- United States

- /

- Chemicals

- /

- NYSE:DOW

Don't Buy Dow Inc. (NYSE:DOW) For Its Next Dividend Without Doing These Checks

It looks like Dow Inc. (NYSE:DOW) is about to go ex-dividend in the next four days. Ex-dividend means that investors that purchase the stock on or after the 28th of August will not receive this dividend, which will be paid on the 11th of September.

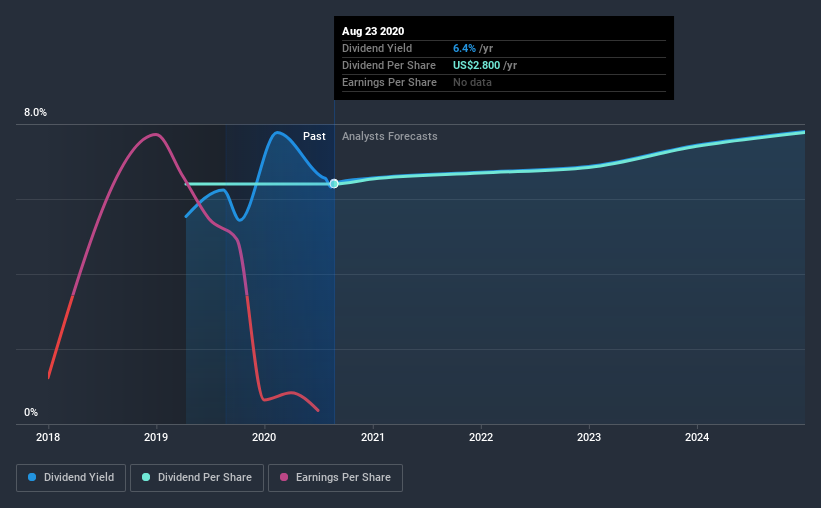

Dow's next dividend payment will be US$0.70 per share. Last year, in total, the company distributed US$2.80 to shareholders. Based on the last year's worth of payments, Dow has a trailing yield of 6.4% on the current stock price of $43.59. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Dow has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Dow

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Dow paid a dividend last year despite being unprofitable. This might be a one-off event, but it's not a sustainable state of affairs in the long run. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. It distributed 44% of its free cash flow as dividends, a comfortable payout level for most companies.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Dow was unprofitable last year, and sadly its loss per share worsened by 252% on the previous year.

Unfortunately Dow has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

We update our analysis on Dow every 24 hours, so you can always get the latest insights on its financial health, here.

The Bottom Line

Is Dow an attractive dividend stock, or better left on the shelf? It's hard to get used to Dow paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. Bottom line: Dow has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

With that in mind though, if the poor dividend characteristics of Dow don't faze you, it's worth being mindful of the risks involved with this business. Our analysis shows 2 warning signs for Dow and you should be aware of them before buying any shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Dow or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives