- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (NasdaqGS:FSLR) Reports Q1 2025 Net Income Dip Despite Sales Growth

Reviewed by Simply Wall St

First Solar (NasdaqGS:FSLR) saw a stock price increase of 20% over the last quarter. This substantial price move came amid several noteworthy developments within the company and a generally positive market environment. The announcement of Q1 2025 earnings revealed a mixed financial performance, with sales increasing but net income declining. A lowered earnings guidance for 2025 might have been expected to weigh on share prices; however, investors appeared more focused on the company's business expansions, such as its significant investment in U.S. manufacturing. The broader market's upward trend, reaching highs not seen since February, likely supported the share growth.

The recent developments surrounding First Solar, including its U.S. manufacturing investments and innovative CuRe technology, are pivotal to understanding the company's future potential. These advancements suggest an emphasis on domestic capacity expansion and efficiency improvements, which might support revenue growth despite concerns from a lowered 2025 earnings guidance. The mixed Q1 2025 financial performance, with rising sales but declining net income, highlights the complexity of balancing growth initiatives with profitability amid changing market dynamics.

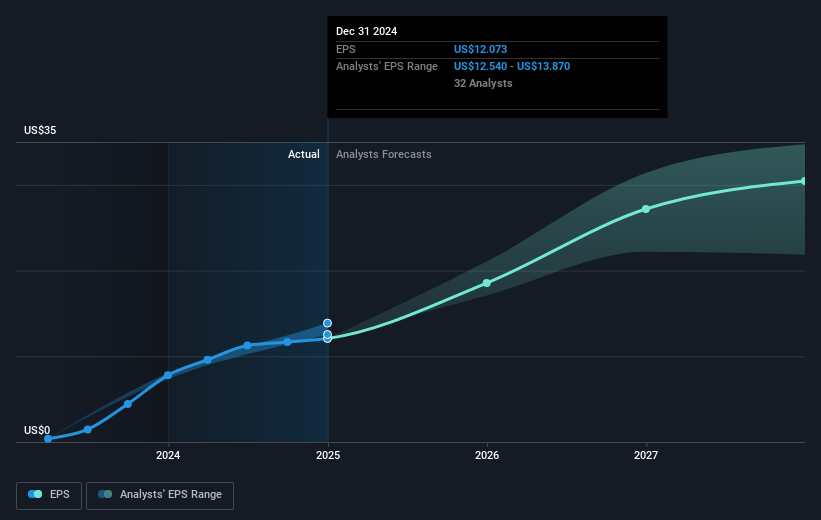

Over a five-year period, First Solar's total shareholder return, including dividends, reached 231.97%, demonstrating solid long-term performance. Compared to the US market's 12.4% return over the past year, First Solar underperformed. However, its 23.4% earnings growth outpaced the US Semiconductor industry, which saw a decline over the same timeframe.

The potential effects of current news on revenue and earnings forecasts appear significant. Expansion into the U.S. and Indian markets could boost revenues through higher sales volumes. First Solar's commitment to its proprietary technology may enhance profit margins amid global trade tensions. Analysts anticipate a 16.5% annual revenue growth and an increase in profit margins to 46.3% by 2028.

Considering the recent share price gain and analysts' consensus price target of US$195.59, First Solar trades at a notable discount, with the current share price standing at US$126.76. Such valuations imply upside potential if projected earnings and sales targets are met, given a required PE ratio of 8.8x by 2028. Investors must assess these targets against their assumptions and expectations for a holistic perspective.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives