- United States

- /

- Healthcare Services

- /

- NYSE:ELV

Elevance Health (NYSE:ELV) Removed From Russell Indices in June 2025

Reviewed by Simply Wall St

Elevance Health (NYSE:ELV) experienced a 11% decline over the past week, coinciding with its removal from several Russell indices in late June 2025. This removal potentially reduced investment appeal and visibility in the market. While the broader market rose by 2% in the same period, Elevance's decline indicates company-specific challenges. The overall market movement, impacted by global trade tensions and tariff concerns, contrasted with the stock's trajectory, emphasizing the significance of Elevance's index exclusion. The wider market trends didn't align with Elevance's drop, highlighting the skew caused by its altered index status.

We've identified 1 warning sign for Elevance Health that you should be aware of.

The recent removal of Elevance Health from several Russell indices may have dented its market visibility, impacting its share price, which fell 11% this past week. This drop contrasts with the company's solid five-year total return, which reached 43.93%, highlighting a longer-term trajectory of growth. Over the last year, Elevance underperformed compared to the broader US market, which rose by 13.7%, signaling possible company-specific challenges that may be surfacing.

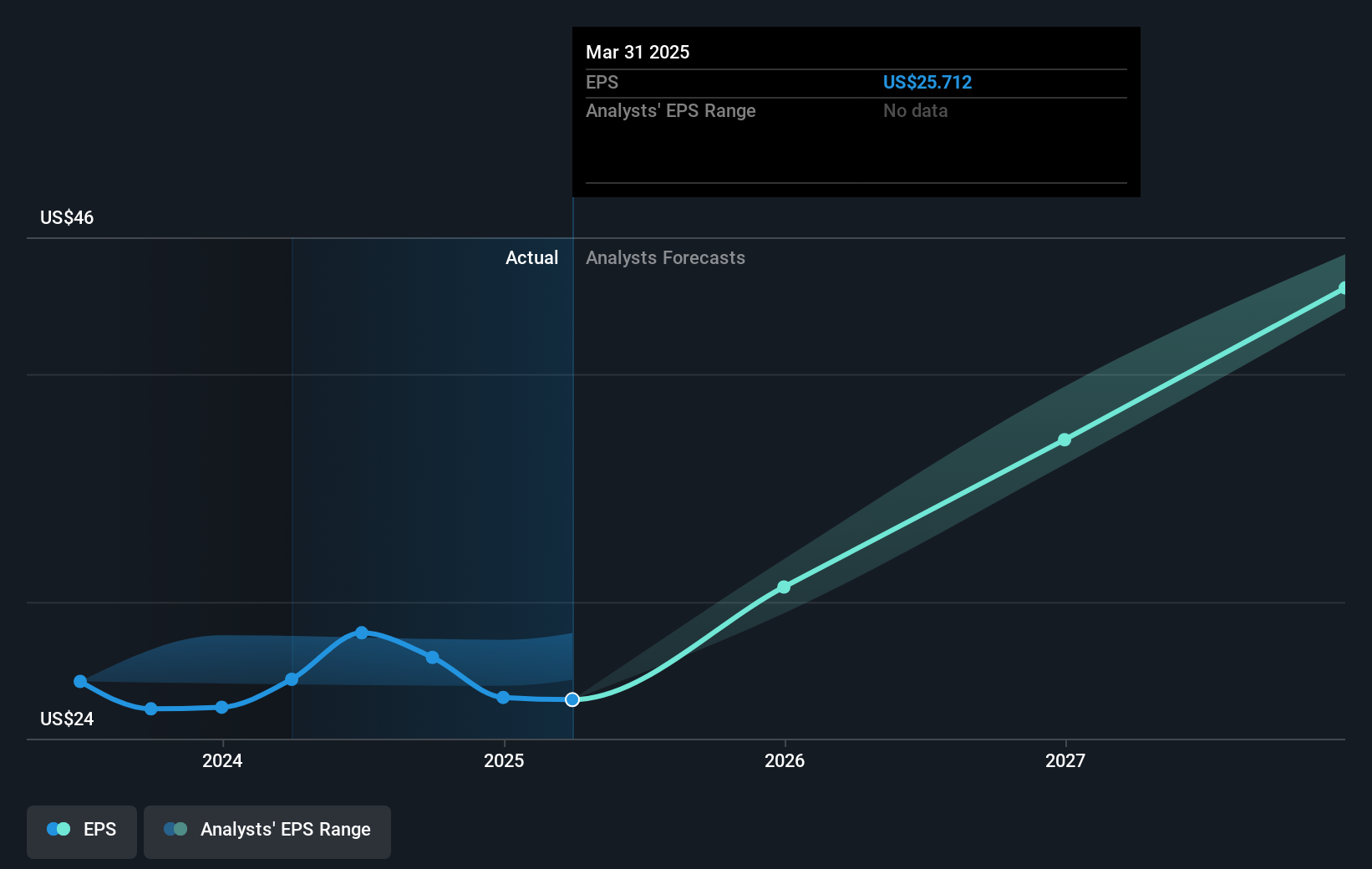

This shift in index status could potentially affect Elevance Health's revenue and earnings forecasts. With current revenue at US$183.12 billion and earnings standing at US$5.92 billion, the outlook remains cautiously optimistic, despite potential obstacles such as elevated Medicare costs and regulatory uncertainties. The price target set by analysts at US$505.55 suggests a potential upside from the current share price of US$413.98, representing approximately an 18.1% discount, indicating confidence in Elevance Health's capacity to navigate through current headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives