- India

- /

- Infrastructure

- /

- NSEI:SADBHIN

Does Sadbhav Infrastructure Project (NSE:SADBHIN) Have A Healthy Balance Sheet?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies. Sadbhav Infrastructure Project Limited (NSE:SADBHIN) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Sadbhav Infrastructure Project

What Is Sadbhav Infrastructure Project's Debt?

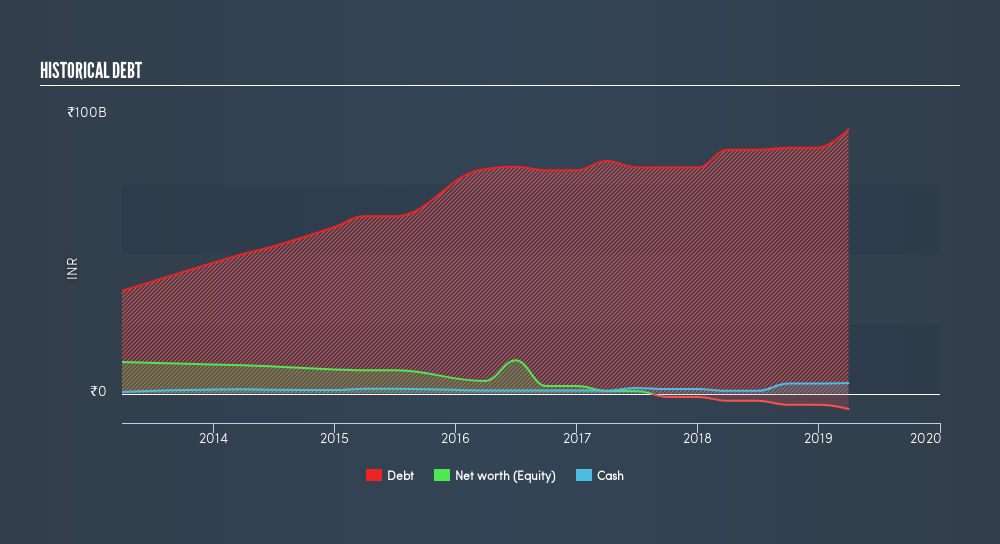

As you can see below, at the end of March 2019, Sadbhav Infrastructure Project had ₹94.6b of debt, up from ₹87.2b a year ago. Click the image for more detail. On the flip side, it has ₹3.76b in cash leading to net debt of about ₹90.8b.

A Look At Sadbhav Infrastructure Project's Liabilities

Zooming in on the latest balance sheet data, we can see that Sadbhav Infrastructure Project had liabilities of ₹27.3b due within 12 months and liabilities of ₹108.2b due beyond that. Offsetting this, it had ₹3.76b in cash and ₹4.70b in receivables that were due within 12 months. So its liabilities total ₹127.0b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the ₹21.8b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Sadbhav Infrastructure Project would likely require a major re-capitalisation if it had to pay its creditors today. Since Sadbhav Infrastructure Project does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.64 times and a disturbingly high net debt to EBITDA ratio of 8.97 hit our confidence in Sadbhav Infrastructure Project like a one-two punch to the gut. The debt burden here is substantial. More concerning, Sadbhav Infrastructure Project saw its EBIT drop by 7.4% in the last twelve months. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Sadbhav Infrastructure Project can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Sadbhav Infrastructure Project recorded free cash flow worth 68% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both Sadbhav Infrastructure Project's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. It's also worth noting that Sadbhav Infrastructure Project is in the Infrastructure industry, which is often considered to be quite defensive. Overall, it seems to us that Sadbhav Infrastructure Project's debt load is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Even though Sadbhav Infrastructure Project lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check outhow earnings have been trending over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SADBHIN

Sadbhav Infrastructure Project

Engages in the development, construction, operation, and maintenance of infrastructure projects in India.

Good value slight.

Similar Companies

Market Insights

Community Narratives