Produces and sells machine tools and special products in Japan, Europe, the United States, and Asia.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives