- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Edera Joins NVIDIA (NVDA) Inception Program To Advance AI Security Solutions

Reviewed by Simply Wall St

NVIDIA (NVDA) experienced a 56% price surge in the last quarter, benefiting partly from its strategic acceptance into the NVIDIA Inception Program and its presence on the AWS Marketplace. These developments align with the tech market's overall upward momentum, as demonstrated by new highs in major indexes like the S&P 500 and Nasdaq Composite. Additionally, NVIDIA's collaborations with firms like Tech Soft 3D, OpenAI, and advancements in AI infrastructure contributed to investor interest. These factors added weight to the company's strong performance amidst a robust market backdrop, as tech stocks continue to capture investor attention.

Be aware that NVIDIA is showing 1 possible red flag in our investment analysis.

The recent developments, including NVIDIA's integration into the NVIDIA Inception Program and its availability on the AWS Marketplace, could enhance its attractiveness in AI and cloud sectors, potentially driving revenue and earnings growth. Over the past five years, NVIDIA shares experienced a very large total return of 1,542.29%. This substantial growth contrasts with the 18% return of the broader US market over the past year. Additionally, NVIDIA's one-year return outperformed the US Semiconductor industry, illustrating its robust market position.

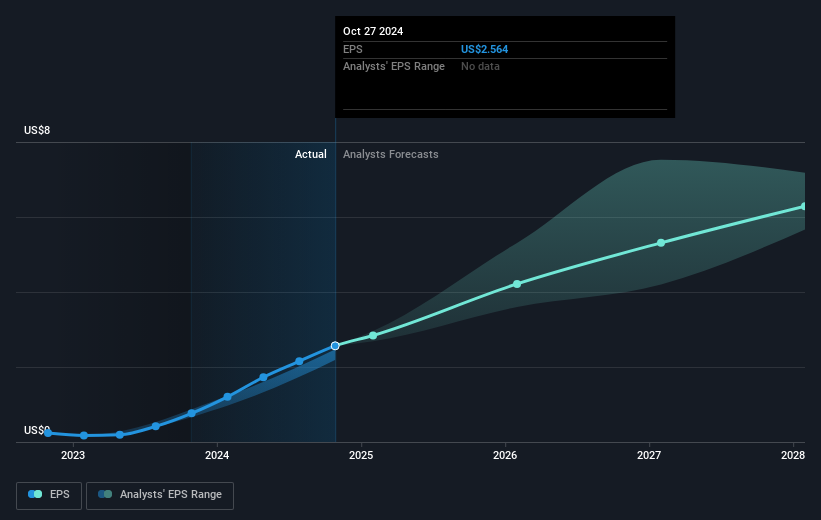

The partnerships with Toyota and Uber are poised to bolster NVIDIA's presence in the automotive AI sector, potentially expanding future revenue streams. While analysts project a revenue growth rate of 26.2% annually over the next three years, these collaborations could contribute positively to those forecasts. As of today's share price of US$173.74, the proximity to the consensus price target of US$179.55 reflects a minor upward potential, suggesting that NVIDIA's current valuation could align closely with analyst expectations. Overall, NVIDIA's strategic engagements highlight its capability to sustain momentum in revenue and earnings, though potential regulatory challenges remain a threat to these projections.

Upon reviewing our latest valuation report, NVIDIA's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives