- United States

- /

- Medical Equipment

- /

- NasdaqGS:GEHC

GE HealthCare Technologies (NasdaqGS:GEHC) Board Confirms US$0.04 Dividend for Q2 2025

Reviewed by Simply Wall St

GE HealthCare Technologies (NasdaqGS:GEHC) recently reaffirmed its commitment to shareholder value with a cash dividend declaration, supplemented by a modest rise of 8% in its share price last month. Though not extraordinary, the dividend affirmation would have added a positive weight alongside broader market trends. Despite the turbulence of being removed from several indices, the company's progress in securing FDA approval for expanded applications of its imaging products marks an encouraging development. Overall, GE HealthCare's stock movement aligns broadly with market patterns amid surging indices, leaving investors to monitor the impact of ongoing financial and product-related undertakings.

Be aware that GE HealthCare Technologies is showing 1 risk in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent dividend declaration by GE HealthCare Technologies demonstrates a continued commitment to reward shareholders, potentially stabilizing investor confidence amid recent share price fluctuations. Despite the modest 8% share price increase over the past month, the overall performance over the past year was less favorable, with a total shareholder return of 0.34%. This return notably lags behind the broader US market and the Medical Equipment industry, which saw respective returns of 13.9% and 12.1% over the same period.

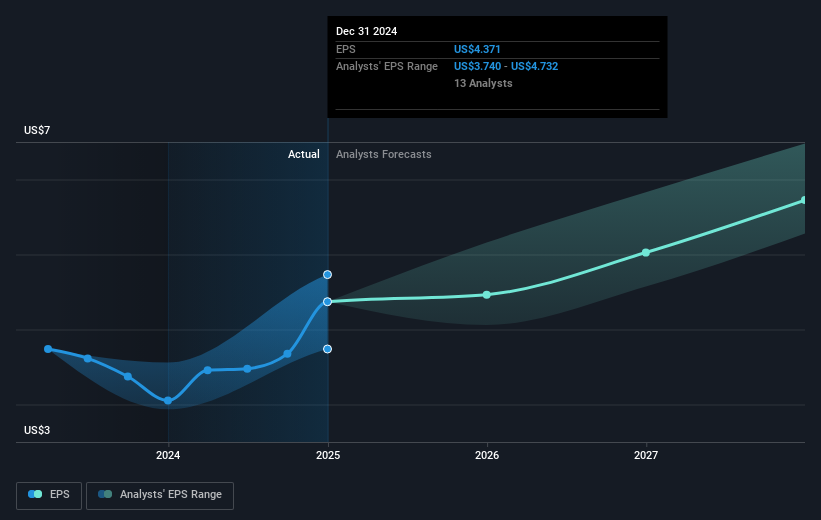

As the company secures FDA approvals for its imaging products, enhancing its market position, these developments might not immediately reflect in revenue or earnings forecasts. While analysts anticipate revenue growth of 4.2% annually and a slight decline in profit margins over the next three years, the recent announcements could positively influence these estimates if successfully capitalized upon.

Trading at US$71.98, the current share price is 17.6% below the consensus analyst price target of US$87.40. This suggests potential for upside if market conditions improve and if the company executes on its planned growth strategies effectively. The price target also assumes GE HealthCare's valuation would reflect a PE ratio of 21.4x by 2028, indicating a trajectory towards industry standards, though still below the current US Medical Equipment industry average of 30.1x.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEHC

GE HealthCare Technologies

Engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives