- United States

- /

- Gas Utilities

- /

- NYSE:SR

Does Spire Inc.'s (NYSE:SR) Past Performance Indicate A Stronger Future?

Examining Spire Inc.'s (NYSE:SR) past track record of performance is a useful exercise for investors. It allows us to reflect on whether the company has met or exceed expectations, which is a powerful signal for future performance. Below, I will assess SR's latest performance announced on 31 December 2019 and weight these figures against its longer term trend and industry movements.

See our latest analysis for Spire

Commentary On SR's Past Performance

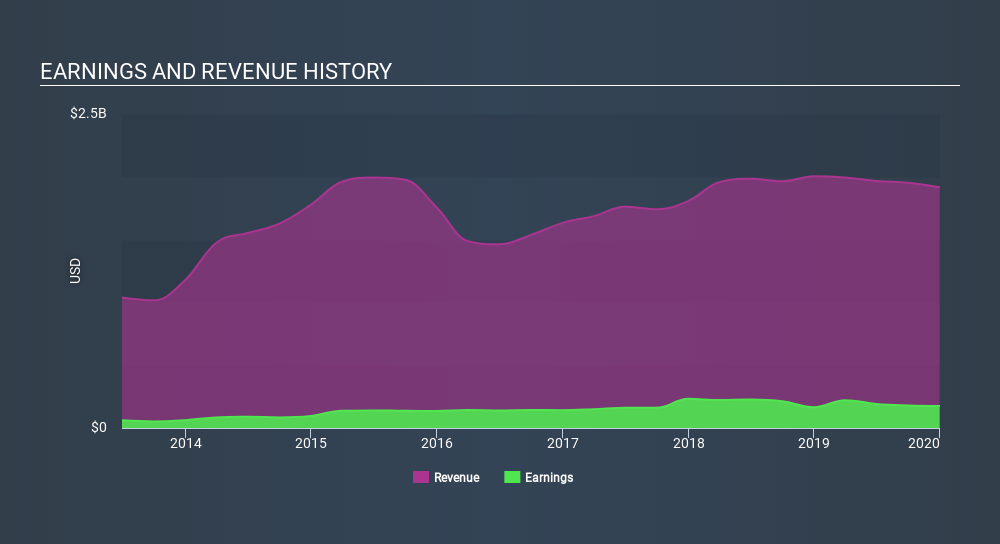

SR's trailing twelve-month earnings (from 31 December 2019) of US$175m has increased by 5.9% compared to the previous year.

However, this one-year growth rate has been lower than its average earnings growth rate over the past 5 years of 11%, indicating the rate at which SR is growing has slowed down. To understand what's happening, let's look at what's going on with margins and whether the whole industry is feeling the heat.

In terms of returns from investment, Spire has fallen short of achieving a 20% return on equity (ROE), recording 7.1% instead. Furthermore, its return on assets (ROA) of 3.5% is below the US Gas Utilities industry of 4.3%, indicating Spire's are utilized less efficiently. And finally, its return on capital (ROC), which also accounts for Spire’s debt level, has declined over the past 3 years from 5.7% to 4.6%.

What does this mean?

While past data is useful, it doesn’t tell the whole story. Positive growth and profitability are what investors like to see in a company’s track record, but how do we properly assess sustainability? You should continue to research Spire to get a more holistic view of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for SR’s future growth? Take a look at our free research report of analyst consensus for SR’s outlook.

- Financial Health: Are SR’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 December 2019. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion