Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Ignite Limited (ASX:IGN) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Ignite

What Is Ignite's Net Debt?

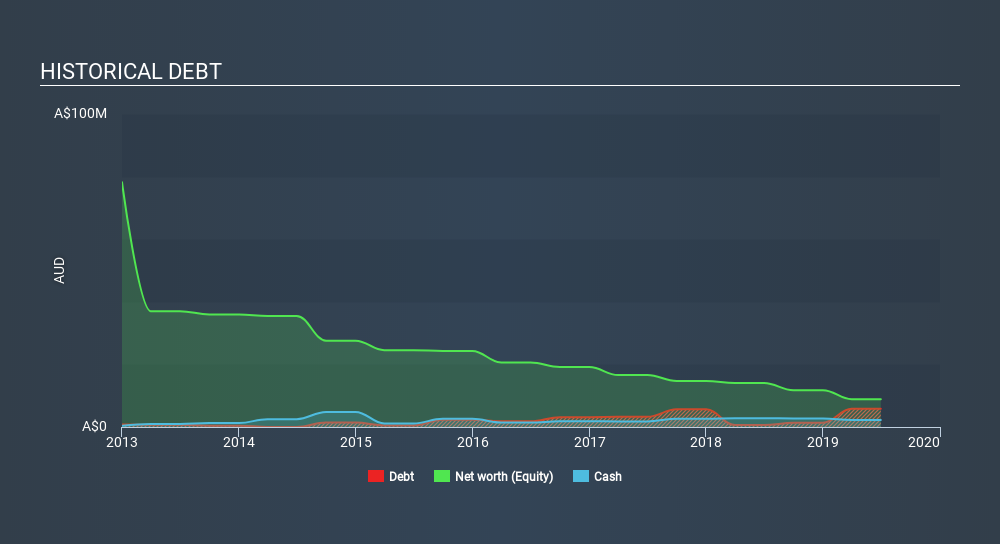

The image below, which you can click on for greater detail, shows that at June 2019 Ignite had debt of AU$5.80m, up from AU$628.0k in one year. However, it does have AU$2.22m in cash offsetting this, leading to net debt of about AU$3.58m.

How Strong Is Ignite's Balance Sheet?

We can see from the most recent balance sheet that Ignite had liabilities of AU$15.3m falling due within a year, and liabilities of AU$275.0k due beyond that. Offsetting this, it had AU$2.22m in cash and AU$21.1m in receivables that were due within 12 months. So it can boast AU$7.69m more liquid assets than total liabilities.

This surplus liquidity suggests that Ignite's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Ignite will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Ignite had negative earnings before interest and tax, and actually shrunk its revenue by 16%, to AU$153m. We would much prefer see growth.

Caveat Emptor

While Ignite's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping AU$6.0m. Having said that, the balance sheet has plenty of liquid assets for now. That should give the business time to grow its cashflow. The company is risky because it will grow into the future to get to profitability and free cash flow. For riskier companies like Ignite I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:IGN

Ignite

Provides specialist recruitment and managed services in Australia and New Zealand.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives