Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Tesmec S.p.A. (BIT:TES) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Tesmec

What Is Tesmec's Debt?

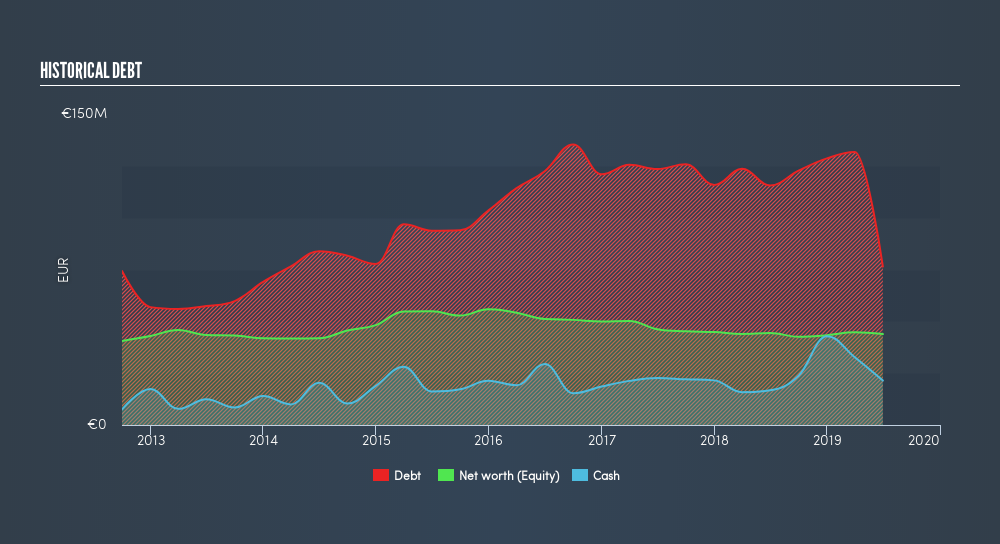

You can click the graphic below for the historical numbers, but it shows that Tesmec had €53.6m of debt in June 2019, down from €116.6m, one year before. However, it does have €21.4m in cash offsetting this, leading to net debt of about €32.2m.

How Healthy Is Tesmec's Balance Sheet?

The latest balance sheet data shows that Tesmec had liabilities of €173.5m due within a year, and liabilities of €76.4m falling due after that. Offsetting these obligations, it had cash of €21.4m as well as receivables valued at €85.7m due within 12 months. So it has liabilities totalling €142.7m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the €42.1m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt After all, Tesmec would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Tesmec's debt to EBITDA ratio (2.6) suggests that it uses some debt, its interest cover is very weak, at 1.1, suggesting high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Shareholders should be aware that Tesmec's EBIT was down 27% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Tesmec's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last two years, Tesmec burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Tesmec's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its net debt to EBITDA is not so bad. It looks to us like Tesmec carries a significant balance sheet burden. If you harvest honey without a bee suit, you risk getting stung, so we'd probably stay away from this particular stock. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Tesmec's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:TES

Tesmec

Designs, manufactures, and sells products, technologies, and integrated solutions for the construction, maintenance, and efficiency of infrastructures related to the transport and distribution of energy, data, and material.

Reasonable growth potential and fair value.

Market Insights

Community Narratives