As global markets continue to reach new heights, buoyed by favorable trade deals and strong business activity in the services sector, investors are increasingly looking to dividend stocks as a means of generating steady income amidst market volatility. In this environment, identifying stocks with robust dividend yields can provide a reliable source of returns, making them an attractive option for those seeking stability and income in their investment portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.22% | ★★★★★★ |

| NCD (TSE:4783) | 4.04% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.14% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.93% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.47% | ★★★★★★ |

Click here to see the full list of 1462 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

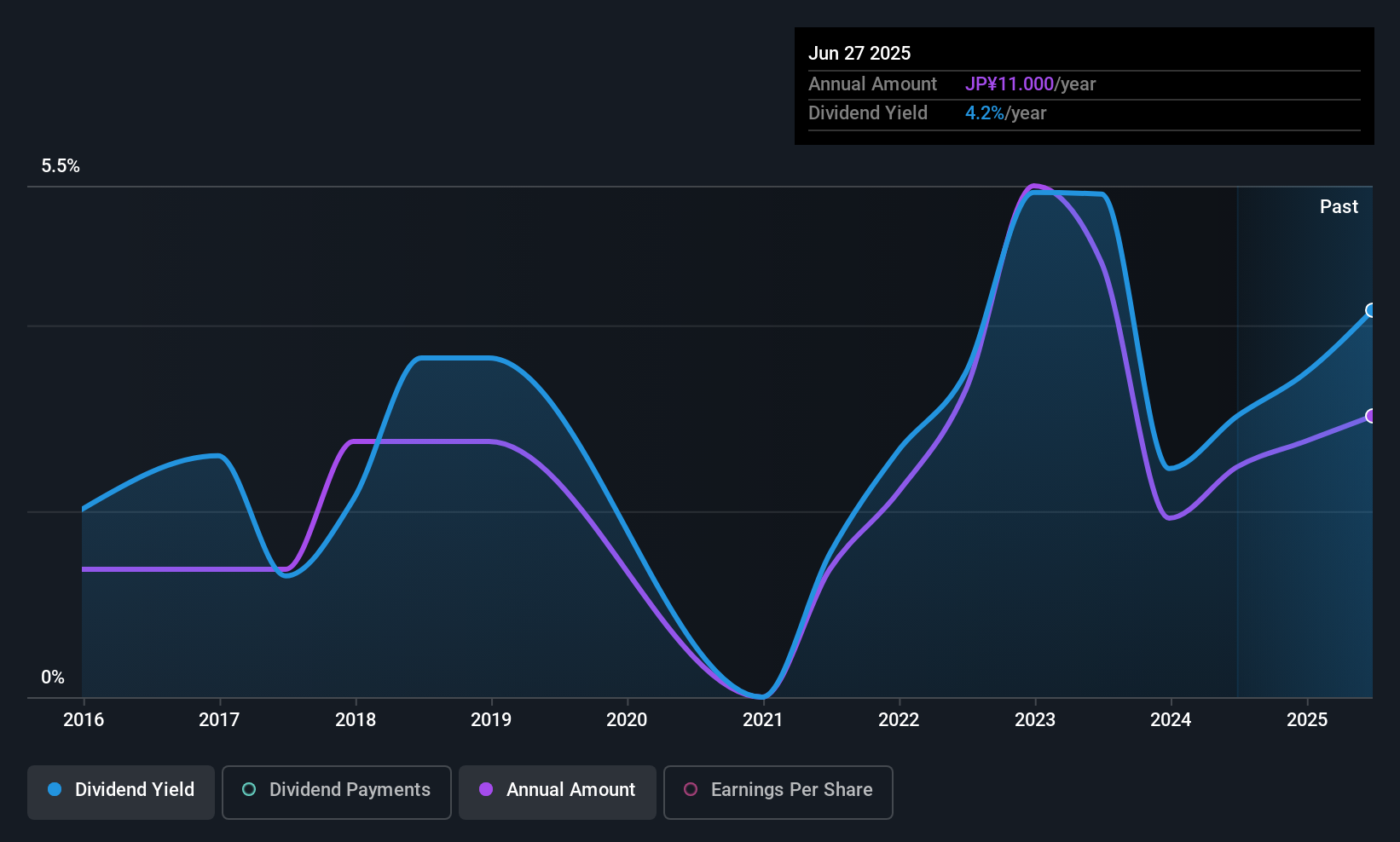

Open Up Group (TSE:2154)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Open Up Group Inc. operates in engineer dispatching, subcontracting, outsourcing, and recruiting across construction management, manufacturing, machinery, electronics, and IT software sectors both in Japan and internationally with a market cap of ¥154.45 billion.

Operations: Open Up Group Inc.'s revenue segments include ¥54.74 billion from the construction sector, ¥100.21 billion from the mechanical and electronics/IT field, and ¥36.82 billion from overseas operations.

Dividend Yield: 4.2%

Open Up Group's dividend, yielding 4.16%, ranks in the top 25% of JP market payers. Despite a reasonable payout ratio (59.3%) and cash flow coverage (54.1%), dividends have been volatile over the past decade with an unstable track record. Earnings have grown significantly at 35.9% annually over five years, supporting future payouts, but recent executive changes may impact stability. The stock trades at a significant discount to its estimated fair value, offering potential upside for investors seeking value and income.

- Click to explore a detailed breakdown of our findings in Open Up Group's dividend report.

- Our comprehensive valuation report raises the possibility that Open Up Group is priced lower than what may be justified by its financials.

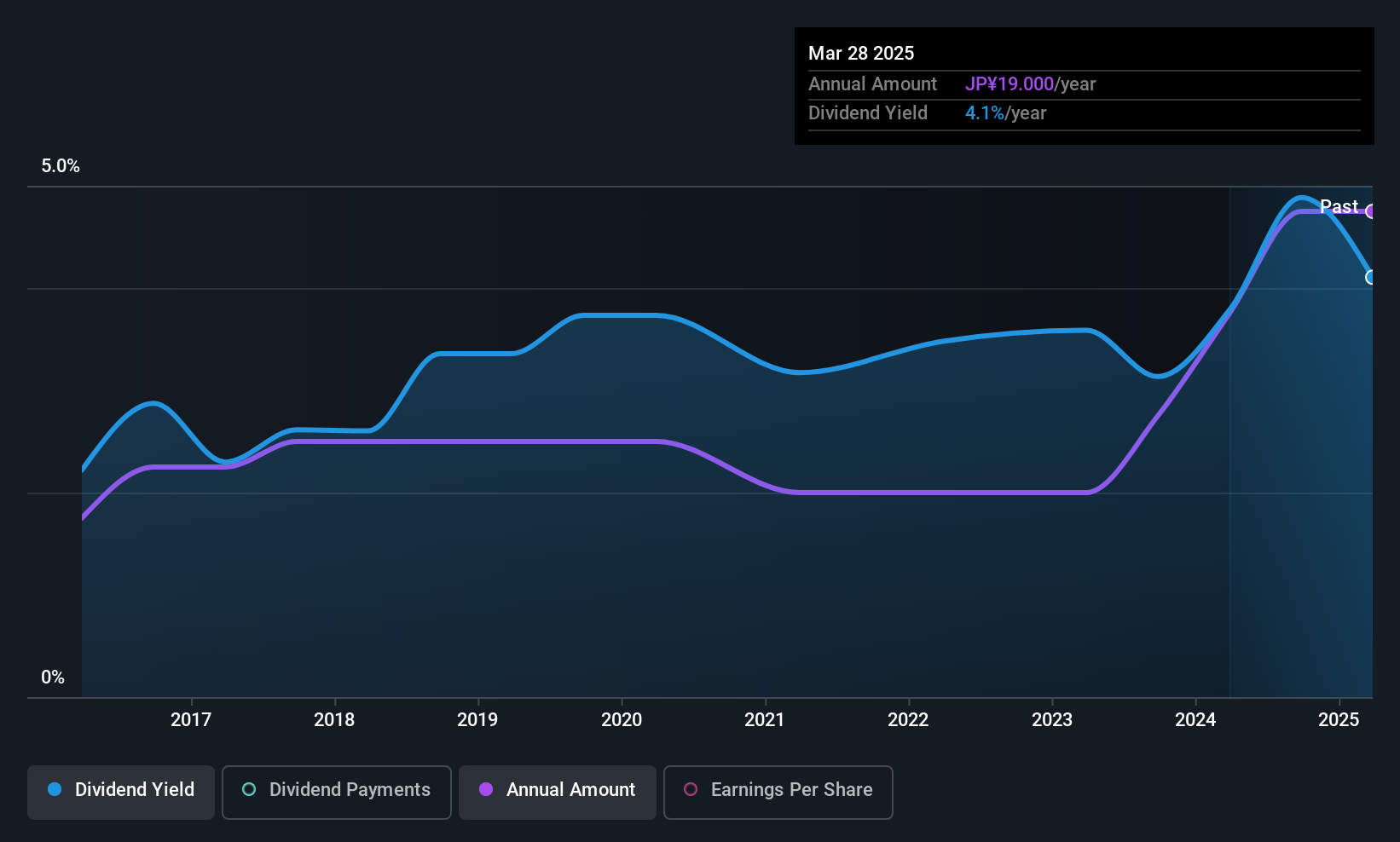

Nippon Denko (TSE:5563)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Denko Co., Ltd. operates in Japan through its subsidiaries, focusing on ferroalloys, functional materials, incineration ash recycling, aqua solutions, and electric power businesses, with a market cap of ¥37.34 billion.

Operations: Nippon Denko Co., Ltd.'s revenue is primarily derived from its Ferroalloy Business at ¥52.74 billion, followed by the Functional Materials Business at ¥14.40 billion, Incineration Ash Recycling Business at ¥8.07 billion, Aqua Solution Business at ¥1.57 billion, and Electric Power Business at ¥1.40 billion.

Dividend Yield: 3.9%

Nippon Denko's dividend yield of 3.93% places it among the top 25% of JP market payers, yet its dividends are not well-covered by free cash flows, with a high cash payout ratio of 91%. Despite a low payout ratio (43.3%) supporting coverage by earnings, dividends have been volatile over the past decade. Recent guidance indicates net sales expectations of ¥76.6 billion for 2025 and an increased dividend to JPY 5.00 per share for Q2 FY2025.

- Click here to discover the nuances of Nippon Denko with our detailed analytical dividend report.

- According our valuation report, there's an indication that Nippon Denko's share price might be on the expensive side.

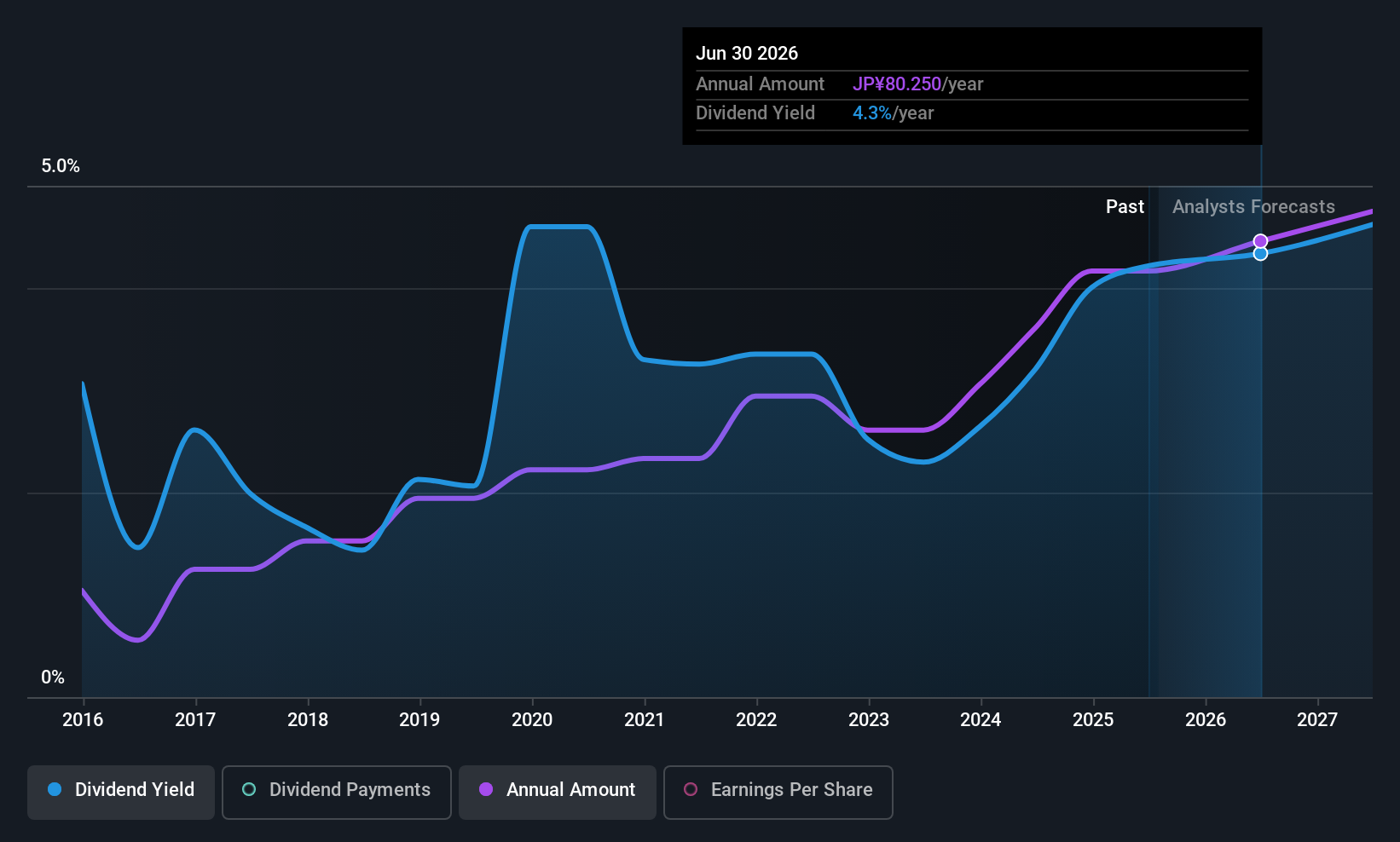

TOLI (TSE:7971)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TOLI Corporation engages in the manufacturing and sale of floor coverings, wallpapers, drapes, and related installation accessories both in Japan and internationally, with a market cap of ¥29.53 billion.

Operations: TOLI Corporation generates revenue primarily from its Product Business, which accounts for ¥63.91 billion, and its Interior Wholesale and Construction Business, contributing ¥68.12 billion.

Dividend Yield: 5%

TOLI Corporation's dividend yield of 5% ranks it among the top 25% in the JP market, although it's not supported by free cash flows. Despite this, a low payout ratio of 35.2% ensures coverage by earnings, with stable and reliable dividends over the past decade. Recent guidance projects net sales of ¥108 billion for FY2026 and an increased dividend to ¥17 per share, reflecting modest growth from ¥16 in FY2025.

- Take a closer look at TOLI's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that TOLI is trading beyond its estimated value.

Next Steps

- Click through to start exploring the rest of the 1459 Top Global Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOLI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7971

TOLI

Manufactures and sells floor coverings, wallpapers, drapes, and related installation accessories in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives