- United States

- /

- Media

- /

- NasdaqGS:FOXA

Fox (NasdaqGS:FOXA) Removed From Russell 1000 Dynamic Index In Latest Reshuffle

Reviewed by Simply Wall St

On June 30, 2025, Fox (NasdaqGS:FOXA) saw the removal of both its share classes from the Russell 1000 Dynamic Index, signaling a potential shift in its market perception. Despite this change, over the past month, Fox's shares rose 3% amid a buoyant market environment where major indexes like the S&P 500 and Nasdaq saw new highs. The appointment of a new Chief Marketing Officer earlier in June may have also provided additional momentum for the company's shares. Overall, index changes and leadership updates may have added context to Fox's performance, aligning it broadly with the positive market trends.

We've discovered 1 warning sign for Fox that you should be aware of before investing here.

The removal of Fox from the Russell 1000 Dynamic Index and the recent leadership change might signal shifts in investor perception and potentially affect its market performance. However, Fox's shares have risen 3% this past month, aligning with the rally in major indexes. Over a five-year period, the company's total return, including dividends, has been 129.02%, showcasing significant growth. This long-term performance stands in contrast to the more modest 12-month performance where Fox exceeded the US Media industry, which experienced a 1.6% decline.

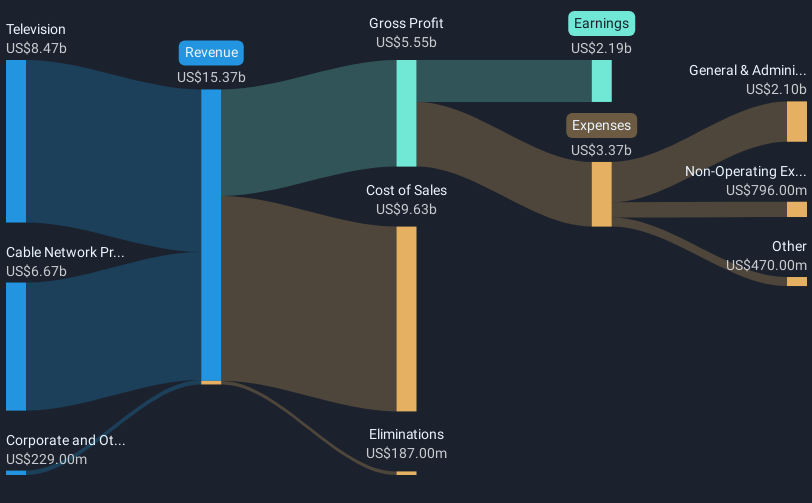

The discontinuation of the Venu joint venture and ongoing pressures from competitors in securing sports rights could impact Fox's future revenue growth and earnings stability. Analysts have conservatively forecast a slight decrease in revenue annually over the next three years, along with a marginal increase in profit margins. As of today's date, the stock is trading at about 0.59% below the consensus price target of US$57.72. The current discrepancy between the share price and the analyst target indicates a belief that the company's market price is relatively in line with its estimated future value. Investors considering the potential implications of these changes should evaluate these expectations carefully.

Evaluate Fox's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States (U.S.).

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives