- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Glaukos (NYSE:GKOS) Shareholders Have Enjoyed A 29% Share Price Gain

Glaukos Corporation (NYSE:GKOS) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But at least the stock is up over the last three years. Arguably you'd have been better off buying an index fund, because the gain of 29% in three years isn't amazing.

View our latest analysis for Glaukos

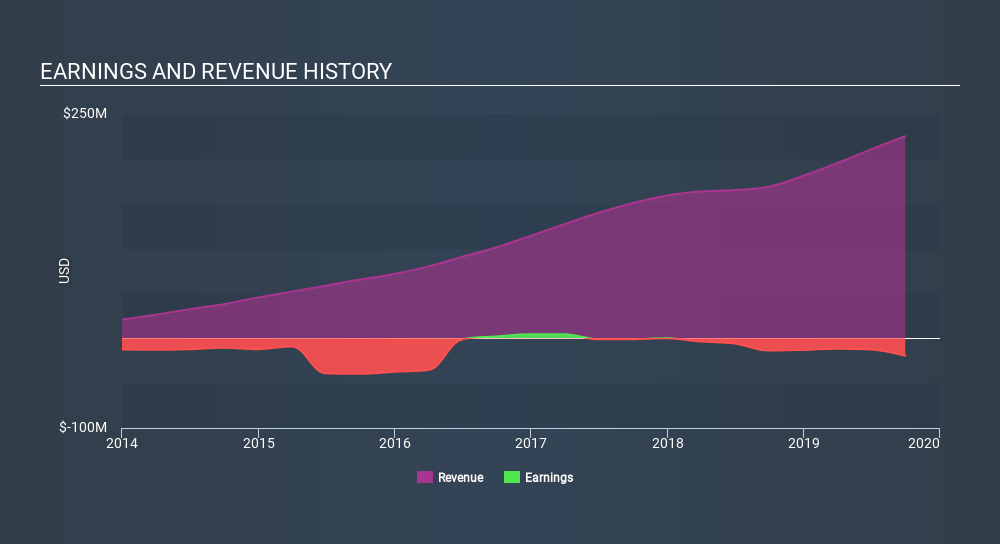

Given that Glaukos didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Glaukos saw its revenue grow at 23% per year. That's much better than most loss-making companies. While long-term shareholders have made money, the 8.9% per year gain over three years isn't that great given the rising market. Generally, we'd expect a stronger share price, given the impressive revenue growth. If the business can trend towards profitability and fund its growth, then the market could present an opportunity. But you might want to take a closer look at this one.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for Glaukos shares, which cost holders 13%, while the market was up about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 8.9% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. It's always interesting to track share price performance over the longer term. But to understand Glaukos better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Glaukos .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives