- United States

- /

- Building

- /

- NasdaqGS:AAON

Don't Ignore The Fact That This Insider Just Sold Some Shares In AAON, Inc. (NASDAQ:AAON)

Anyone interested in AAON, Inc. (NASDAQ:AAON) should probably be aware that the VP of Finance & CFO, Scott Asbjornson, recently divested US$166k worth of shares in the company, at an average price of US$56.03 each. However, the silver lining is that the sale only reduced their total holding by 0.2%, so we're hesitant to read anything much into it, on its own.

Check out our latest analysis for AAON

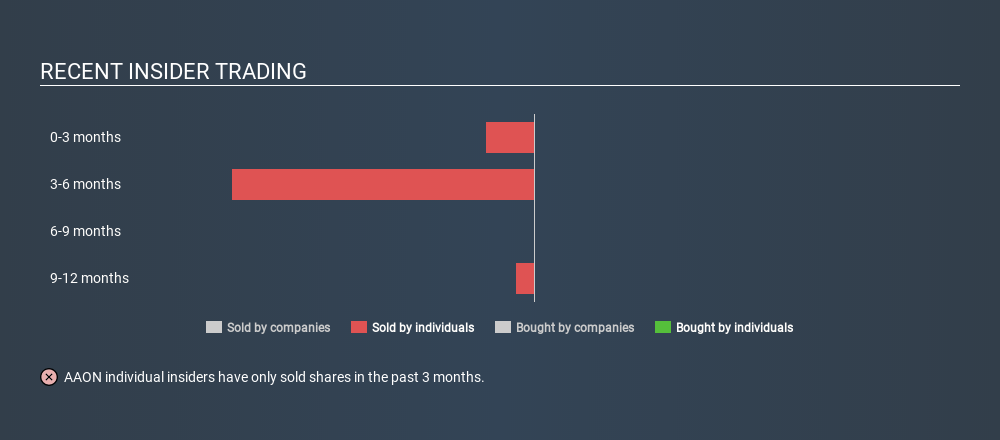

AAON Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the insider, Jack Short, for US$841k worth of shares, at about US$56.07 per share. That means that an insider was selling shares at slightly below the current price (US$57.82). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. We note that the biggest single sale was only 31% of Jack Short's holding.

In the last year AAON insiders didn't buy any company stock. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does AAON Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that AAON insiders own 22% of the company, worth about US$666m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The AAON Insider Transactions Indicate?

An insider hasn't bought AAON stock in the last three months, but there was some selling. And even if we look at the last year, we didn't see any purchases. But it is good to see that AAON is growing earnings. It is good to see high insider ownership, but the insider selling leaves us cautious. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. You'd be interested to know, that we found 1 warning sign for AAON and we suggest you have a look.

But note: AAON may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives