- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Equinix (NasdaqGS:EQIX) Removed From Multiple Russell Growth Indexes

Reviewed by Simply Wall St

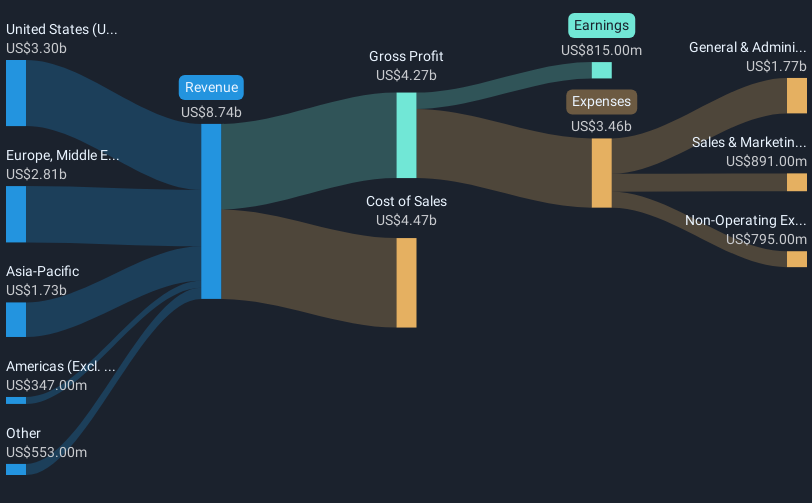

Equinix (NasdaqGS:EQIX) recently experienced a significant event with its removal from several key growth indices, including the Russell 1000 Growth Index and others, which coincided with a 4% decrease in its share price over the last quarter. Despite a positive corporate development with raised revenue guidance for 2025 and strong earnings for Q1 2025, the market's robust overall performance, with major indices reaching new highs, diverged from Equinix's trajectory. The company's dividend affirmations and major client announcements, such as partnerships with Hyundai Motor Group and EntropiQ, may have helped counter some broader market movements but were not enough to offset the price decline.

Equinix has 3 possible red flags we think you should know about.

Equinix’s recent removal from growth indices poses challenges impacting investor sentiment, potentially affecting its long-term growth narrative. Over the past three years, Equinix delivered a total return of 23.82%, reflecting a solid growth trajectory amid industry changes. Despite the positive performance, the company underperformed the US Specialized REITs industry, which witnessed a 4.9% return over the past year.

The disconnect between short-term share price movement and analyst projections highlights a broader concern regarding the company's future outlook. With the share price currently at US$875.38, it's trading at a 13.4% discount to the consensus price target of US$1011.27, signaling potential upside based on forecasted earnings growth and margin expansion.

However, uncertainties such as customer spending and execution risks could temper revenue and earnings projections. Despite these challenges, Equinix's focus on digital transformation and AI deployment can support its revenue and earnings growth, ultimately transitioning towards the analyst consensus expectations. As the company enhances its strategic offerings and operational efficiency, the market will likely reassess its trajectory relative to the broader industry.

Click here to discover the nuances of Equinix with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix (Nasdaq: EQIX) is the world's digital infrastructure company.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives