- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1931

E-Commodities Holdings And 2 Other Asian Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As global markets experience fluctuations, with consumer inflation heating up in the U.S. and mixed performances across major indices, investors are keenly observing opportunities that may arise from these shifts. Penny stocks, often associated with smaller or newer companies, continue to capture attention due to their potential for growth at lower price points. Despite being a somewhat outdated term, penny stocks can still offer significant opportunities when they possess strong financials and solid fundamentals—qualities that make them intriguing options for those seeking hidden value in today's market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.46 | HK$921.19M | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.49 | SGD198.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.17 | HK$1.95B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.60 | THB2.76B | ✅ 3 ⚠️ 3 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.68 | SGD648.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.53 | SGD9.96B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.96 | THB1.41B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.24 | SGD48.53M | ✅ 4 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.63 | SGD995.89M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 968 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

E-Commodities Holdings (SEHK:1733)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E-Commodities Holdings Limited, with a market cap of HK$2.99 billion, is involved in the processing and trading of coal and other products through its subsidiaries.

Operations: The company's revenue is primarily derived from trading coal and other products, generating HK$35.22 billion, and providing integrated supply chain services, which contribute HK$4.92 billion.

Market Cap: HK$2.99B

E-Commodities Holdings Limited, with a market cap of HK$2.99 billion, is trading at 12.5% below its estimated fair value and maintains high-quality earnings despite recent challenges. The company has reduced its debt to equity ratio significantly over the past five years and holds more cash than total debt, indicating strong financial management. However, profit margins have declined from last year, presenting a concern for potential investors. Short-term assets comfortably cover both short-term and long-term liabilities, while interest payments are well covered by EBIT. The dividend of 7.68% remains poorly supported by free cash flows.

- Click here and access our complete financial health analysis report to understand the dynamics of E-Commodities Holdings.

- Examine E-Commodities Holdings' past performance report to understand how it has performed in prior years.

IVD Medical Holding (SEHK:1931)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market cap of HK$5.64 billion.

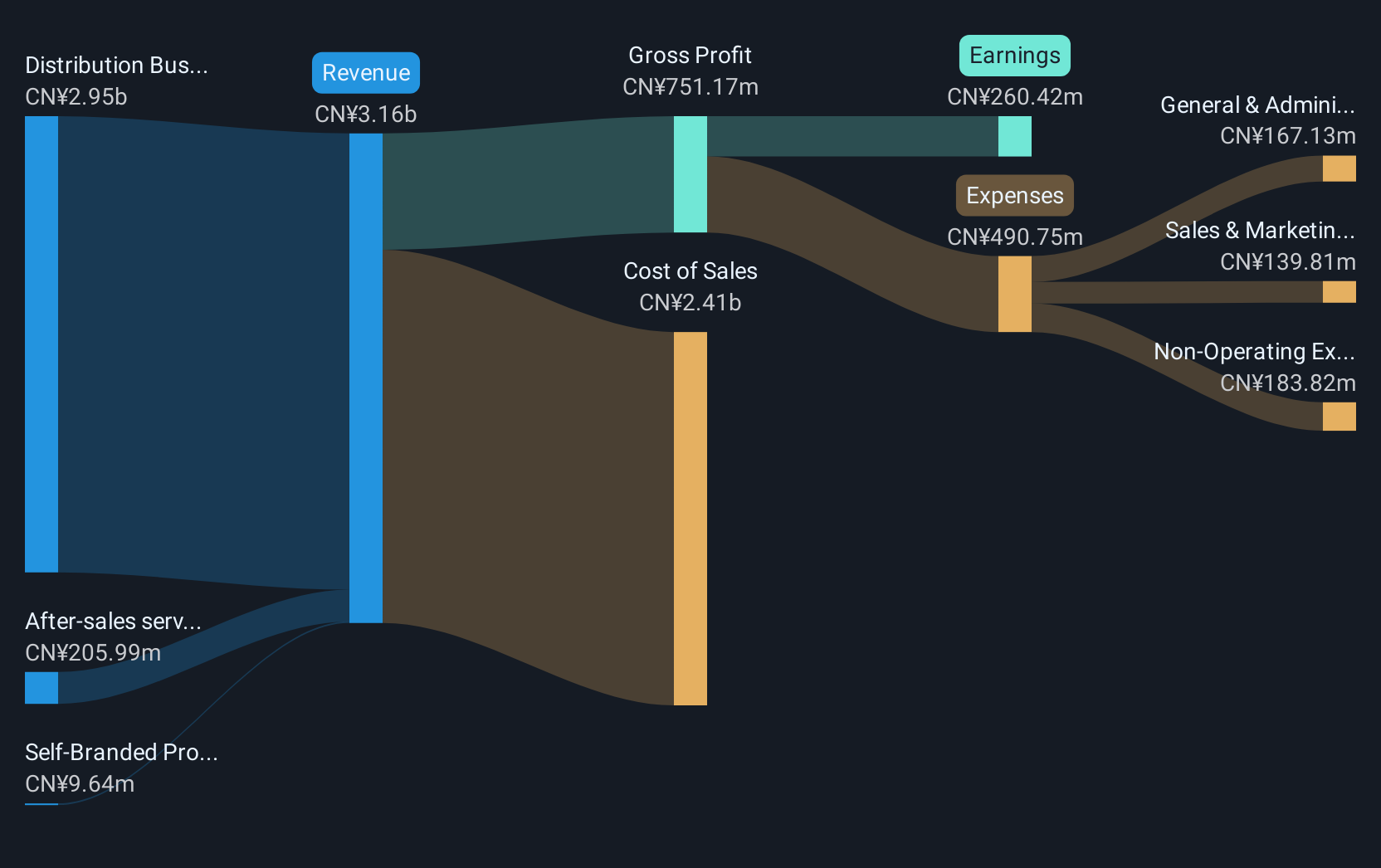

Operations: The company's revenue is primarily derived from its Distribution Business, which generated CN¥2.95 billion, followed by After-sales services at CN¥205.99 million and the Self-Branded Products Business contributing CN¥9.64 million.

Market Cap: HK$5.64B

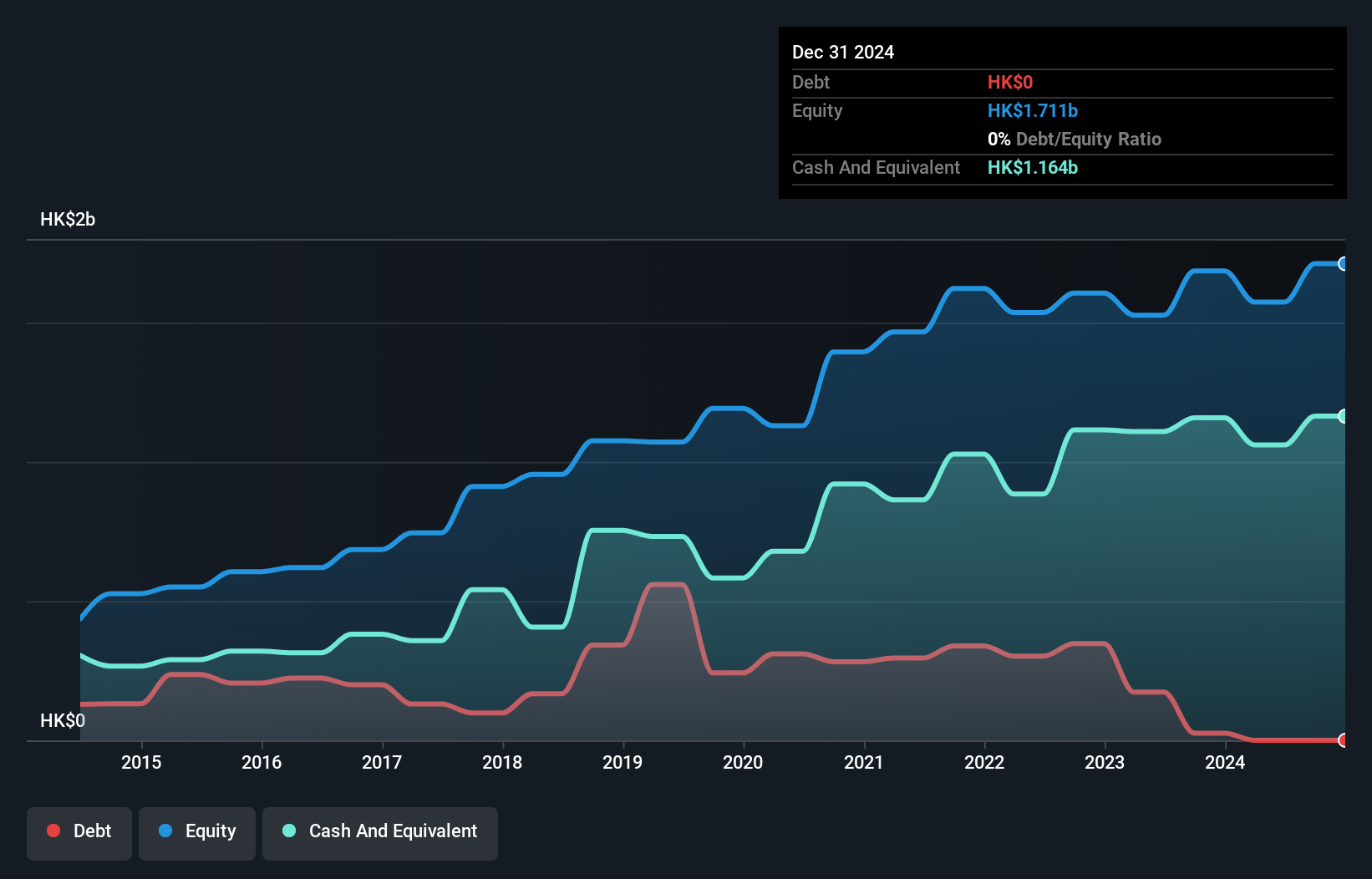

IVD Medical Holding Limited, with a market cap of HK$5.64 billion, is navigating significant strategic shifts while maintaining a solid financial footing. The company's revenue streams are robust, led by its Distribution Business generating CN¥2.95 billion. Recent initiatives include the establishment of a US subsidiary and plans for the IVDNewCo Exchange to integrate Web3 technology, which could enhance global asset liquidity. Despite stable earnings growth at 9.3%, challenges like increased administrative and selling expenses have impacted profitability forecasts for 2025. The company has more cash than debt, but volatility remains high with recent executive changes potentially affecting stability.

- Click here to discover the nuances of IVD Medical Holding with our detailed analytical financial health report.

- Learn about IVD Medical Holding's historical performance here.

TK Group (Holdings) (SEHK:2283)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TK Group (Holdings) Limited is an investment holding company involved in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components with a market cap of HK$2.15 billion.

Operations: The company generates revenue primarily from two segments: Mold Fabrication, which accounts for HK$830.13 million, and Plastic Components Manufacturing, contributing HK$1.66 billion.

Market Cap: HK$2.15B

TK Group (Holdings) Limited, with a market cap of HK$2.15 billion, shows potential within the penny stock landscape due to its solid financial structure and operational growth. The company generates significant revenue from its Mold Fabrication and Plastic Components Manufacturing segments. Its earnings have grown by 28.2% over the past year, surpassing industry averages, although long-term profit trends show a decline of 2.9% annually over five years. Despite trading below estimated fair value and having no debt obligations, TK Group's dividend history is unstable. Recent approval of special dividends reflects shareholder returns focus amidst stable weekly volatility and experienced management oversight.

- Get an in-depth perspective on TK Group (Holdings)'s performance by reading our balance sheet health report here.

- Gain insights into TK Group (Holdings)'s outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Discover the full array of 968 Asian Penny Stocks right here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1931

IVD Medical Holding

An investment holding company, distributes In vitro diagnostic (IVD) products in Mainland China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives