Don't Race Out To Buy Gradus AD (BUL:GR6) Just Because It's Going Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Gradus AD (BUL:GR6) is about to go ex-dividend in just 1 days. Ex-dividend means that investors that purchase the stock on or after the 18th of June will not receive this dividend, which will be paid on the 13th of July.

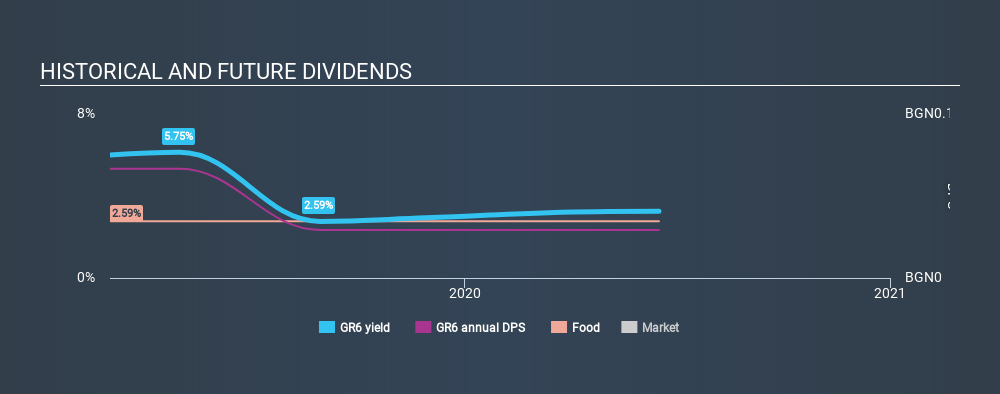

Gradus AD's next dividend payment will be лв0.022 per share. Last year, in total, the company distributed лв0.044 to shareholders. Based on the last year's worth of payments, Gradus AD has a trailing yield of 3.1% on the current stock price of BGN1.44. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Gradus AD

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Gradus AD paid out 53% of its earnings to investors last year, a normal payout level for most businesses. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 90% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Gradus AD paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Gradus AD to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit Gradus AD paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. As a result, it's definitely disappointing to see that earnings per share have declined 15% over the past year.

Given that Gradus AD has only been paying a dividend for a year, there's not much of a past history to draw insight from.

The Bottom Line

From a dividend perspective, should investors buy or avoid Gradus AD? Gradus AD had an average payout ratio, but its free cash flow was lower and earnings per share have been declining. It's not that we think Gradus AD is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

With that being said, if you're still considering Gradus AD as an investment, you'll find it beneficial to know what risks this stock is facing. For example, Gradus AD has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BUL:GR6

Gradus AD

Produces and sells poultry products in Bulgaria, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives