- Hong Kong

- /

- Semiconductors

- /

- SEHK:85

Does China Electronics Huada Technology Company Limited's (HKG:85) P/E Ratio Signal A Buying Opportunity?

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll show how you can use China Electronics Huada Technology Company Limited's (HKG:85) P/E ratio to inform your assessment of the investment opportunity. China Electronics Huada Technology has a P/E ratio of 10.86, based on the last twelve months. That is equivalent to an earnings yield of about 9.2%.

Check out our latest analysis for China Electronics Huada Technology

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for China Electronics Huada Technology:

P/E of 10.86 = HK$0.830 ÷ HK$0.076 (Based on the year to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each HK$1 the company has earned over the last year. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

Does China Electronics Huada Technology Have A Relatively High Or Low P/E For Its Industry?

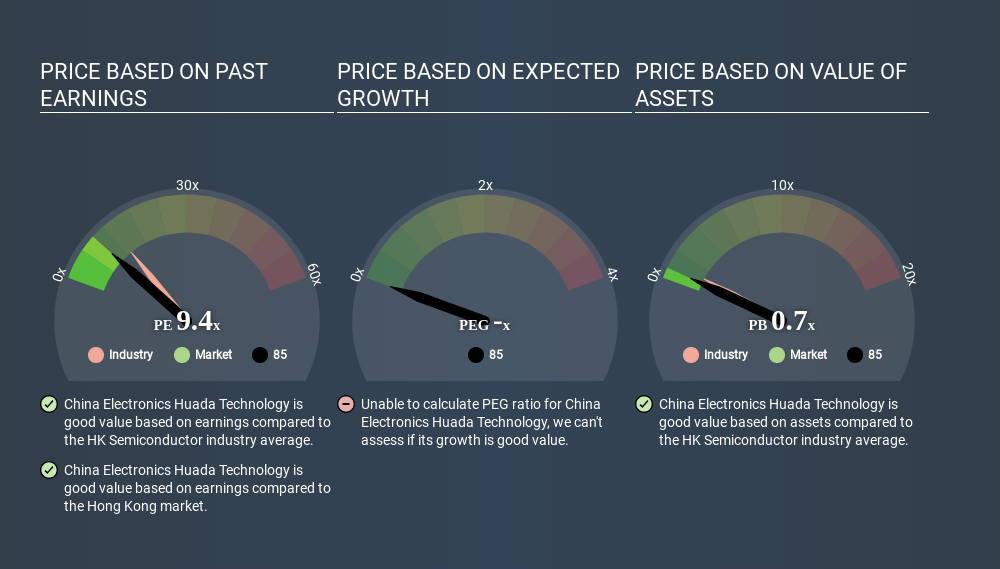

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. If you look at the image below, you can see China Electronics Huada Technology has a lower P/E than the average (15.0) in the semiconductor industry classification.

Its relatively low P/E ratio indicates that China Electronics Huada Technology shareholders think it will struggle to do as well as other companies in its industry classification. Since the market seems unimpressed with China Electronics Huada Technology, it's quite possible it could surprise on the upside. You should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

When earnings fall, the 'E' decreases, over time. That means unless the share price falls, the P/E will increase in a few years. So while a stock may look cheap based on past earnings, it could be expensive based on future earnings.

It's nice to see that China Electronics Huada Technology grew EPS by a stonking 37% in the last year. Unfortunately, earnings per share are down 4.6% a year, over 5 years.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

China Electronics Huada Technology's Balance Sheet

Net debt totals 81% of China Electronics Huada Technology's market cap. This is a reasonably significant level of debt -- all else being equal you'd expect a much lower P/E than if it had net cash.

The Verdict On China Electronics Huada Technology's P/E Ratio

China Electronics Huada Technology has a P/E of 10.9. That's higher than the average in its market, which is 9.7. Its meaningful level of debt should warrant a lower P/E ratio, but the fast EPS growth is a positive. So it seems likely the market is overlooking the debt because of the fast earnings growth.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

You might be able to find a better buy than China Electronics Huada Technology. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:85

China Electronics Huada Technology

An investment holding company, engages in the design, development, and sale of integrated circuit chips in the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives