- Switzerland

- /

- Building

- /

- SWX:DOKA

European Stocks That May Be Trading Below Their Estimated Value In September 2025

Reviewed by Simply Wall St

As the European markets grapple with concerns over U.S. Federal Reserve independence, renewed tariff uncertainties, and political instability in France, major indices like the STOXX Europe 600 have seen declines. In this environment of caution and volatility, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to navigate these challenges effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKAN Group (SWX:SKAN) | CHF61.40 | CHF120.15 | 48.9% |

| SBO (WBAG:SBO) | €27.30 | €54.56 | 50% |

| Robit Oyj (HLSE:ROBIT) | €1.155 | €2.26 | 49% |

| Pluxee (ENXTPA:PLX) | €17.40 | €34.03 | 48.9% |

| Norconsult (OB:NORCO) | NOK46.15 | NOK90.70 | 49.1% |

| Hanza (OM:HANZA) | SEK113.60 | SEK221.31 | 48.7% |

| E-Globe (BIT:EGB) | €0.67 | €1.31 | 49% |

| dormakaba Holding (SWX:DOKA) | CHF744.00 | CHF1452.75 | 48.8% |

| Camurus (OM:CAMX) | SEK720.00 | SEK1416.78 | 49.2% |

| Aker BioMarine (OB:AKBM) | NOK84.90 | NOK169.50 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

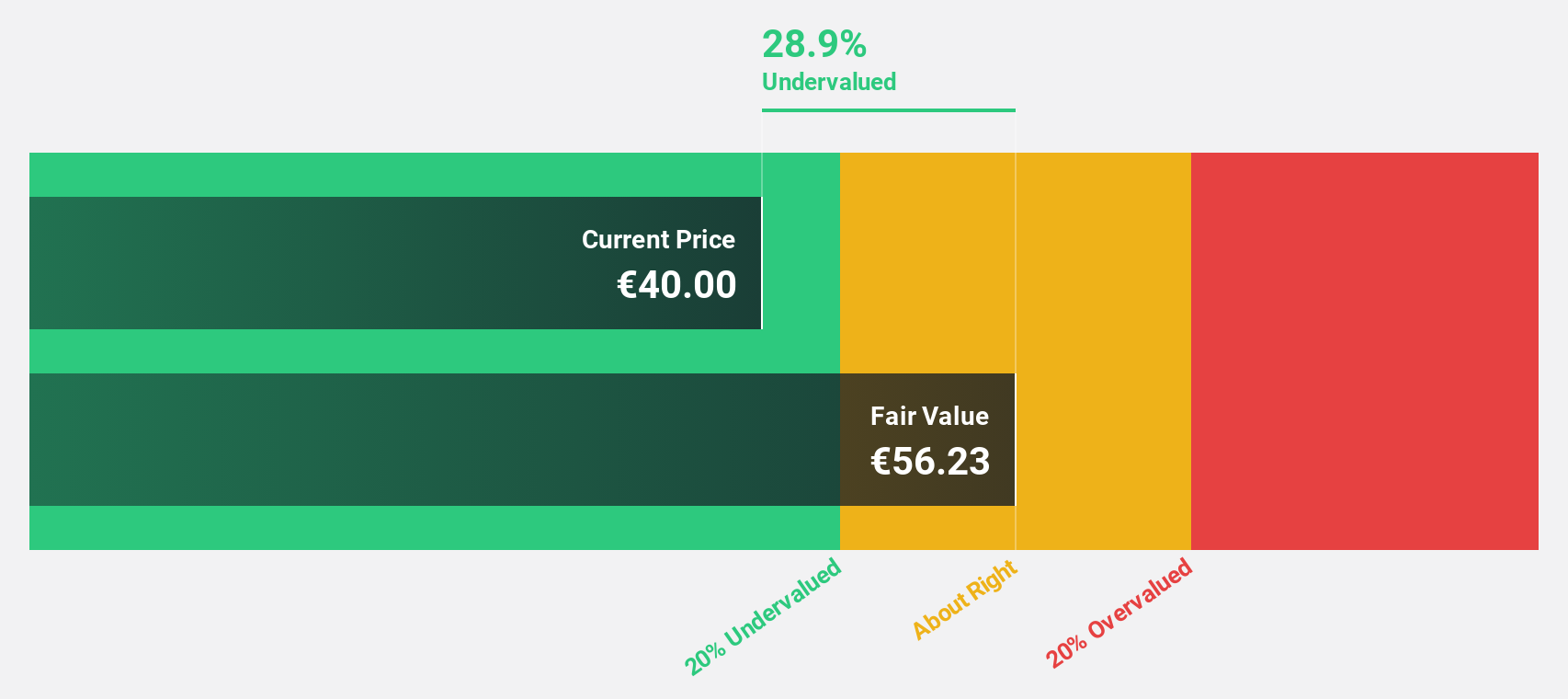

Lisi (ENXTPA:FII)

Overview: Lisi S.A. designs and produces assembly and component solutions for the aerospace, automotive, and medical sectors globally, with a market cap of €2.08 billion.

Operations: The company's revenue is generated from three primary segments: LISI Aerospace (€1.13 billion), LISI Automotive (€561.21 million), and LISI Medical (€183.94 million).

Estimated Discount To Fair Value: 21.5%

Lisi is trading at €45.4, significantly below its estimated fair value of €57.8, highlighting potential undervaluation based on cash flows. Despite this, the company faces challenges such as a high level of debt and low forecasted return on equity (11%). However, earnings are expected to grow significantly at 31.22% annually over the next three years, outpacing the French market's growth rate and reflecting strong profit potential amidst recent revenue increases to €1.03 billion for H1 2025.

- In light of our recent growth report, it seems possible that Lisi's financial performance will exceed current levels.

- Get an in-depth perspective on Lisi's balance sheet by reading our health report here.

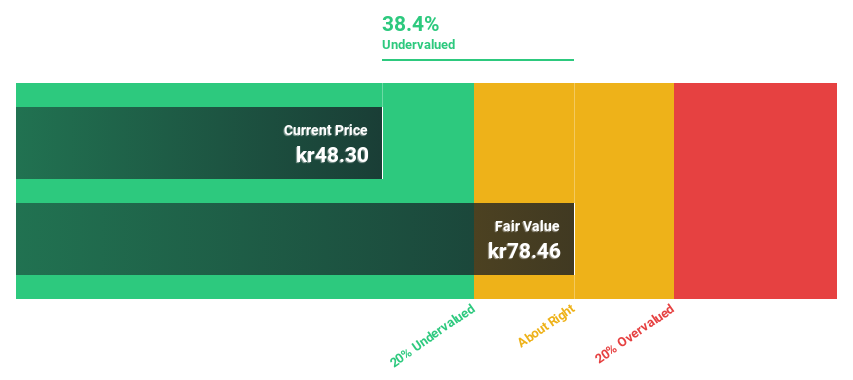

Pexip Holding (OB:PEXIP)

Overview: Pexip Holding ASA is a video technology company offering an end-to-end video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of NOK6.73 billion.

Operations: The company's revenue primarily comes from the Sale of Collaboration Services, amounting to NOK1.19 billion.

Estimated Discount To Fair Value: 16.4%

Pexip Holding, trading at NOK 65.7, is undervalued relative to its fair value estimate of NOK 78.59. The company has become profitable this year and forecasts indicate significant earnings growth of 20.72% annually, surpassing the Norwegian market's rate. Recent buybacks totaling NOK 99.9 million may enhance shareholder value, although the dividend remains unsustainably covered by earnings or cash flows. Revenue for H1 2025 rose to NOK 629.07 million from the previous year's NOK 557.56 million.

- The growth report we've compiled suggests that Pexip Holding's future prospects could be on the up.

- Click here to discover the nuances of Pexip Holding with our detailed financial health report.

dormakaba Holding (SWX:DOKA)

Overview: dormakaba Holding AG is a global provider of access and security solutions, with a market capitalization of CHF3.12 billion.

Operations: The company's revenue is primarily derived from Access Solutions, which generated CHF2.44 billion, and Key & Wall Solutions and OEM, contributing CHF496.40 million.

Estimated Discount To Fair Value: 48.8%

Dormakaba Holding, trading at CHF744, is significantly undervalued compared to its estimated fair value of CHF1452.75. Despite a high level of debt and large one-off items affecting earnings quality, the company's earnings grew by 60% last year and are projected to increase by 24.9% annually over the next three years, outpacing the Swiss market's growth rate. However, revenue growth remains modest at 3.7%, below both company targets and market expectations.

- Upon reviewing our latest growth report, dormakaba Holding's projected financial performance appears quite optimistic.

- Take a closer look at dormakaba Holding's balance sheet health here in our report.

Make It Happen

- Click here to access our complete index of 214 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DOKA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives