- United States

- /

- Trade Distributors

- /

- NYSE:GWW

Earnings Miss: W.W. Grainger, Inc. Missed EPS By 12% And Analysts Are Revising Their Forecasts

W.W. Grainger, Inc. (NYSE:GWW) shares fell 8.0% to US$303 in the week since its latest annual results. It was not a great result overall. While revenues of US$11b were in line with analyst predictions, earnings were less than expected, missing statutory estimates by 12% to hit US$15.32 per share. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see analysts' latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for W.W. Grainger

After the latest results, the 17 analysts covering W.W. Grainger are now predicting revenues of US$12.0b in 2020. If met, this would reflect a reasonable 4.4% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to climb 19% to US$18.50. Yet prior to the latest earnings, analysts had been forecasting revenues of US$12.0b and earnings per share (EPS) of US$18.81 in 2020. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

There were no changes to revenue or earnings estimates or the price target of US$332, suggesting that the company has met expectations in its recent result. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic W.W. Grainger analyst has a price target of US$398 per share, while the most pessimistic values it at US$278. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

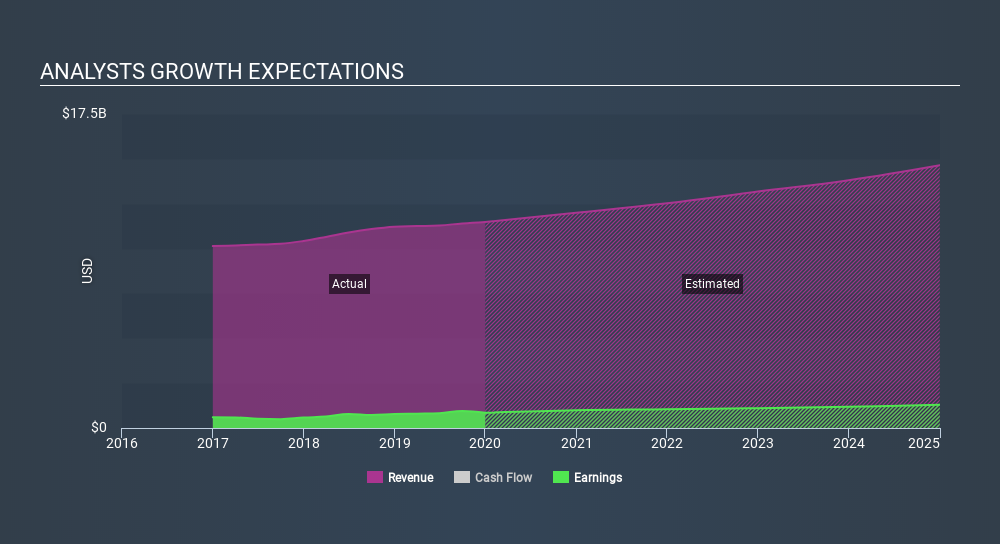

It can be useful to take a broader overview by seeing how analyst forecasts compare, both to the W.W. Grainger's past performance and to peers in the same market. It's clear from the latest estimates that W.W. Grainger's rate of growth is expected to accelerate meaningfully, with forecast 4.4% revenue growth noticeably faster than its historical growth of 3.2%p.a. over the past five years. Compare this with other companies in the same market, which are forecast to grow their revenue 4.6% next year. Factoring in the forecast acceleration in revenue, it's pretty clear that W.W. Grainger is expected to grow at about the same rate as the wider market.

The Bottom Line

The most obvious conclusion from these results is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider market. The consensus price target held steady at US$332, with the latest estimates not enough to have an impact on analysts' estimated valuations.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for W.W. Grainger going out to 2024, and you can see them free on our platform here..

You can also view our analysis of W.W. Grainger's balance sheet, and whether we think W.W. Grainger is carrying too much debt, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion