- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Gilead Sciences (NasdaqGS:GILD) Partners With Global Fund To Supply HIV Prevention Drug

Reviewed by Simply Wall St

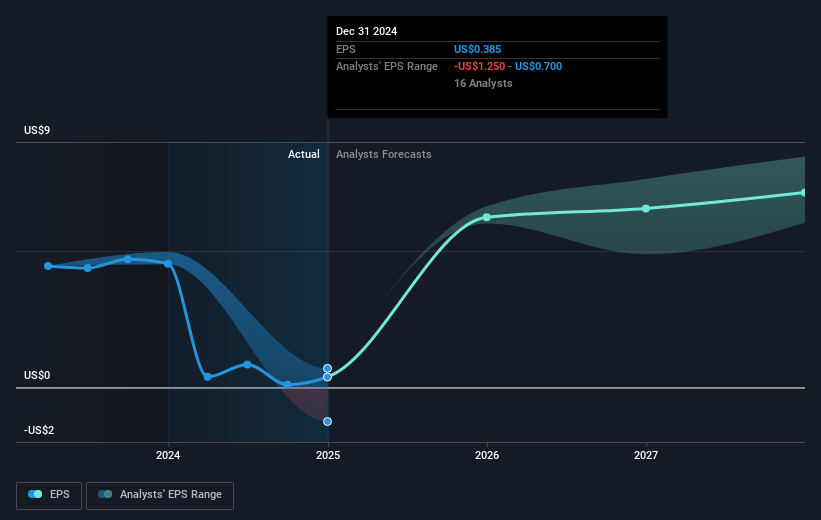

Gilead Sciences (NasdaqGS:GILD) recently announced a partnership with the Global Fund to supply lenacapavir for HIV prevention, marking a significant client collaboration. This and other positive events, such as the FDA's approval of Yeztugo for PrEP and clinical trial successes, highlight the company's active engagement in expanding access and treatment options. These factors may have bolstered investor confidence, aligning with a broader market trend, which saw modest gains amid trade policy uncertainty. The company’s 5.52% price increase over the last quarter reflects its robust initiatives against the backdrop of a largely flat market performance.

We've discovered 2 risks for Gilead Sciences that you should be aware of before investing here.

The recent collaboration between Gilead Sciences and the Global Fund to supply lenacapavir for HIV prevention, alongside the FDA's approval of Yeztugo for PrEP, enhances Gilead’s growth narrative by positioning it in expanding markets. These developments underline Gilead's efforts to strengthen its portfolio and could potentially accelerate revenue and earnings growth through increased market penetration and reduced competition. The emphasis on innovative HIV and oncology therapies aligns with Gilead’s strategy to sustain revenue growth amid market uncertainties.

Over the past three years, Gilead's total shareholder return, factoring in both share price and dividends, was 99.18%, demonstrating significant growth. In the past year alone, it notably outperformed the US Market's 12.6% return and the US Biotechs industry's decline, reflecting its resilience in a competitive sector. In comparison, this past year saw Gilead’s earnings surge by a very large percentage, far exceeding the industry average of 21.7%.

Looking forward, the recent news could positively influence Gilead's long-term revenue and earnings forecasts, supporting bullish analyst projections which expect substantial growth. Despite a short-term share price increase of 5.52% in the last quarter, Gilead is trading at about US$97.88, representing a discount to the consensus fair value price target of approximately US$116.81. This implies potential upside if the company continues to leverage its strategic partnerships and product launches effectively.

Evaluate Gilead Sciences' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives