- Italy

- /

- Capital Markets

- /

- BIT:AZM

European Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index rose by 0.90% amid easing inflation and a supportive monetary policy from the European Central Bank, investors are increasingly looking towards dividend stocks as a way to capture steady income in an evolving economic landscape. With the ECB's rate cuts and positive GDP revisions providing a backdrop of stability, selecting dividend stocks that offer consistent payouts can be an attractive strategy for those seeking to balance growth with income in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.96% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.95% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.84% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.67% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.51% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.32% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.19% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.45% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

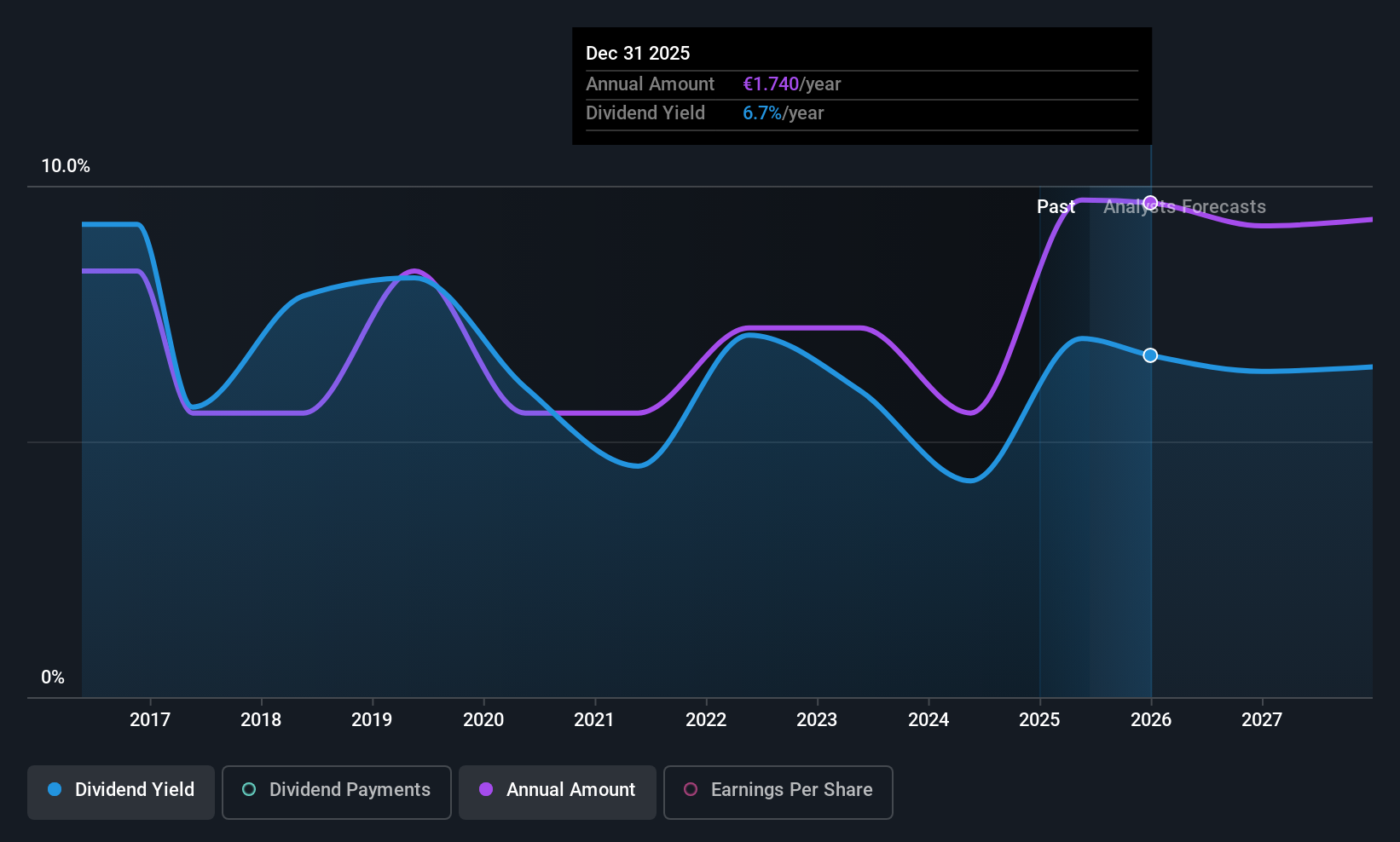

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management sector and has a market capitalization of €3.82 billion.

Operations: Azimut Holding S.p.A. generates revenue primarily from its asset management segment, which accounts for €1.40 billion.

Dividend Yield: 6.5%

Azimut Holding's dividend profile presents a mixed picture for investors. Despite trading at a good value compared to peers, its dividend yield of 6.5% is among the top in Italy but is not well covered by free cash flows, with a high cash payout ratio of 523.9%. The company's dividends have been volatile over the past decade despite recent increases, and earnings growth has averaged 5.7% annually over five years. Recent strategic moves like forming TNB aim to enhance Azimut's global positioning and financial advisory capabilities with €100 billion in assets under management, potentially impacting future performance and dividend sustainability.

- Click to explore a detailed breakdown of our findings in Azimut Holding's dividend report.

- Our valuation report here indicates Azimut Holding may be undervalued.

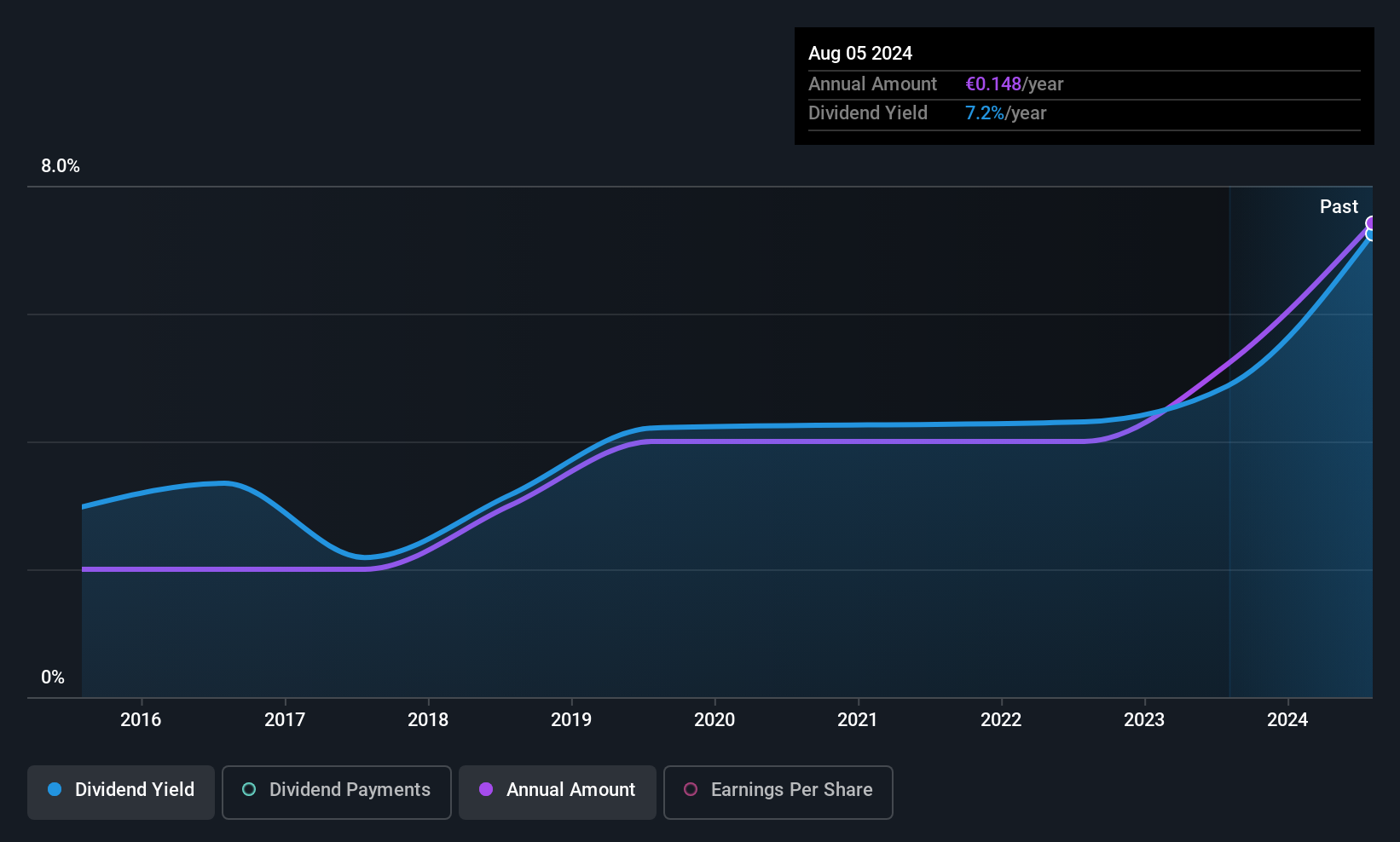

Piquadro (BIT:PQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piquadro S.p.A. designs, produces, and markets leather goods and accessories in Italy, the rest of Europe, and internationally with a market cap of €106.27 million.

Operations: Piquadro's revenue is derived from its brands, with Lancel contributing €69.18 million, Piquadro generating €82.34 million, and The Bridge adding €35.84 million.

Dividend Yield: 6.6%

Piquadro's dividend profile shows potential for income-focused investors. The company's dividend yield of 6.59% ranks it in the top 25% among Italian stocks, supported by a reasonable payout ratio of 61.8% and a cash payout ratio of 46.1%, indicating coverage by earnings and cash flows. However, dividends have been volatile over the past decade despite growth in payments, reflecting an unstable track record that may concern some investors seeking reliability.

- Dive into the specifics of Piquadro here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Piquadro shares in the market.

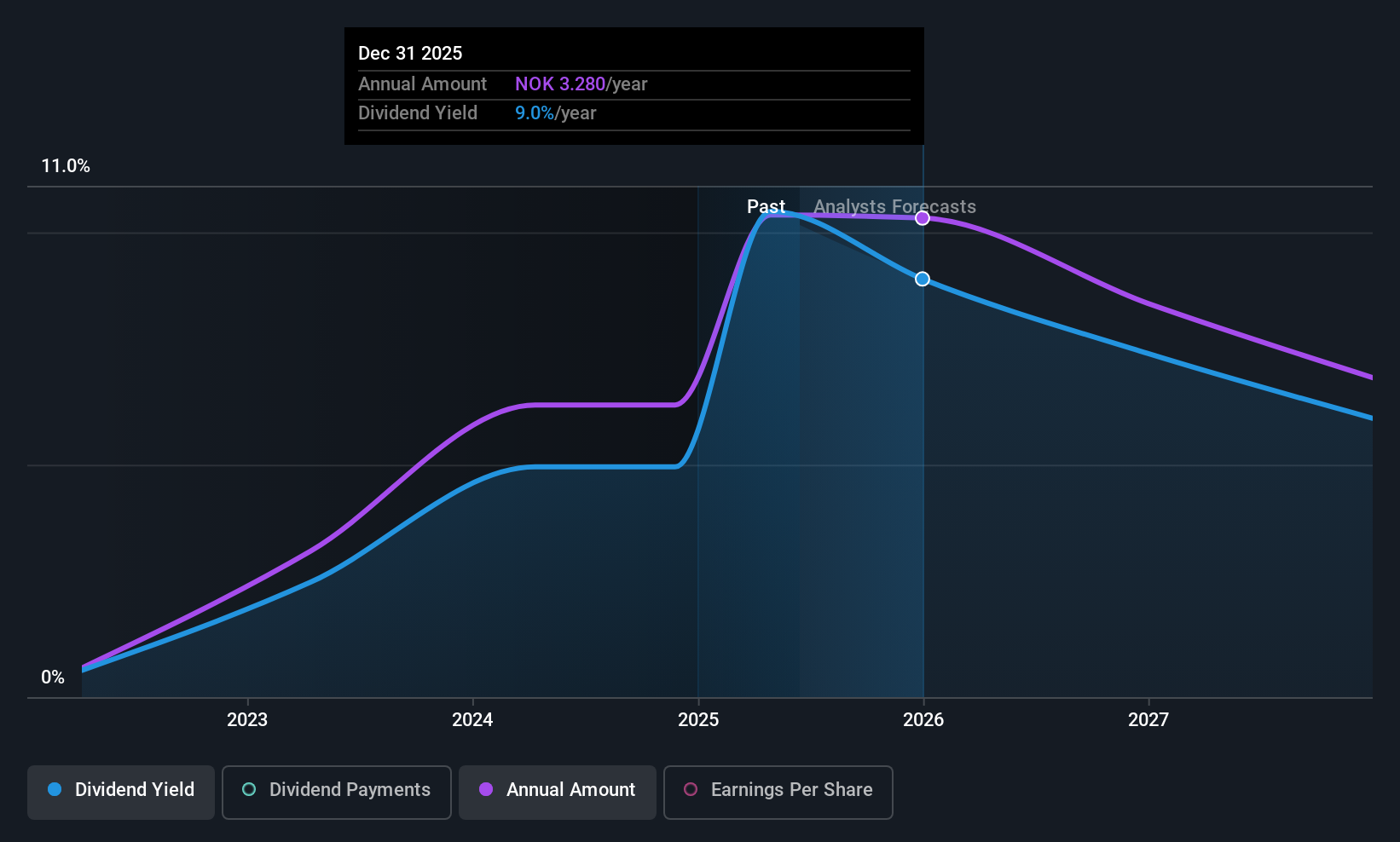

Aker Solutions (OB:AKSO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aker Solutions ASA offers solutions, products, systems, and services to the oil and gas industry across various countries including Norway, the United States, and Brazil, with a market cap of NOK17.33 billion.

Operations: Aker Solutions ASA generates revenue primarily from its Renewables and Field Development segment, which accounts for NOK40.41 billion, followed by the Life Cycle segment contributing NOK13.68 billion.

Dividend Yield: 9.2%

Aker Solutions' dividend profile is characterized by a payout ratio of 65.2%, indicating coverage by earnings, while the cash payout ratio stands at 79.5%, suggesting dividends are also supported by cash flows. Despite an increase in dividend payments over the past decade, they have been volatile and unreliable, which may be concerning for investors seeking stability. Recent contract wins in Brunei and Germany could bolster future revenue streams, potentially impacting dividend sustainability positively.

- Unlock comprehensive insights into our analysis of Aker Solutions stock in this dividend report.

- In light of our recent valuation report, it seems possible that Aker Solutions is trading behind its estimated value.

Taking Advantage

- Take a closer look at our Top European Dividend Stocks list of 229 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AZM

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives