As the European market experiences mixed returns, with the pan-European STOXX Europe 600 Index remaining flat and major indices showing varied performances, investors are keenly observing economic indicators such as inflation rates and labor market stability. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to bolster their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.46% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.28% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.82% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.19% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.47% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 3.95% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 236 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

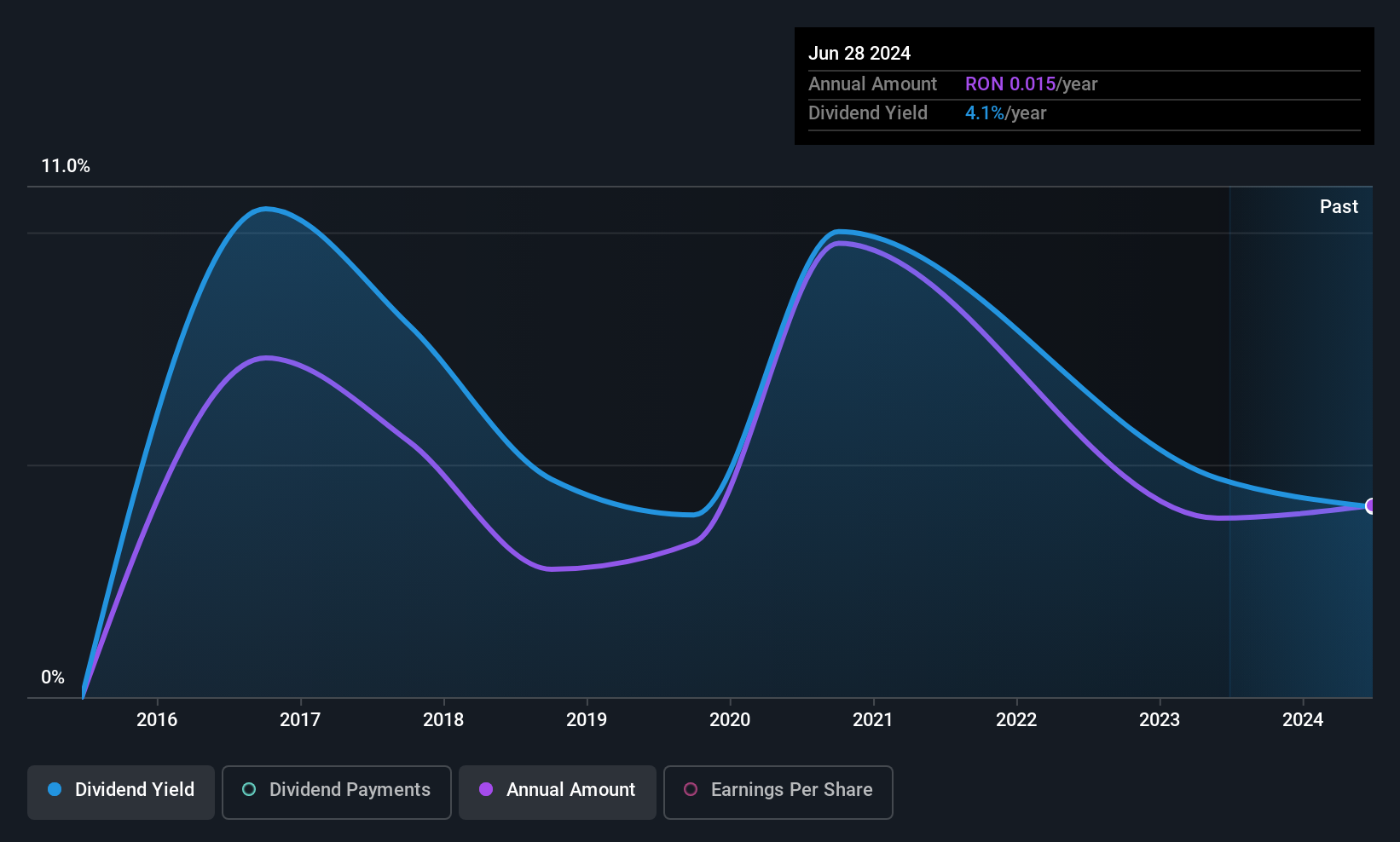

Transilvania Investments Alliance (BVB:TRANSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Transilvania Investments Alliance S.A. is a closed-ended financial investment company with a market cap of RON802.13 million.

Operations: Transilvania Investments Alliance S.A. generates revenue from its financial services segment, specifically through closed-end funds, amounting to RON104.84 million.

Dividend Yield: 4%

Transilvania Investments Alliance's recent earnings report shows significant growth, with revenue at RON 46.77 million and net income at RON 38.99 million for Q1 2025. Despite a below-market dividend yield of 3.96%, the dividends are well-covered by earnings (payout ratio: 45.5%) and cash flows (cash payout ratio: 66.6%). However, the dividend track record is unstable, having been volatile over the past decade despite some growth in payments during this period.

- Click here and access our complete dividend analysis report to understand the dynamics of Transilvania Investments Alliance.

- The analysis detailed in our Transilvania Investments Alliance valuation report hints at an inflated share price compared to its estimated value.

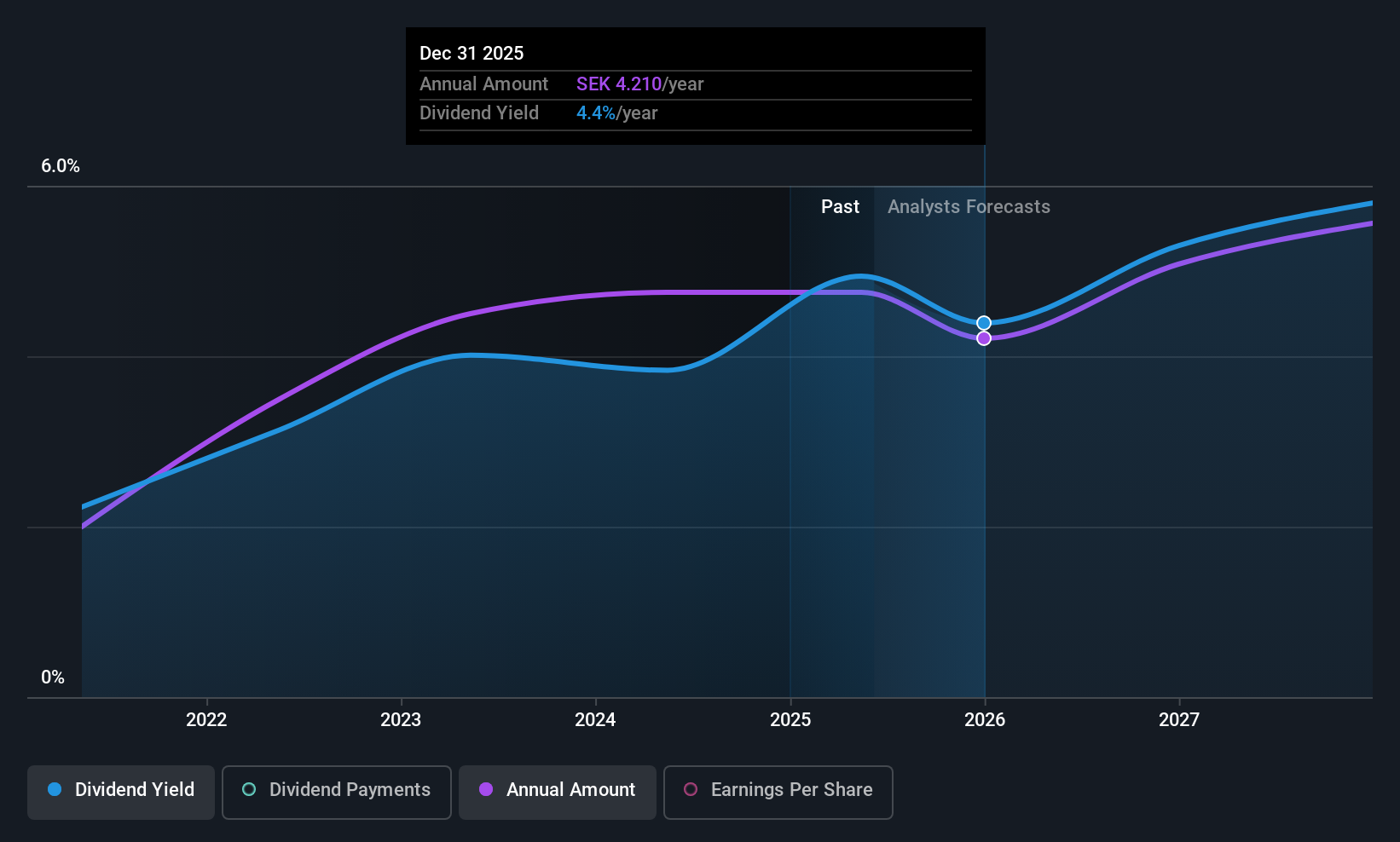

NCC (OM:NCC B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NCC AB (publ) is a construction company operating in Sweden, Norway, Denmark, and Finland with a market cap of SEK17.46 billion.

Operations: NCC AB (publ) generates revenue through several segments, including NCC Industry (SEK12.66 billion), NCC Infrastructure (SEK18.27 billion), NCC Building Sweden (SEK13.78 billion), NCC Building Nordics (SEK13.92 billion), and NCC Property Development (SEK4.31 billion).

Dividend Yield: 5%

NCC's dividend yield is among the top 25% in Sweden, supported by a sustainable payout ratio of 57.6% and strong cash flow coverage at 25.8%. However, its dividend history has been volatile over the past decade, with payments declining during this period. Despite recent earnings challenges and a net loss in Q1 2025, NCC continues to secure significant contracts across various sectors in Europe, potentially bolstering future revenue streams and supporting its dividend strategy.

- Take a closer look at NCC's potential here in our dividend report.

- Our expertly prepared valuation report NCC implies its share price may be lower than expected.

Prevas (OM:PREV B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prevas AB is a technical consultancy firm operating in Sweden, Denmark, Finland, and internationally with a market cap of SEK1.22 billion.

Operations: Prevas AB generates its revenue primarily from technical consultancy services, with SEK1.28 billion from Sweden and SEK164.26 million from Denmark.

Dividend Yield: 5%

Prevas offers a compelling dividend profile with a payout ratio of 75% and cash flow coverage at 45.9%, ensuring dividends are well-supported. While its dividend history is short, spanning only four years, payments have been stable and growing. Recent strategic partnerships, including with Hexagon's Asset Lifecycle Intelligence division, enhance Prevas' market position in the Nordic region. Despite recent earnings decline, these alliances may support future revenue growth and sustain its dividend strategy.

- Click to explore a detailed breakdown of our findings in Prevas' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Prevas shares in the market.

Seize The Opportunity

- Get an in-depth perspective on all 236 Top European Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PREV B

Prevas

Provides technical consultancy services in Sweden, Denmark, Finland, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives