As the pan-European STOXX Europe 600 Index remains relatively stable amidst ongoing U.S. and European trade discussions, investors are keeping a close eye on economic indicators such as the Eurozone's expanding industrial output and widening trade surplus. In this environment, dividend stocks can offer a compelling option for those seeking steady income streams, particularly when considering companies with strong fundamentals that can weather mixed market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.11% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.67% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.77% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| ERG (BIT:ERG) | 5.24% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Azkoyen (BME:AZK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azkoyen, S.A. designs, manufactures, and markets technology solutions both in Spain and internationally with a market cap of €221.88 million.

Operations: Azkoyen, S.A. generates its revenue through three main segments: Time & Security (€67.13 million), Payment Technologies (€69.07 million), and Coffee & Vending Systems (€63.06 million).

Dividend Yield: 3.9%

Azkoyen's dividend yield of 3.95% is below the top quartile in Spain, but its payout ratio of 49.3% and cash payout ratio of 26.2% suggest dividends are well-covered by earnings and cash flows. Despite recent increases, the dividend has been volatile over the past decade with a history of instability. The stock trades significantly below estimated fair value, though its share price has shown high volatility recently.

- Click here and access our complete dividend analysis report to understand the dynamics of Azkoyen.

- Insights from our recent valuation report point to the potential undervaluation of Azkoyen shares in the market.

CIE Automotive (BME:CIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIE Automotive, S.A. and its subsidiaries design, manufacture, and sell automotive components and sub-assemblies with a market capitalization of €3.08 billion.

Operations: CIE Automotive generates revenue through its design, manufacture, and sale of automotive components and sub-assemblies.

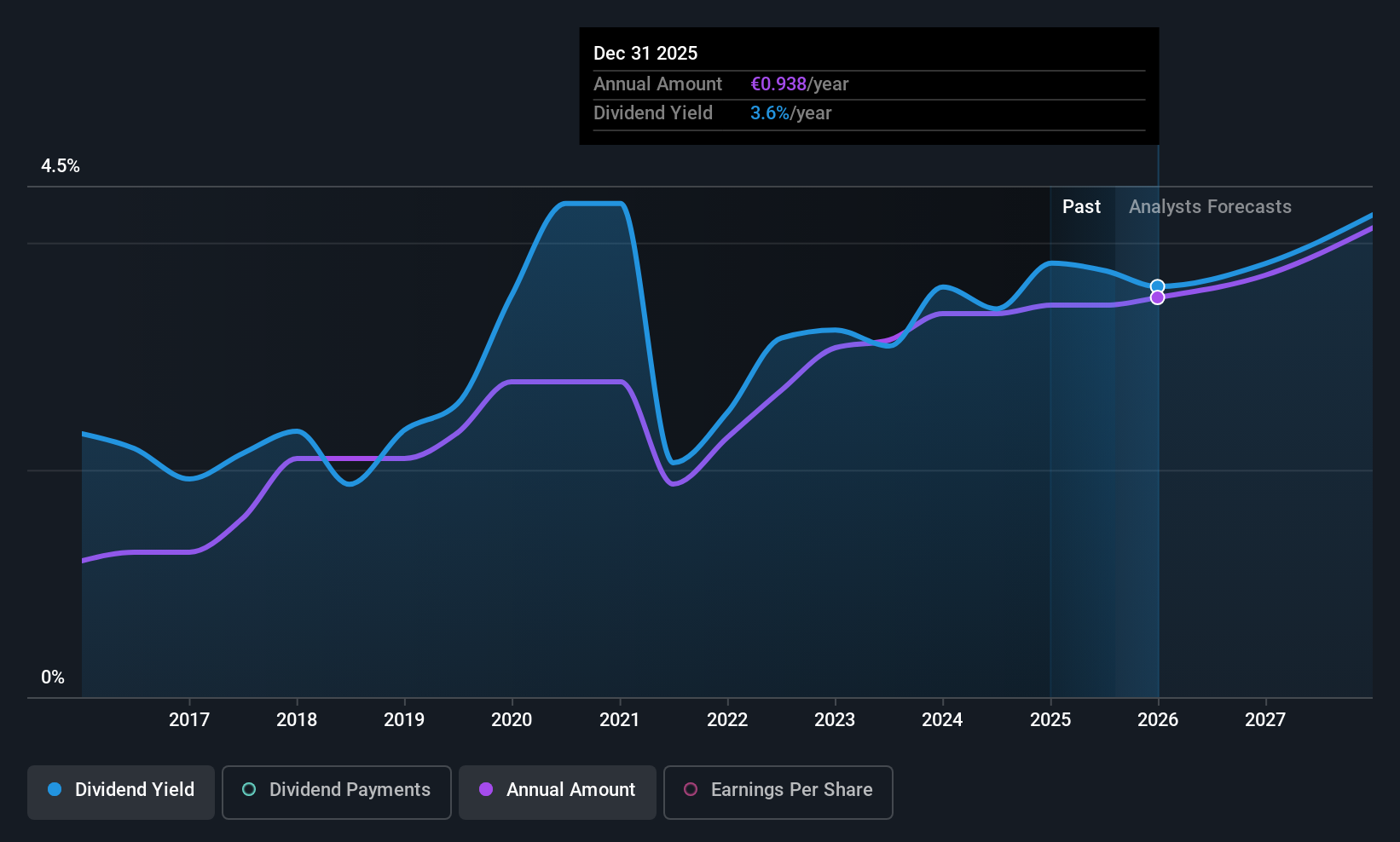

Dividend Yield: 3.6%

CIE Automotive's dividend yield of 3.58% is lower than the top quartile in Spain, yet with a payout ratio of 9% and cash payout ratio of 37.8%, dividends are well-supported by earnings and cash flows. Despite recent growth, dividends have been volatile over the past decade, reflecting an unstable track record. Trading at a significant discount to fair value, CIE recently concluded its buyback plan on July 2, potentially impacting future capital allocation strategies.

- Take a closer look at CIE Automotive's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that CIE Automotive is priced lower than what may be justified by its financials.

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across multiple regions including North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of €5.46 billion.

Operations: Valmet Oyj's revenue is derived from its offerings in process technologies, automation, and services targeted at the pulp, paper, and energy sectors across various global regions.

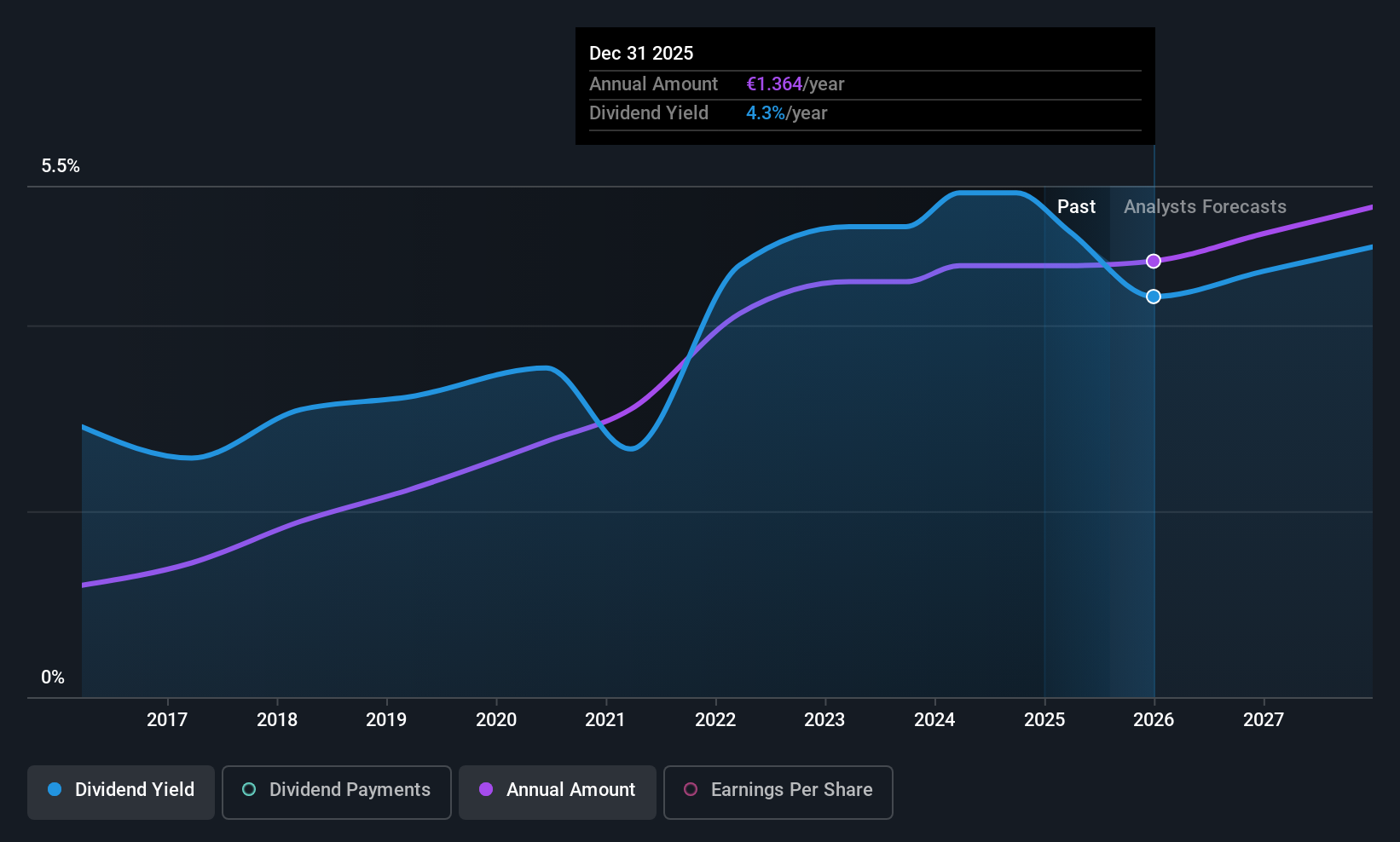

Dividend Yield: 4.6%

Valmet Oyj's dividend yield of 4.56% is below the top quartile in Finland, but its payout ratio of 87.2% and cash payout ratio of 46.8% indicate dividends are well-supported by earnings and cash flows. Although recent earnings have declined, dividends remain stable and reliable over the past decade. The company re-iterated its 2025 sales guidance at €5.36 billion, despite a decrease in Q2 net income to €28 million from €58 million a year ago, reflecting ongoing operational challenges amidst strategic realignments.

- Click to explore a detailed breakdown of our findings in Valmet Oyj's dividend report.

- Our valuation report unveils the possibility Valmet Oyj's shares may be trading at a discount.

Next Steps

- Get an in-depth perspective on all 228 Top European Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AZK

Azkoyen

Designs, manufactures, and markets technology solutions in Spain and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives