- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Eni S.p.A. (BIT:ENI) Investors Should Think About This Before Buying It For Its Dividend

Is Eni S.p.A. (BIT:ENI) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

One way to look into the risks is to look at a snapshot of Eni's latest financial position, by checking our visualisation of its financial health.

A high yield and a long history of paying dividends is an appealing combination for Eni. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can reduce the risk of holding Eni for its dividend, and we'll focus on the most important aspects below.

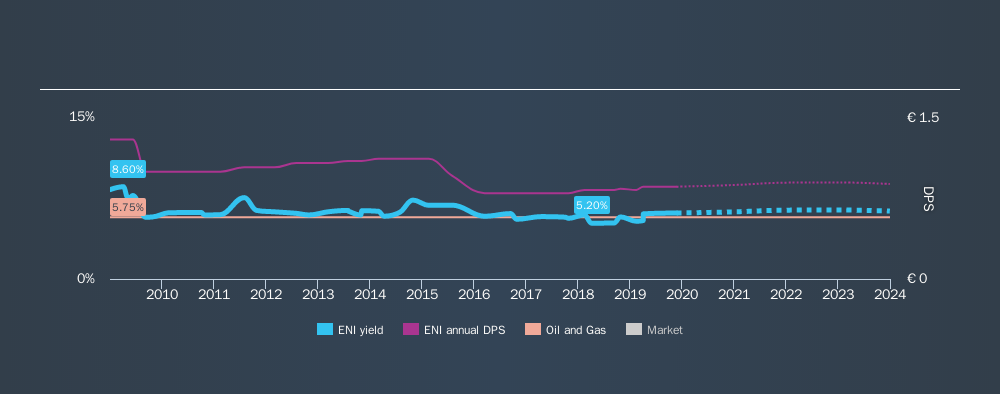

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Eni paid out 124% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Eni paid out 74% of its free cash flow last year, which is acceptable, but is starting to limit the amount of earnings that can be reinvested into the business. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Eni fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Eni has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was €1.30 in 2009, compared to €0.86 last year. This works out to be a decline of approximately 4.0% per year over that time. Eni's dividend hasn't shrunk linearly at 4.0% per annum, but the CAGR is a useful estimate of the historical rate of change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? In the last five years, Eni's earnings per share have shrunk at approximately 6.7% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

To summarise, shareholders should always check that Eni's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. There are a few too many issues for us to get comfortable with Eni from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Given that earnings are not growing, the dividend does not look nearly so attractive. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 21 analysts we track are forecasting for the future.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives