- United Kingdom

- /

- IT

- /

- AIM:ECK

Does Eckoh plc's (LON:ECK) CEO Salary Reflect Performance?

Nik Philpot has been the CEO of Eckoh plc (LON:ECK) since 2006. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Eckoh

How Does Nik Philpot's Compensation Compare With Similar Sized Companies?

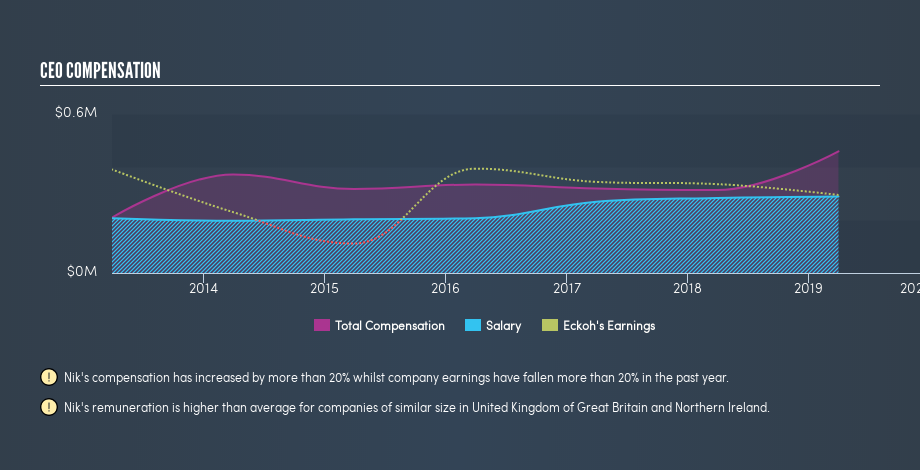

At the time of writing our data says that Eckoh plc has a market cap of UK£119m, and is paying total annual CEO compensation of UK£459k. (This is based on the year to March 2019). That's a notable increase of 47% on last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at UK£289k. We looked at a group of companies with market capitalizations under UK£165m, and the median CEO total compensation was UK£251k.

As you can see, Nik Philpot is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Eckoh plc is paying too much. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see a visual representation of the CEO compensation at Eckoh, below.

Is Eckoh plc Growing?

Eckoh plc has reduced its earnings per share by an average of 15% a year, over the last three years (measured with a line of best fit). In the last year, its revenue is up 5.4%.

Sadly for shareholders, earnings per share are actually down, over three years. The modest increase in revenue in the last year isn't enough to make me overlook the disappointing change in earnings per share. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration.

Has Eckoh plc Been A Good Investment?

Since shareholders would have lost about 2.1% over three years, some Eckoh plc shareholders would surely be feeling negative emotions. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared total CEO remuneration at Eckoh plc with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

We think many shareholders would be underwhelmed with the business growth over the last three years.Over the same period, investors would have come away with nothing in the way of share price gains. Notably, the CEO remuneration is actually up on last year. This analysis suggests to us that the CEO is paid too generously! CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Eckoh (free visualization of insider trades).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:ECK

Eckoh

Provides customer engagement data and payment security solutions in the United Kingdom, the United States, Canada, Ireland, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

A case for Ridgeline Minerals: Base case CAD$2.00, Bull case CAD$5.00+

CSL: The Dip Is the Opportunity

Apple will shine with a 6% revenue growth in the next 5 years

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026