- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

GigaCloud Technology (NasdaqGM:GCT) Shares Gain 38% In Last Quarter

Reviewed by Simply Wall St

On June 28, 2025, GigaCloud Technology (NasdaqGM:GCT) was reclassified, highlighting a shift from growth to value-focused indices. This notable transition may have contributed to the company's share price increase of 38% over the last quarter. The index reclassifications aligned with stable financial performance, including Q1 revenue growth and a slight net income dip. A share buyback initiative that saw 6.6% of shares repurchased further signified shareholder value priorities. Amid broader market movements with tech stocks rising, these strategic adjustments at GigaCloud provided weight to its impressive share price surge during a period when markets have risen 14% over the year.

GigaCloud Technology has 1 risk we think you should know about.

The recent reclassification of GigaCloud Technology to value-focused indices has sparked interest due to its immediate 38% share price increase this quarter. This shift positions the company differently within the investment landscape, potentially appealing to a new class of investors who prioritize stable returns. However, looking at a broader timeframe, the company's total shareholder return, combining share price and dividends, reflects a 35.53% decline over the past year. This contrasts sharply with its short-term jump and underscores the volatility it has experienced.

Relative to the broader market, GigaCloud's recent quarterly performance has outpaced a market rise of 14% over the year. However, its one-year performance lags behind both the industry and market averages, revealing challenges that extend beyond immediate reclassifications and buybacks. Factors such as the integration of Noble House, the shift to diversified M&A in Europe, and expansions into Germany could influence revenue positively, but the macroeconomic risks present significant hurdles.

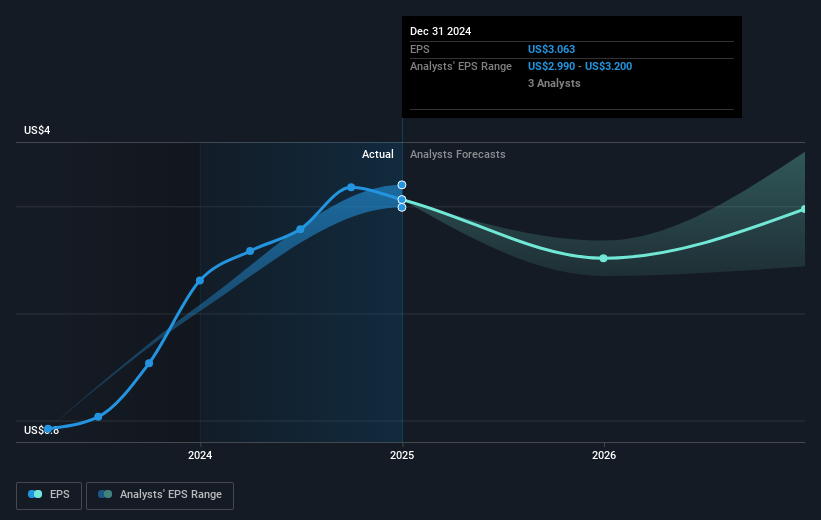

Forecasts indicate a modest increase in revenue, anticipated to grow 2.5% annually, with earnings expected to decline to US$82.1 million by 2028. The redirected focus toward brick-and-mortar and European markets needs to be carefully balanced against freight cost volatility and decreased buyer spend. The current share price of US$17.69 sits below the analyst consensus target of US$29.5, suggesting a potential upside if GigaCloud can meet future expectations. This is juxtaposed with the observed decline in profit margins and the competitive peer Price-To-Earnings ratios, marking an environment where GigaCloud's strategic positioning needs precision to transform short-term gains into sustained growth.

Assess GigaCloud Technology's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives