European Market Highlights: High Leads 3 Promising Penny Stocks

Reviewed by Simply Wall St

The European market has recently experienced a mixed performance, with the pan-European STOXX Europe 600 Index ending slightly higher amid hopes for more trade deals, although gains were curbed by tariff concerns. As investors navigate these shifting conditions, they often seek opportunities in various segments of the market. Penny stocks, though an outdated term, still represent a niche area where smaller or newer companies can offer growth potential when backed by strong financial health. This article will explore three promising penny stocks that may provide hidden value and long-term potential despite their modest price points.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.39 | €45.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.49 | RON16.57M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.89 | €60.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €5.00 | €18.7M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.38 | PLN11.8M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.41 | SEK2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.984 | €33.18M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 332 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

High (ENXTPA:HCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Co. SA offers consumer engagement chain solutions in France, Belgium, and Spain with a market cap of €85.29 million.

Operations: The company generates €146.38 million in revenue from its advertising segment.

Market Cap: €85.29M

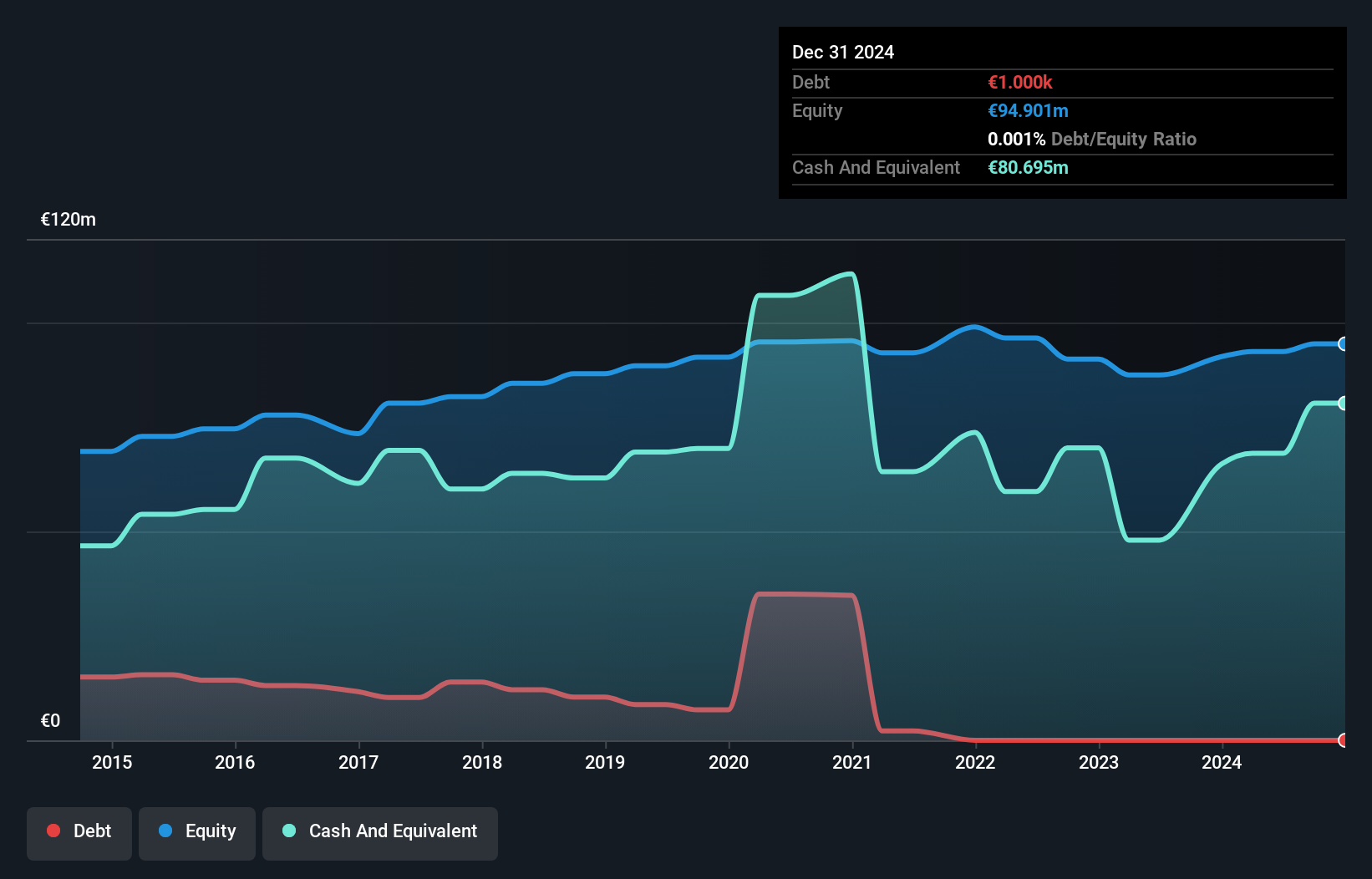

High Co. SA, with a market cap of €85.29 million, generates €146.38 million in revenue from its advertising segment across France, Belgium, and Spain. The company maintains high-quality earnings without significant shareholder dilution over the past year and has reduced its debt to equity ratio to 0% over five years. Despite stable weekly volatility and well-covered interest payments by EBIT (57.2x), it faces challenges with negative earnings growth (-27.4%) last year and declining profit margins (5.3% from 7.3%). While trading below fair value estimates, future earnings are forecasted to decline by an average of 15.3% annually over three years.

- Get an in-depth perspective on High's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into High's future.

Isofol Medical (OM:ISOFOL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Isofol Medical AB (publ) is a clinical stage biotech company with a market cap of SEK161.52 million.

Operations: Isofol Medical AB (publ) has not reported any revenue segments.

Market Cap: SEK161.52M

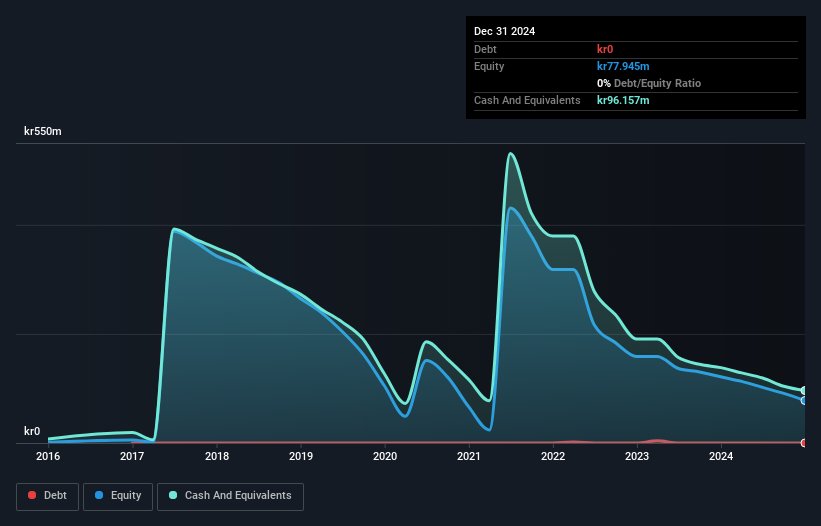

Isofol Medical AB, a clinical-stage biotech firm with a market cap of SEK161.52 million, is pre-revenue and unprofitable but has been reducing losses by 30.7% annually over the past five years. The company remains debt-free and its short-term assets surpass both short- and long-term liabilities, providing some financial stability. Recent strategic moves include a private placement raising SEK4.99 million and ongoing clinical trials for arfolitixorin in metastatic colorectal cancer treatment, with FDA engagement indicating potential U.S. expansion plans. However, Isofol's management team lacks experience, contributing to higher-than-average stock volatility in Sweden.

- Click here to discover the nuances of Isofol Medical with our detailed analytical financial health report.

- Gain insights into Isofol Medical's future direction by reviewing our growth report.

Xbrane Biopharma (OM:XBRANE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xbrane Biopharma AB is a biotechnology company focused on the development, manufacture, and sale of biosimilars, with a market cap of SEK388.26 million.

Operations: The company generates revenue from its biosimilar development segment, amounting to SEK277.89 million.

Market Cap: SEK388.26M

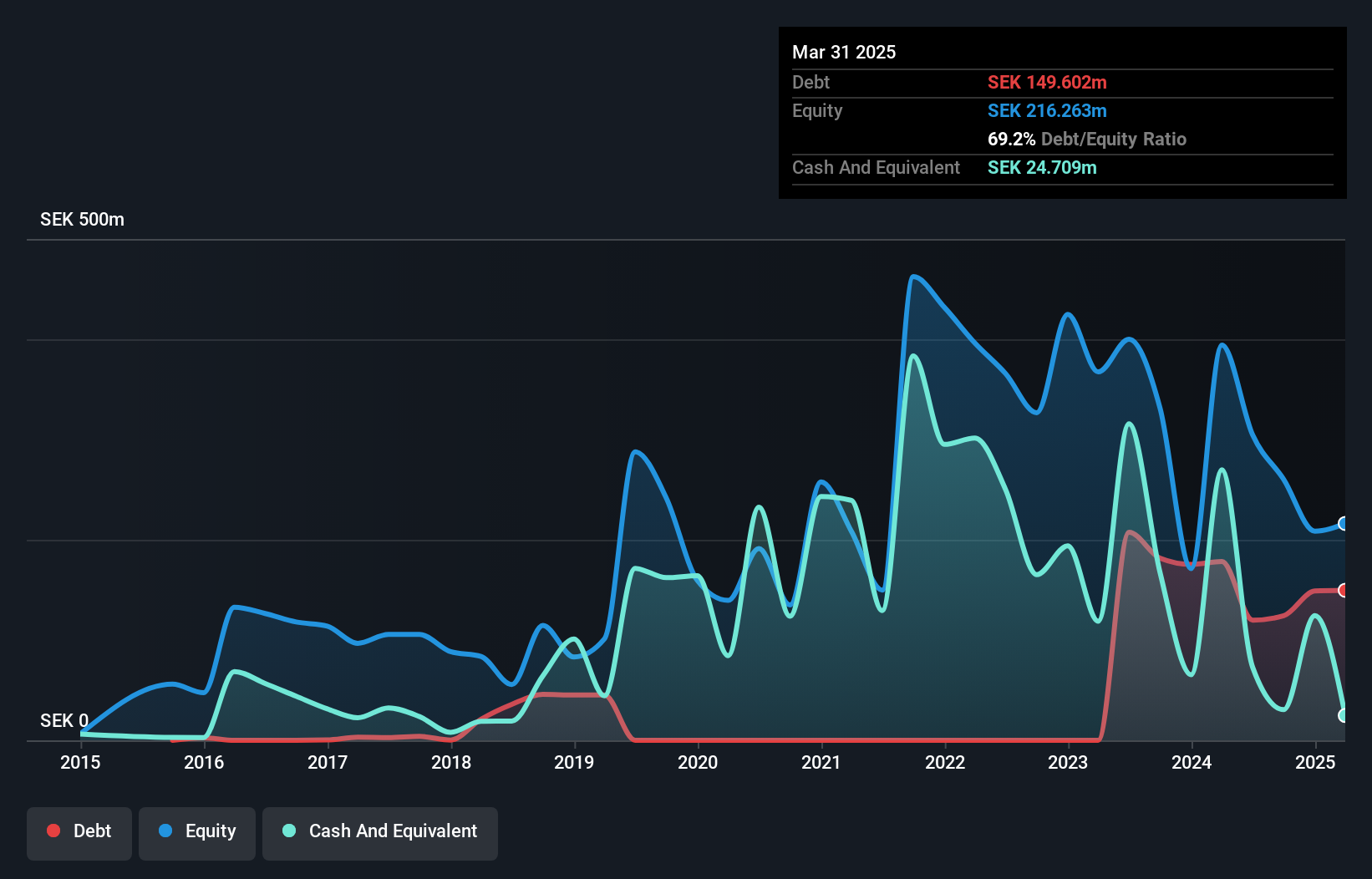

Xbrane Biopharma, with a market cap of SEK388.26 million, is focused on biosimilars and has shown significant revenue growth, reporting SEK93.24 million in Q1 2025 compared to SEK14.07 million the previous year. Despite being unprofitable and having high debt levels (net debt to equity at 57.8%), its seasoned management team and strategic partnerships are promising for future developments. The recent collaboration with OneSource aims to enhance global supply capabilities and regulatory approvals for its lead candidate Ximluci, which is under U.S. FDA review after gaining European market authorization in 2023.

- Take a closer look at Xbrane Biopharma's potential here in our financial health report.

- Understand Xbrane Biopharma's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Reveal the 332 hidden gems among our European Penny Stocks screener with a single click here.

- Ready For A Different Approach? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ISOFOL

Flawless balance sheet moderate.

Market Insights

Community Narratives