- United States

- /

- Auto

- /

- NYSE:GM

General Motors (NYSE:GM) Extends Strategic Partnership With Malibu Boats For Engine Innovation

Reviewed by Simply Wall St

General Motors (NYSE:GM) recently extended its collaboration with Malibu Boats, designating Chevrolet as the Official Vehicle Brand of Malibu Boats, which underscores GM's innovative engagement in diverse sectors. Over the last quarter, GM's stock price moved 2.7% lower, amid a flat market backdrop and various corporate changes including new executive appointments. Additionally, the company's lower-than-anticipated full-year earnings guidance and recent debt financing activities added to the mix of influences on its stock performance. While these individual events mark important strides for GM, they collectively weighed against the broader market uptrend over the past year.

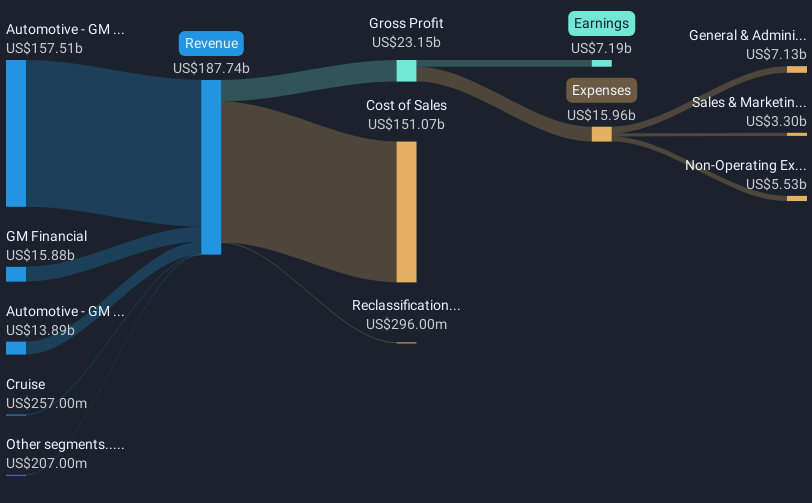

The recent collaboration between General Motors and Malibu Boats as the Official Vehicle Brand underscores GM's approach to broadening its market engagement through partnerships, potentially enhancing brand value and attractiveness. Over the past five years, GM's total returns, including share price and dividends, reached 96.26%, signaling robust long-term performance. In contrast, the stock has underperformed the U.S. Auto industry over the past year, which saw a 61.6% return, compared to GM's negative movement. This disparity highlights the challenges faced by GM in aligning short-term market performance with long-term strategic goals.

The extension of this partnership could potentially bolster GM's brand reputation, influencing revenue and earnings forecasts favorably in the longer term as these synergies take effect. However, given the minor short-term share price decline of 2.7%, the effects on revenue and earnings might be limited and may not significantly impact the current forecasts of a slight annual revenue decline of 0.4% over the next three years. The current share price represents a discount of 12.61% to the analyst consensus price target of $54.39, suggesting a potential upside if GM can enhance operational efficiency and effectively navigate industry challenges.

Jump into the full analysis health report here for a deeper understanding of General Motors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives