- United Kingdom

- /

- Biotech

- /

- AIM:ABC

Don't Ignore The Fact That This Insider Just Sold Some Shares In Abcam plc (LON:ABC)

Some Abcam plc (LON:ABC) shareholders may be a little concerned to see that the Co-Founder & Non-Executive Deputy Chairman, Jonathan Milner, recently sold a whopping UK£16m worth of stock at a price of UK£14.12 per share. However, it's crucial to note that they remain very much invested in the stock and that sale only reduced their holding by 5.8%.

See our latest analysis for Abcam

Abcam Insider Transactions Over The Last Year

In fact, the recent sale by Jonathan Milner was the biggest sale of Abcam shares made by an insider individual in the last twelve months, according to our records. That means that an insider was selling shares at around the current price of UK£14.07. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

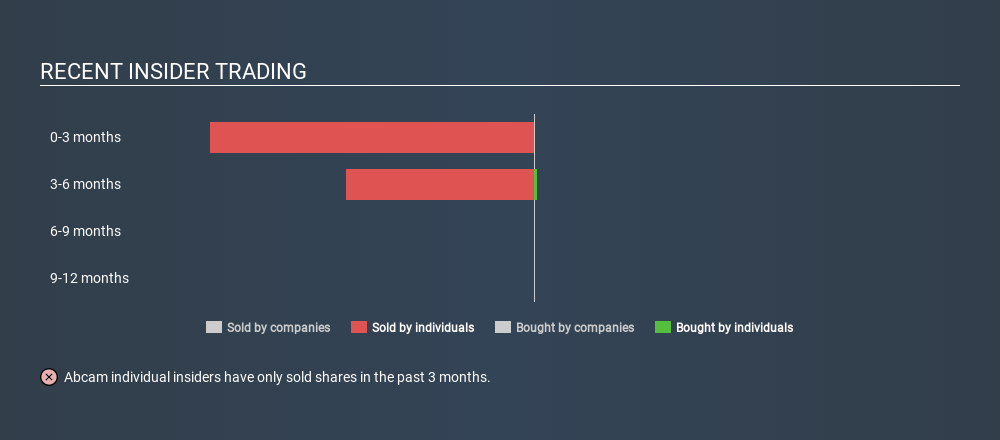

Happily, we note that in the last year insiders paid UK£132k for 11.63k shares. On the other hand they divested 1736363 shares, for UK£23m. Jonathan Milner sold a total of 1736363 shares over the year at an average price of UK£13.15. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Abcam

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Abcam insiders own about UK£276m worth of shares (which is 9.5% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Abcam Tell Us?

An insider sold stock recently, but they haven't been buying. Zooming out, the longer term picture doesn't give us much comfort. It is good to see high insider ownership, but the insider selling leaves us cautious. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:ABC

Abcam

Abcam plc, a life science company, focuses on identifying, developing, and distributing reagents and tools for scientific research, diagnostics, and drug discovery.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives