As European markets navigate the complexities of new U.S. tariffs and mixed economic signals, indices like the STOXX Europe 600 have shown resilience with modest gains. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for investors seeking stability amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.52% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.17% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.69% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.90% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.55% | ★★★★★★ |

| ERG (BIT:ERG) | 5.44% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.10% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★★ |

Click here to see the full list of 232 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative (ENXTPA:CRLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a range of banking products and services to diverse clients in France, with a market cap of €600.35 million.

Operations: The company's revenue segments include Land (€1.13 billion), Leasing activity (€151.14 million), and Local Banking in France (€234.80 million).

Dividend Yield: 3.8%

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a dividend yield of 3.82%, which is below the top tier in the French market but remains reliable and stable over the past decade. Trading at 26.3% below its estimated fair value, it presents good value for investors. The payout ratio of 29.5% suggests dividends are well covered by earnings, though concerns arise from a high bad loans ratio of 3.2%.

- Unlock comprehensive insights into our analysis of Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative stock in this dividend report.

- The valuation report we've compiled suggests that Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative's current price could be quite moderate.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €622.96 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative generates revenue primarily from its Proximity Bank segment (€251.71 million) and Management for Own Account and Miscellaneous segment (€60.97 million).

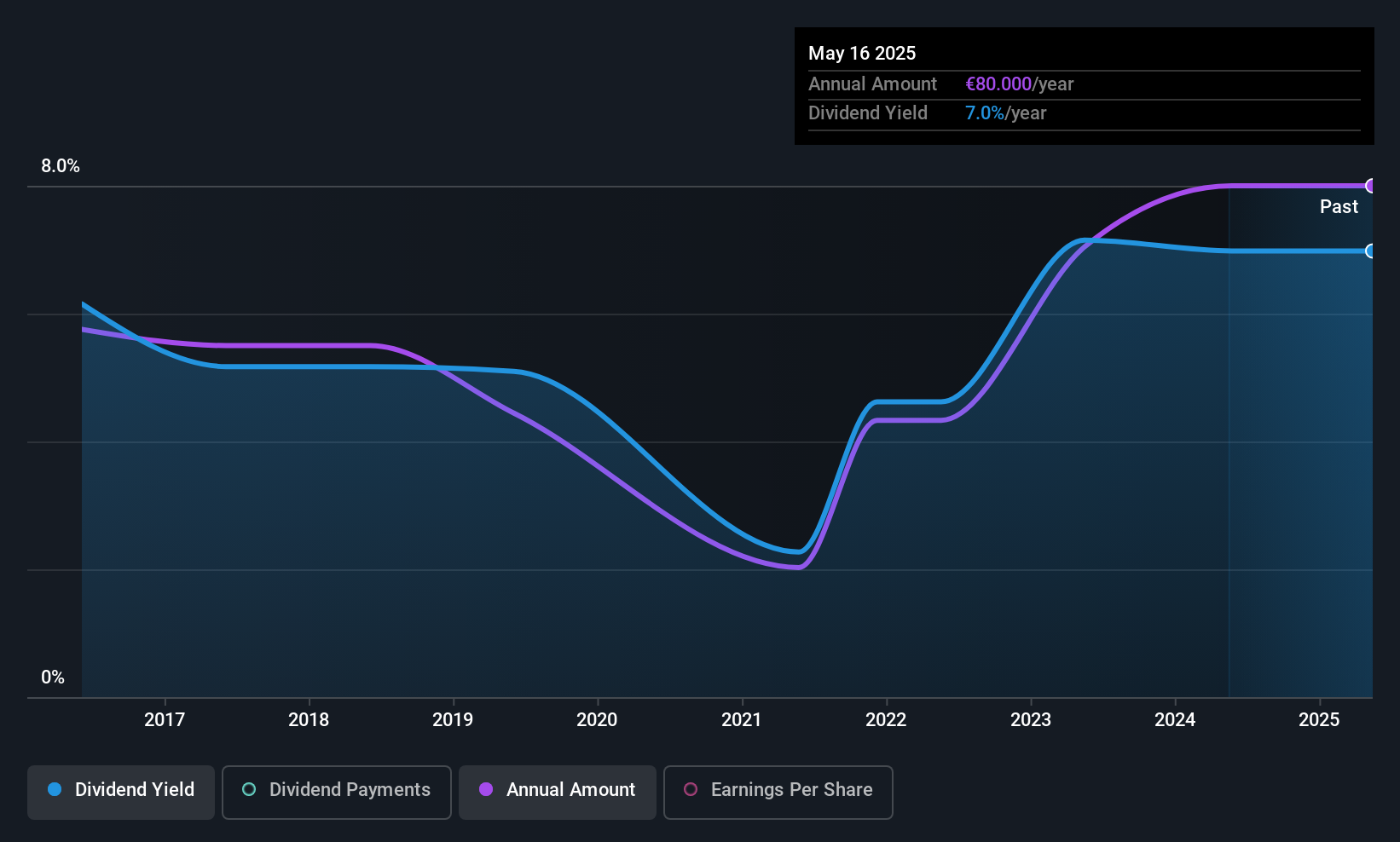

Dividend Yield: 3.2%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative provides a reliable and stable dividend yield of 3.23%, though it falls short compared to the top 25% in the French market. The low payout ratio of 25% indicates dividends are well covered by earnings, enhancing sustainability. Trading at 32.4% below its estimated fair value, it offers attractive valuation for investors seeking consistent income with potential for capital appreciation.

- Click here and access our complete dividend analysis report to understand the dynamics of Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative.

- In light of our recent valuation report, it seems possible that Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative is trading behind its estimated value.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, with a market cap of €836.58 million, operates in Monaco and internationally, offering banking and financial solutions through its subsidiaries.

Operations: CFM Indosuez Wealth Management SA generates revenue primarily from its Wealth Management segment, which amounts to €196.43 million.

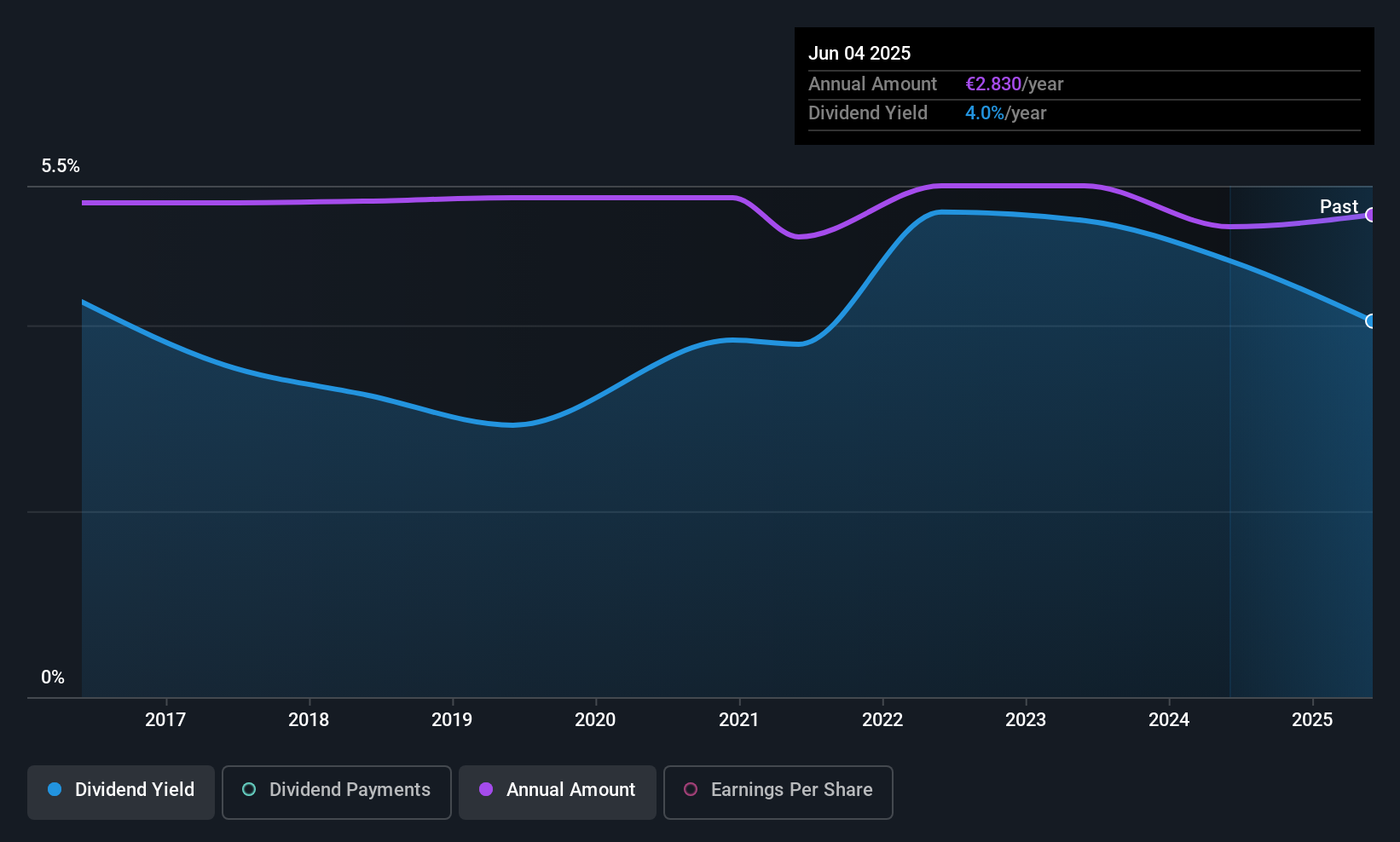

Dividend Yield: 5.3%

CFM Indosuez Wealth Management offers a dividend yield in the top 25% of the French market, with a reasonable payout ratio of 73.6%, indicating coverage by earnings. However, its dividend track record is unstable and unreliable due to past volatility and inconsistent growth. The Price-To-Earnings ratio of 14.1x suggests it is undervalued compared to the broader French market. Despite these factors, insufficient data exists to predict future dividend sustainability or coverage by cash flows.

- Get an in-depth perspective on CFM Indosuez Wealth Management's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, CFM Indosuez Wealth Management's share price might be too optimistic.

Key Takeaways

- Click this link to deep-dive into the 232 companies within our Top European Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRTO

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative provides various banking products and services in France.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives