Does Northamber's (LON:NAR) Share Price Gain of 80% Match Its Business Performance?

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. For example, the Northamber plc (LON:NAR) share price is up 80% in the last year, clearly besting the market return of around 17% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! And shareholders have also done well over the long term, with an increase of 68% in the last three years.

Check out our latest analysis for Northamber

Given that Northamber didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Northamber saw its revenue shrink by 13%. Despite the lack of revenue growth, the stock has returned a solid 80% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

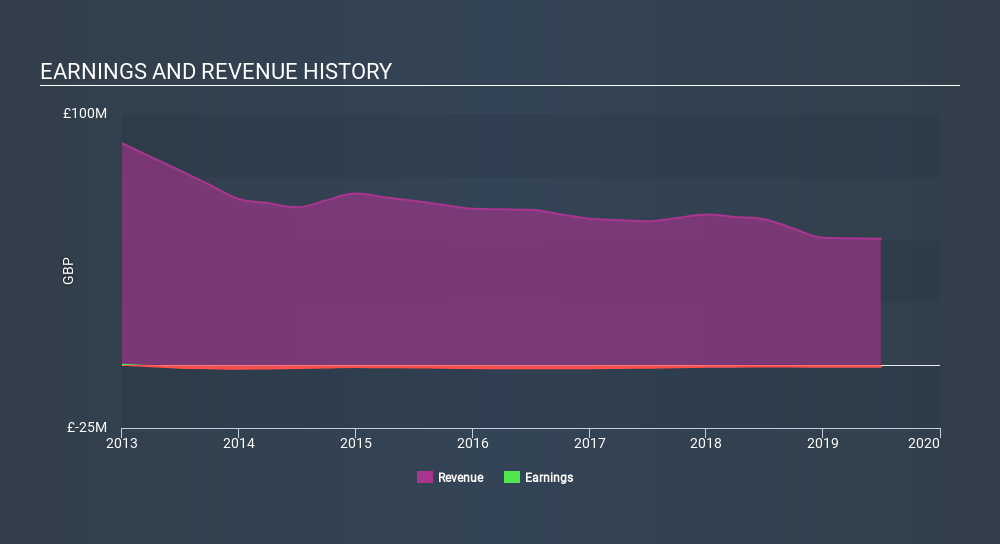

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 2 warning signs for Northamber which any shareholder or potential investor should be aware of.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Northamber's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Northamber's TSR of 81% for the year exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Northamber has rewarded shareholders with a total shareholder return of 81% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7.3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Northamber may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:NAR

Northamber

Engages in the supply of computer hardware, computer printers and peripheral products, computer telephony products, and other electronic transmission equipment in the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Community Narratives