- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY) Announces Positive Results For Jaypirca In Phase 3 Trial

Reviewed by Simply Wall St

Eli Lilly (LLY) made headlines with positive results from the Phase 3 BRUIN CLL-314 clinical trial for Jaypirca, marking a significant advancement in treatment options for chronic lymphocytic leukemia. The company's 6% share price increase over the past week may have been influenced by investor optimism surrounding these findings, aligning with general market trends which saw the S&P 500 and Nasdaq reach new highs. While broader market dynamics favor strong corporate earnings and positive economic data, Lilly’s success and strategic positioning in key therapeutic areas add weight to its recent performance.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

The positive results from the Phase 3 BRUIN CLL-314 trial for Jaypirca may bolster Eli Lilly's strategic positioning in oncological treatment, enhancing long-term growth potential in this high-demand sector. Over the last five years, the company achieved a substantial total shareholder return of over 460%, illustrating its ability to deliver strong returns in tandem with advancing its product pipeline. Compared to the previous year's industry tumble of 6.8%, Lilly's recent stock appreciation positions it favorably within the pharmaceuticals sphere.

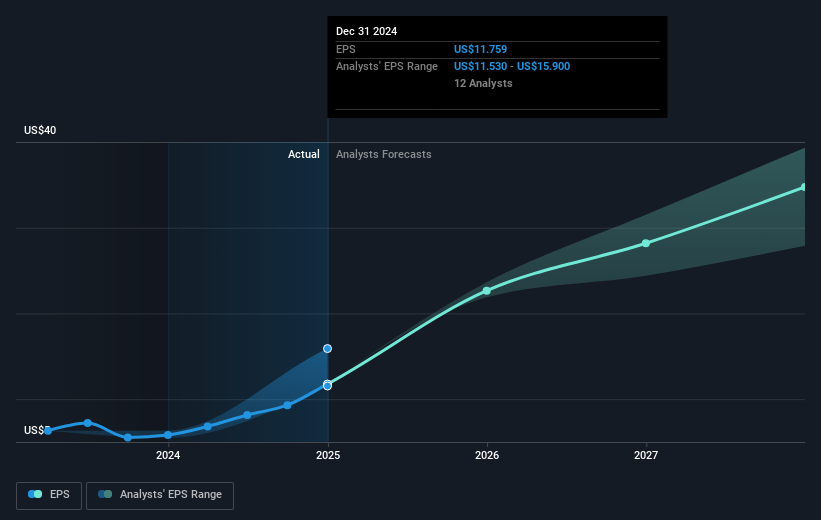

The new clinical trial outcomes could influence revenue and earnings projections, particularly if future regulatory approvals expedite market entry for various treatments. Analysts' expectations for revenue growth of 14.7% annually suggest favorable prospects, although short-term cash flow impacts from major manufacturing investments might require attention. The stock's recent surge to $808.11, although below the consensus price target of approximately $952.27, could signify market confidence aligned with upcoming catalysts. Yet, this gap suggests room for evaluation by investors regarding the company's potential alignment with analyst forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives