Does TFF Group's (EPA:TFF) Statutory Profit Adequately Reflect Its Underlying Profit?

Broadly speaking, profitable businesses are less risky than unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether TFF Group's (EPA:TFF) statutory profits are a good guide to its underlying earnings.

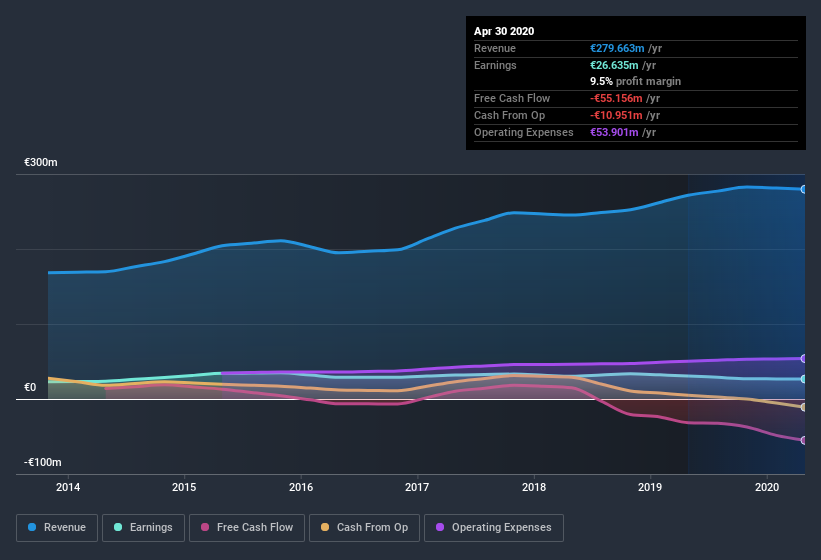

While TFF Group was able to generate revenue of €279.7m in the last twelve months, we think its profit result of €26.6m was more important. While it managed to grow its revenue over the last three years, its profit has moved in the other direction, as you can see in the chart below.

Check out our latest analysis for TFF Group

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will focus on the impact unusual items have had on TFF Group's statutory earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

For anyone who wants to understand TFF Group's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by €8.1m due to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect TFF Group to produce a higher profit next year, all else being equal.

Our Take On TFF Group's Profit Performance

Unusual items (expenses) detracted from TFF Group's earnings over the last year, but we might see an improvement next year. Because of this, we think TFF Group's earnings potential is at least as good as it seems, and maybe even better! On the other hand, its EPS actually shrunk in the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing TFF Group at this point in time. Every company has risks, and we've spotted 1 warning sign for TFF Group you should know about.

Today we've zoomed in on a single data point to better understand the nature of TFF Group's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade TFF Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TFF Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:TFF

TFF Group

Manufactures and distributes barrels and wood products for the aging of wines and alcohols in France, rest of Europe, the United States, Asia, and internationally.

Undervalued average dividend payer.

Market Insights

Community Narratives