- Australia

- /

- Metals and Mining

- /

- ASX:AOA

Easy Come, Easy Go: How Ausmon Resources (ASX:AOA) Shareholders Got Unlucky And Saw 75% Of Their Cash Evaporate

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Ausmon Resources Limited (ASX:AOA); the share price is down a whopping 75% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 50%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 40% in the last three months.

Check out our latest analysis for Ausmon Resources

Ausmon Resources hasn't yet reported any revenue, so it's as much a business idea as an actual business. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Ausmon Resources finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Ausmon Resources investors have already had a taste of the bitterness stocks like this can leave in the mouth.

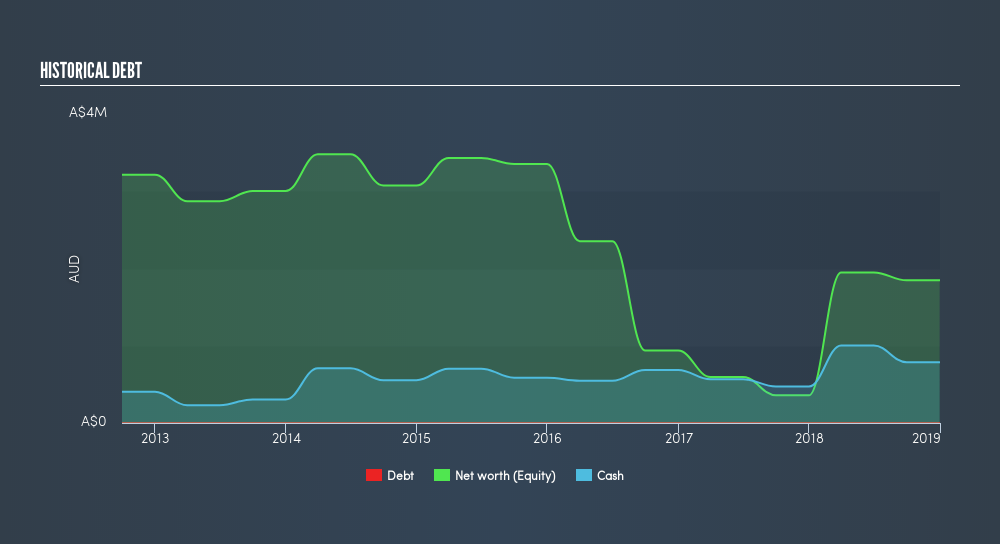

Ausmon Resources had cash in excess of all liabilities of AU$752k when it last reported (December 2018). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. We'd venture that shareholders are concerned about the need for more capital, because the share price has dropped 37% per year, over 3 years. You can see in the image below, how Ausmon Resources's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

While the broader market gained around 13% in the last year, Ausmon Resources shareholders lost 50%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 16% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Ausmon Resources better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:AOA

Ausmon Resources

An exploration company, engages in the exploration and evaluation of mineral resource properties in Australia.

Imperfect balance sheet very low.

Market Insights

Community Narratives