- Australia

- /

- Healthcare Services

- /

- ASX:AHX

Even With A 27% Surge Cautious Investors Are Not Rewarding Apiam Animal Health Limited's (ASX:AHX) Performance Completely

Despite an already strong run, Apiam Animal Health Limited (ASX:AHX) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 26%.

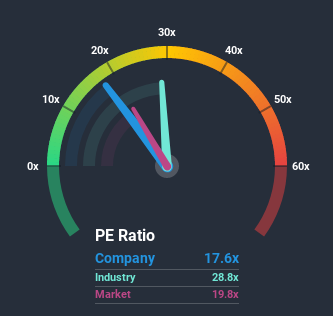

Although its price has surged higher, Apiam Animal Health may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.6x, since almost half of all companies in Australia have P/E ratios greater than 20x and even P/E's higher than 40x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Apiam Animal Health certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Apiam Animal Health

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Apiam Animal Health would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 23% gain to the company's bottom line. Still, incredibly EPS has fallen 24% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 34% each year as estimated by the only analyst watching the company. With the market only predicted to deliver 18% per year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Apiam Animal Health is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Apiam Animal Health's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Apiam Animal Health currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 5 warning signs for Apiam Animal Health that you should be aware of.

Of course, you might also be able to find a better stock than Apiam Animal Health. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you’re looking to trade Apiam Animal Health, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:AHX

Apiam Animal Health

A vertically integrated animal health company, provides veterinary products and services to production and companion animals, and equine in Australia.

Moderate and good value.

Market Insights

Community Narratives