Henning Deters has been the CEO of Gelsenwasser AG (FRA:WWG) since 2011. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Gelsenwasser

How Does Henning Deters's Compensation Compare With Similar Sized Companies?

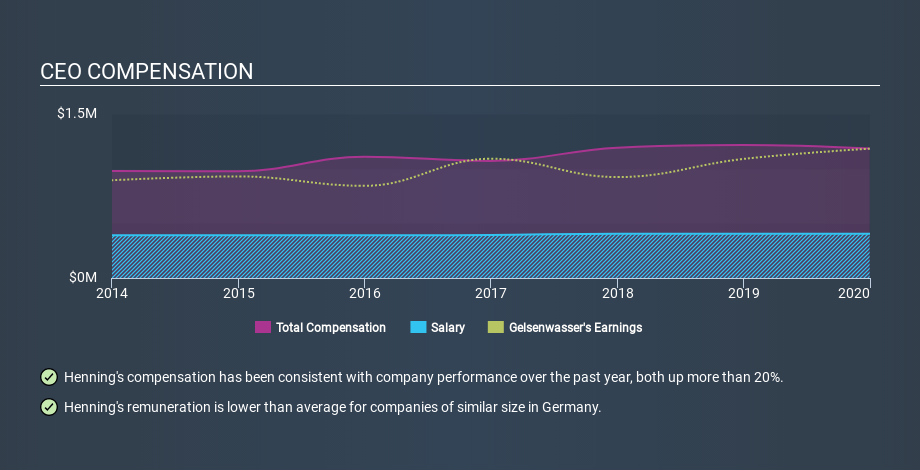

At the time of writing, our data says that Gelsenwasser AG has a market cap of €4.8b, and reported total annual CEO compensation of €1.2m for the year to December 2019. That's actually a decrease on the year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at €405k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from €3.6b to €11b, we found the median CEO total compensation was €2.7m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Gelsenwasser. Talking in terms of the sector, salary represented approximately 29% of total compensation out of all the companies we analysed, while other remuneration made up 71% of the pie. So it seems like there isn't a significant difference between Gelsenwasser and the broader market, in terms of salary allocation in the overall compensation package.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. Though positive, it's important we delve into the performance of the actual business. The graphic below shows how CEO compensation at Gelsenwasser has changed from year to year.

Is Gelsenwasser AG Growing?

On average over the last three years, Gelsenwasser AG has seen earnings per share (EPS) move in a favourable direction by 5.1% each year (using a line of best fit). Its revenue is up 2.1% over last year.

I would argue that the improvement in revenue isn't particularly impressive, but I'm happy with the modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Gelsenwasser AG Been A Good Investment?

I think that the total shareholder return of 64%, over three years, would leave most Gelsenwasser AG shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Gelsenwasser AG is currently paying its CEO below what is normal for companies of its size.

Henning Deters is paid less than what is normal at similar size companies, and the total shareholder return has been pleasing over the last three years. So, while it might be nice to have better EPS growth, on our analysis the CEO compensation is quite modest. Shareholders may want to check for free if Gelsenwasser insiders are buying or selling shares.

If you want to buy a stock that is better than Gelsenwasser, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About DB:WWG

Gelsenwasser

Engages in the water, energy, and service businesses in Germany, the Czech Republic, and Poland.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion