- United States

- /

- IT

- /

- NYSE:EPAM

Don't Ignore The Fact That This Insider Just Sold Some Shares In EPAM Systems, Inc. (NYSE:EPAM)

We'd be surprised if EPAM Systems, Inc. (NYSE:EPAM) shareholders haven't noticed that the Senior VP, Jason Peterson, recently sold US$115k worth of stock at US$229 per share. The eyebrow raising move amounted to a reduction of 11% in their holding.

View our latest analysis for EPAM Systems

The Last 12 Months Of Insider Transactions At EPAM Systems

In the last twelve months, the biggest single sale by an insider was when the insider, Boris Shnayder, sold US$3.0m worth of shares at a price of US$208 per share. That means that even when the share price was below the current price of US$217, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was 82% of Boris Shnayder's stake.

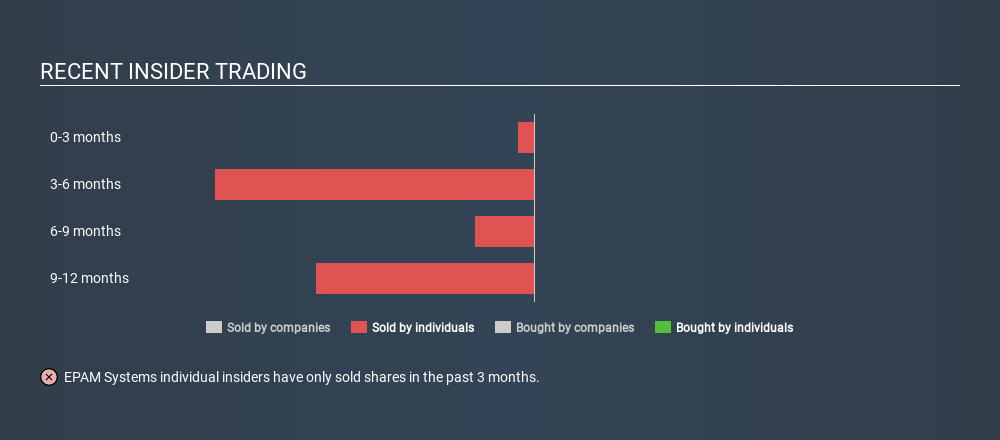

EPAM Systems insiders didn't buy any shares over the last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Does EPAM Systems Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. EPAM Systems insiders own 3.5% of the company, currently worth about US$421m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At EPAM Systems Tell Us?

Insiders haven't bought EPAM Systems stock in the last three months, but there was some selling. And even if we look at the last year, we didn't see any purchases. But it is good to see that EPAM Systems is growing earnings. It is good to see high insider ownership, but the insider selling leaves us cautious. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Case in point: We've spotted 1 warning sign for EPAM Systems you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives